Archive

New Age Metals Launches Rhodium Assay Program on Mineralized Metallurgical Samples from the River Valley Palladium Project

| |||||||||

|  |  |  | ||||||

March 22, 2022 – TheNewswire - Rockport, Ontario - New Age Metals Inc. (TSXV:NAM); (OTC:NMTLF); (FSE:P7J.F) (“NAM” or “Company”) is pleased to announce the launch of its rhodium (“Rh”) assay program on 2021 metallurgical drill core samples from NAM’s 100% owned River Valley Palladium Project near Sudbury, Ontario. Based on encouraging recent Rh assay results from historical core (see Company press releases dated March 2, 2021 and December 12, 2021), NAM has commenced a much larger rhodium assaying program of all the samples used to make-up the composite samples for the ongoing metallurgical testwork. The purpose of this rhodium assay program is to further investigate whether Rh could be a payable metal for any future potential mining and mineral processing operation at River Valley.

Rhodium MinMet Assay Program

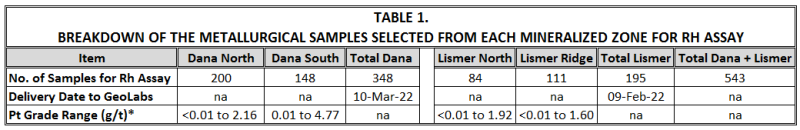

In February and March 2022, 543 mineralized samples from four of the mineralized zones at River Valley were delivered to Geoscience Laboratory in Sudbury for Rh assay. Breakdowns of the core sampling for Rh assay by mineralized zone and by drill hole are shown in Figure 1 and Table 1. All the samples were ¼ HQ size core drilled for fresh rock material to be used in metallurgical studies. The samples selected for Rh assay are those that have been used to make-up the grade variability composites for testwork at SGS Canada Inc, from which metal recoveries will be determined. The Rh assay samples are currently in processing and preparation at the Geoscience Laboratory. In addition to Rh, the assays will include results for iridium (“Ir”) and ruthenium (“Ru”), which are also very valuable PGMs. The assay results are anticipated to be available in summer 2022.

In addition to the primary applications in the payable metal investigation, the Rh assay results will also be utilized to generate more reliable regression equations to more accurately predict

Rh grades for each of the major mineralized zones at River Valley. Given the high metal price (US$20,000/oz Rh as of March 7, 2022 Source: Kitco.com), this input could potentially add significant value to future Mineral Resource Estimates and even Mineral Reserve Estimates for the Project. Concurrently, additional Rh assaying of historical drill core is also planned to continue in 2022, mainly from the Dana South and Lismer Ridge Zones, as outlined below.

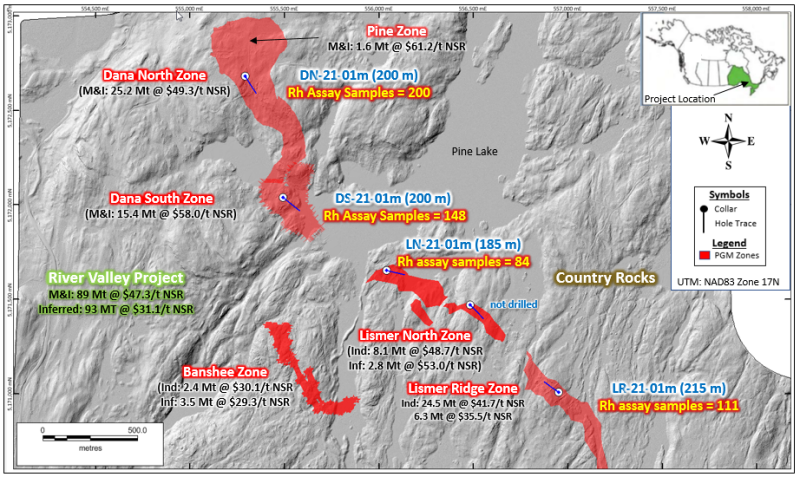

Figure 1. Sampling of 2021 metallurgical hole drill cores for rhodium assay. The background image is from the 2014 LiDAR survey of the River Valley Property. The 2021 Updated Mineral Resource Estimates given for each palladium mineralized zone and for the River Valley Intrusion overall are for a $15/t NSR cut-off.

