Archive

Vanguard Mining to Acquire Nucleon Uranium Ltd., Expanding Uranium Exploration Footprint in Saskatchewan's Athabasca Basin

| |||||||||

|  |  | |||||||

Vancouver, BC – TheNewswire - September 10, 2025 – Vanguard Mining Corp. ("Vanguard" or the "Company") (CSE: UUU | OTC: UUUFF | Frankfurt: SL51) ) is pleased to announce that it has entered into a share exchange agreement (the “Definitive Agreement”) among the Company, Nucleon Uranium Ltd. (“Nucleon Uranium”), a private Canadian corporation, and the shareholders of Nucleon Uranium (the “Shareholders”), pursuant to which the Company will acquire 100% of the issued and outstanding common shares in the capital of Nucleon Uranium (the “Proposed Transaction”).

The acquisition of Nucleon Uranium is expected to significantly enhance Vanguard’s uranium portfolio, aligning with the Company’s strategy of building a diversified pipeline of high-potential exploration and development assets in North and South America. By integrating Nucleon Uranium’s properties and technical expertise, Vanguard aims to strengthen its positioning in the global uranium market at a time of growing demand for nuclear energy as a critical component of the clean energy transition.

About Nucleon Uranium

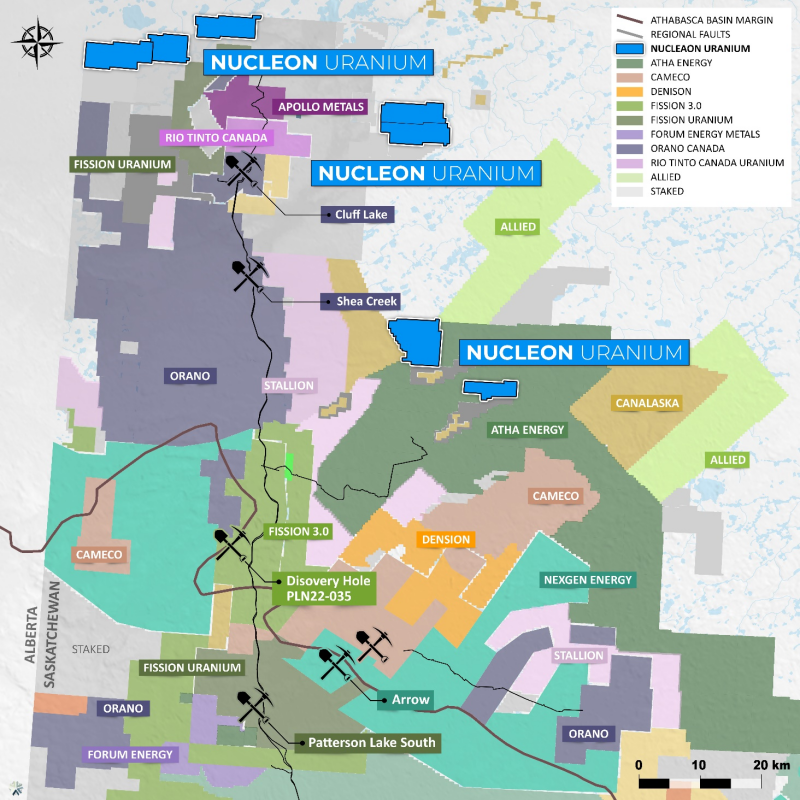

Nucleon Uranium holds seven mineral claims totaling 23,424.90 hectares in Saskatchewan, Canada. These claims are situated in the heart of the world-class Athabasca Basin — recognized globally as the premier uranium district. With its exceptionally high-grade deposits, the Athabasca Basin forms the backbone of Canada’s leadership in clean nuclear energy supply.

"The acquisition of Nucleon Uranium represents a transformational step for Vanguard Mining," stated David Greenway, President & CEO of Vanguard Mining Corp. "With seven highly prospective claims in the heart of Saskatchewan’s Athabasca Basin, strategically positioned alongside industry leaders such as Atha Energy Corp., CanAlaska Uranium Ltd., and Cameco Corporation, we are strengthening our footprint in the world’s premier uranium district. This transaction not only adds scale and geological potential to our portfolio but also positions Vanguard to capitalize on the global nuclear renaissance as governments and utilities seek secure, high-grade uranium supply for the clean energy transition."

Highly Prospective Nucleon Uranium Claims

The newly acquired Nucleon Uranium claims are strategically located in the heart of the Athabasca Basin, surrounded by major uranium companies and deposits:

-

West: Near Fission Uranium’s Patterson Lake South and NexGen Energy’s Arrow deposits, discoveries that are transforming the global uranium supply pipeline; as well as active exploration by CanAlaska Uranium Ltd.

-

North and East: Adjacent to active exploration projects from Atha Energy Corp., Denison Mines, Cameco Corporation, and Orano Canada, underscoring the strong prospectivity of the Basin.

-

Nearby: Historic deposits such as Cluff Lake and Shea Creek highlight the region’s proven uranium endowment.

-

Alongside Industry Leaders: Reinforcing the strategic importance of Nucleon Uranium’s land package.