Note that the Pine Zone occurs in the footwall to the Dana North Zone and is not exposed at surface.

M&I = Measured plus Indicated Mineral Resources; Inf = Inferred Mineral Resources.

*Rh is regressed on Pt (platinum) for the River Valley Project

Concurrent Rhodium Evaluation Work Programs

Based on improved PGM and especially Rh metal prices, NAM decided in 2020 to initiate a

Rh evaluation program focused on re-assaying historical River Valley drill holes for Rh.

The primary purpose of that program is to determine the contents of Rh in each of the major mineralized zones for direct inclusion in future Mineral Resource estimations of the River Valley Deposit. The historical drill holes to be sampled are carefully selected from representative drill cross-sections of priority mineralized zones, starting at the Pine and Lismer North Zones in Phases 1 and 2 in 2020 and 2021, and then progressing to the Dana South and Lismer Ridge Zones in Phases 3 and 4 in 2022 and 2023. Samples from mineralized core intervals above the lower cut-off grade and adjacent material at Pine and Lismer North were submitted to the Geoscience Laboratory, for PGM assay with enhanced detection limits. Results from completed Phases 1 and 2 of the Rh evaluation program are summarized below.

Phase 1 (2020): Rhodium at Pine Zone

Rhodium at Pine Zone was determined from 303 out of 2,443 drill core samples. The sampled drill holes were completed between 2015 and 2020. Assays ranged in grade from the lower detection limit up to 0.177 g/t Rh. Fifty of the samples returned assays >0.05 g/t Rh. Rhodium was interpreted from statistical analysis to occur with sulphides and not chromite, which differs from other Rh-bearing deposits elsewhere and could potentially simplify future metallurgical recovery processes.

Phase 2 (2021): Rhodium at Lismer North Zone

Rhodium at Lismer North was determined from 187 samples. The highest assay result was 0.595 g/t Rh and a total of 25 samples returned assays >0.05 g/t Rh. As for the Pine Zone, Rh at Lismer North does not correlate with chromium, and therefore is unlikely to be held in chromium-bearing phases like chromite. In 2022, Phases 3 and 4 of the Rh evaluation program will take samples from historical drill holes completed at the Dana South and Lismer Ridge Zones for Rh assay at Geoscience Laboratory in 2022 and 2023.

About Rhodium

Rh is the rarest and most valuable of the PGMs. The main use for Rh is in catalytic converters designed to clean vehicle emissions. This metal is particularly effective in cleaning nitric oxide emissions from internal combustion engine vehicles. The majority of Rh is produced as a

by-product of platinum mining in South Africa. South Africa is the world’s largest producer of Rh (~80%), followed by Russia (~10%), Zimbabwe (~5%), Canada (~2%), and the USA (~2%).

The global average mineral resource/reserve grade is 0.281 g/t Rh, with the lowest reported mineral resource/reserve grade of 0.010 g/t Rh and the highest reported mineral resource/reserve grade of 0.381 g/t Rh (source: S&P Global, 2020). Note that on March 7, 2022, the rhodium price reached $US20,000/oz (Kitco).

About River Valley Palladium Project

The River Valley Palladium Project is located 100 road-km east from the City of Sudbury.

The Project area is linked to Sudbury by a network of all-weather highways, roads and rail beds and is accessible year-round with hydro grid and natural gas power nearby. River Valley enjoys the strong support of local communities, like the village of River Valley, 20 km to the south.

Fully executed Memorandum of Understandings are in place with local First Nations, environmental baseline studies re-commenced in 2020, and archeological studies were completed in 2021.

The current Mineral Resource Estimate was announced in a press release dated October 5, 2021 (Figure 2). At cut-offs of CDN$15/t NSR (pit constrained) and CDN$50/t NSR (out-of-pit),

the Mineral Resource Estimate consists of: 89.9 Mt grading 0.54 g/t Pd, 0.21 g/t Pt, 0.04 g/t Au and 0.06% Cu, or CDN$47.58/t NSR in the Measured and Indicated classifications; and 94 Mt grading 0.35 g/t Pd, 0.16 g/t Pt, 0.04 g/t Au and 0.06% Cu, or CDN$31.69/t NSR in the Inferred classification. Contained metal contents are 2.3 Moz Pd+Pt+Au in the Measured and Indicated classifications and 1.6 Moz Pd+Pt+Au in the Inferred classification.