With established regional infrastructure — including road access, power, and proximity to uranium processing facilities — combined with proven geology and a dense concentration of world-class discoveries in direct proximity, Vanguard believes the Nucleon Uranium claims represent a rare and compelling exploration opportunity. Situated in the world’s premier uranium district, these claims provide the Company with exposure to both near-term exploration catalysts and long-term development potential. Vanguard views this land package as a cornerstone for building shareholder value as it advances its broader uranium strategy during a time of unprecedented global demand for secure, high-grade uranium supply.

Figure 1: Nucleon Uranium Claim Map consisting of 23,424.9 Ha in the Athabasca Basin

Transaction Terms

Pursuant to the terms of the Definitive Agreement, Vanguard Mining Corp. will acquire 100% of the issued and outstanding common shares of Nucleon Uranium As consideration, the Company will issue an aggregate of 7,000,000 common shares in the capital of the Company (the “Consideration Shares”) to the shareholders of Nucleon Uranium on a pro rata basis. In addition, the Company will make aggregate cash payments of C$200,000 as directed by the shareholders.

It is anticipated that the Consideration Shares will be issued pursuant to the Take-Over Bid and Issuer Bid prospectus exemption set forth in Section 2.16 of National Instrument 45-106 – Prospectus Exemptions and, as such, will not be subject to any statutory restrictions on resale.

Completion of the Proposed Transaction remains subject to customary closing conditions, including but not limited to:

-

Receipt of all necessary consents and approvals;

-

Completion of satisfactory due diligence;

-

Accuracy of each party’s representations and warranties as of the closing date; and

-

Fulfillment by each party of its covenants and obligations under the Definitive Agreement.

There can be no assurance that the Proposed Transaction will be completed as contemplated or at all.

Next Steps

Following the completion of the Proposed Transaction, Vanguard Mining intends to integrate the Nucleon Uranium claims into its broader exploration portfolio and initiate a staged exploration program in Saskatchewan’s Athabasca Basin. Near-term priorities will include detailed geological review, data compilation, and permitting activities to prepare for fieldwork. Vanguard also anticipates engaging with technical advisors and local stakeholders to ensure responsible and efficient advancement of the projects.

The Company expects the transaction to close in Q4 2025, subject to the satisfaction of all customary conditions and regulatory approvals. Upon closing, Nucleon Uranium will become a wholly owned subsidiary of Vanguard Mining, providing shareholders with direct exposure to one of the most prospective uranium districts globally.

Positioned for Growth in a Nuclear Renaissance

Global demand for secure, carbon-free baseload energy is fueling an unprecedented nuclear power resurgence. As governments implement aggressive energy transition strategies, uranium has re-emerged as a critical mineral. Saskatchewan’s Athabasca Basin remains the premier jurisdiction for future uranium supply, and Vanguard is strategically positioned to capitalize on this nuclear renaissance.

Option Agreement

Vanguard Mining is pleased to announce that it has entered into a mineral property option agreement with Hilltop Resources Inc. ("Hilltop"), pursuant to which Hilltop has been granted the sole and exclusive option to acquire a 100% interest in the Pinchi Lake Nickel Project (“Pinchi”), located in British Columbia, and the Georgia Lake Project (“Georgia Lake”), located in Ontario (together, the “Properties”).

Under the terms of the agreement, Hilltop will provide total consideration consisting of:

-

Cash Payments – $30,000 in cash to Vanguard, with $15,000 payable upon execution of the agreement and $15,000 within 12 months.

-

Share Issuances – 500,000 common shares of Hilltop, issued to Vanguard upon signing.

-

Assessment Work – Hilltop will assume responsibility for all required property payments and assessment work to maintain the Properties in good standing.

Upon completion of these obligations, Hilltop will earn a 100% undivided interest in the Properties, subject to a 0.5% net smelter return (“NSR”) royalty payable to Vanguard. In addition, the Pinchi claims remain subject to an existing 2% underlying NSR royalty. Hilltop will act as operator of the Properties during the option period, and all exploration expenditures will be credited as assessment work.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Lawrence Segerstrom, a consulting geologist who is a “Qualified Person” as such term is defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43- 101”).

Vanguard Mining Corp. is a Canadian mineral exploration company focused on the discovery and development of high-value strategic minerals. The Company is currently advancing uranium exploration projects in the United States and Paraguay, with a focus on identifying and developing assets critical to the global energy transition. Vanguard is committed to responsible exploration and value creation through the acquisition and advancement of highly prospective uranium properties.

On Behalf of the Board of Directors

“David Greenway” David Greenway, CEO

For further information, please contact:

Vanguard Mining Corp.

Brent Rusin

Phone: +1 672-533-0348

E-Mail:brent@vanguardminingcorp.com

Website: https://vanguardminingcorp.com/

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

This news release may contain certain forward-looking statements and forward-looking information (collectively, “Forward-Looking Statements”) within the meaning of the applicable Canadian and U.S. securities laws. All statements, other than statements of historical fact, included herein including, without limitation, statements with respect to the Offering and the anticipated use of the proceeds therefrom, are forward-looking statements. When or if used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target, “plan”, “forecast”, “may”, “schedule” and similar words or expressions identify forward-looking statements or information. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

###