The 2019 PEA results for the River Valley Palladium Project were announced in a press release dated June 27, 2019, and are based on the updated 2019 Mineral Resource Estimate for River Valley. The 2019 PEA outlines a 20,000 t/day open pit mine and processing plant operation producing an average of 119,000 ounces of PdEq per year over a mine life of 14 years. Using base case metal prices of US$1,200/oz Pd, $1,050/oz Pt and $3.25/lb Cu, the PEA showed a pre-tax NPV5% of US$261 million and a pre-tax IRR of 13%. At a +20% palladium price of $1,440/oz Pd, the pre-tax NPV5% increases to $501M and the pre-tax IRR to 19%. Note that as of March 7, 2022, the palladium price reached a new all-time high of $US 3,499/oz (Kitco).

The 2021 updated Mineral Resource Estimate will form a basis for the ongoing Pre-Feasibility Study of the River Valley Palladium Project.

About NAM

New Age Metals is a junior mineral exploration and development company focused on the discovery, exploration and development of green metal projects in North America. The Company has two divisions; a Platinum Group Metals division and a Lithium/Rare Element division.

The PGM Division includes the 100% owned, multi-million-ounce, district scale River Valley Project, one of North America’s largest undeveloped Platinum Group Metals Projects, situated

100 km by road east of Sudbury, Ontario. The Company completed a positive Preliminary Economic Assessment on the Project in 2019 and, is fully financed to complete a

Pre-Feasibility Study on the Project in 2022. In addition to River Valley, the Company owns 100% of the Genesis PGM-Cu-Ni Project in Alaska, and has plans to complete a surface mapping and sampling program in 2022.

The Lithium Division is one of the largest mineral claim holders in the Winnipeg River Pegmatite Field, where the Company is exploring for hard rock lithium occurrences and various rare elements such as tantalum and rubidium. The plans for 2022 include additional geophysical surveys and a maiden drill program on the Lithium One Project, phase two drill program at Lithium Two Project, and a field program to follow up prospective targets identified on the five grids completed in the 2021 geophysical surveys. On September 28, 2021, the Company announced a partnership with Mineral Resource Limited (MRL, ASX: MIN), the world’s fifth largest lithium producer, to explore and develop the Company’s lithium project portfolio.

Our philosophy is to be a project generator with the objective of optioning our projects with major and junior mining companies through to production. The Company is actively seeking an option/ joint venture partner for its road-accessible Genesis PGM-Cu-Ni project in Alaska.

Investors are invited to visit the New Age Metals website at www.newagemetals.com where they can review the company and its corporate activities. Any questions or comments can be directed to info@newagemetals.com or Harry Barr at Hbarr@newagemetals.com or Cody Hunt at Codyh@newagemetals.com or call 613 659 2773.

If you have not done so already, we encourage you to sign up on our website (www.newagemetals.com) to receive our updated news.

Qualified Persons

The contents contained herein that relate to the scientific and exploration results for the River Valley Project is based on information compiled, reviewed or prepared by Dr. Bill Stone, P.Geo., a consulting geoscientist for New Age Metals. Dr. Stone is the Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical content of this news release.

On behalf of the Board of Directors

“Harry Barr”

Harry G. Barr

Chairman and CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Cautionary Note Regarding Forward Looking Statements: This release contains forward-looking statements that involve risks and uncertainties. These statements may differ materially from actual future events or results and are based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. In addition, forward-looking statements include statements in which the Company uses words such as “continue”, “efforts”, “expect”, “believe”, “anticipate”, “confident”, “intend”, “strategy”, “plan”, “will”, “estimate”, “project”, “goal”, “target”, “prospects”, “optimistic” or similar expressions. These statements by their nature involve risks and uncertainties, and actual results may differ materially depending on a variety of important factors, including, among others, the Company’s ability and continuation of efforts to timely and completely make available adequate current public information, additional or different regulatory and legal requirements and restrictions that may be imposed, and other factors as may be discussed in the documents filed by the Company on SEDAR (www.sedar.com), including the most recent reports that identify important risk factors that could cause actual results to differ from those contained in the forward-looking statements. The Company does not undertake any obligation to review or confirm analysts’ expectations or estimates or to release publicly any revisions to any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Investors should not place undue reliance on forward-looking statements.