Inflection Resources and AngloGold Ashanti Sign Definitive Exploration Agreement Across Portfolio of Copper-Gold Projects in Australia

| |||||||||

|  | ||||||||

Vancouver, British Columbia – TheNewswire - June 14, 2023: Inflection Resources Ltd. (CSE:AUCU) (OTC:AUCUF) (FSE:5VJ) (the "Company" or "Inflection") is pleased to announce it has signed a Definitive Farm-in Agreement (the “Agreement”) with AngloGold Ashanti Australia Limited (“AngloGold”) (NYSE: AU / JSE: ANG / ASX: AGG) that outlines the terms under which AngloGold may earn into a number of Inflection’s copper-gold projects in New South Wales, Australia.

Summary Highlights:

-

AngloGold shall fund up to AUD$10,000,000 on exploration expenditures across the portfolio of projects as part of a Phase I exploration program. Phase I will drill test a wide range of large intrusive-related, copper-gold targets including the Duck Creek project. Phase I includes a minimum expenditure commitment of AUD$6,000,000 and a 10% management fee payable to Inflection;

-

Phases II and III of the Agreement are staged earn-in’s where AngloGold may select up to five Designated Projects in which it may earn up to a 65% interest by funding AUD$27,000,000 in exploration expenditures on each Designated Project for cumulative maximum expenditures of AUD$135,000,000;

-

AngloGold retains a further right under Phase IV to earn an additional 10% interest in each Designated Project by:

-

-

Completing a Pre-Feasibility Study (“PFS”) solely funded by AngloGold based on a minimum of 2,000,000 ounces of gold or gold-copper equivalent Measured and Indicated resources;

-

Granting to Inflection, subject to existing underlying royalties, a 2% or 1% net smelter return (“NSR”) royalty; and,

-

-

The Phase I exploration program is expected to comprise of approximately 30,000 metres of drilling with an initial two drill rigs. The Company intends to commence drilling in the coming days with an initial focus on the completion of deep drill holes on the Duck Creek project. Details of the exploration program will be provided soon.

Alistair Waddell, Inflection’s President and CEO, states: “The execution of this Agreement with AngloGold sets the foundation for the upcoming exploration program and provides the necessary capital to aggressively drill test and potentially develop our large portfolio of copper-gold porphyry targets within the northern extension of the Macquarie Arc. We very much look forward to working with our partners AngloGold to explore the portfolio of targets over the coming years.”

Philip Newton, AngloGold’s SVP Greenfields Exploration, states: “We are excited to partner with Inflection for this opportunity in a proven Tier 1 terrane and to contribute towards this promising project in Australia. The complementary skills of AngloGold and Inflection can accelerate the discovery process in a sustainable manner that benefits all stakeholders.”

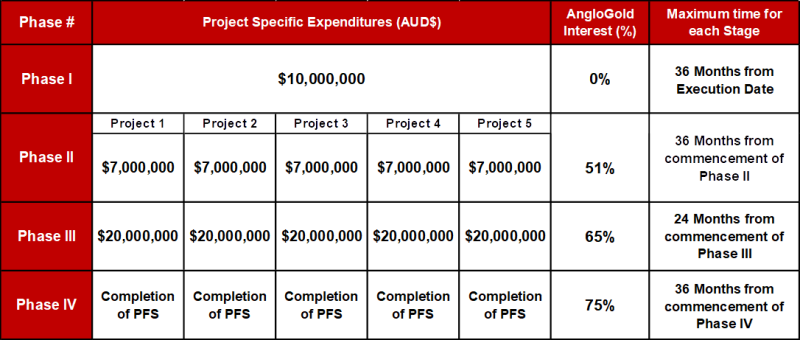

Table 1: Summary structure of the Farm-in Agreement

Notes:

-

Phase I is inclusive of the minimum commitment of AUD$6,000,000.

-

Completion of PFS to include a minimum resource of two million ounces of gold or gold-copper equivalent Measured and Indicated resources per Designated Project.

-

All expenditure timelines can be accelerated.

Further Details of the Agreement:

Phase I:

AngloGold will sole fund up to AUD$10,000,000 on exploration expenditures across a wide range of different intrusive related exploration targets within a 36-month period following the execution of the Farm-in Agreement. AngloGold has committed to fund minimum expenditures of AUD$6,000,000. If Phase I Expenditures of AUD$10,000,000 are not incurred within the required time frame, then the Farm-in Agreement shall terminate and no interest in any of the properties will be earned by AngloGold. Inflection will receive a 10% management fee for being the operator of Phase I.

Upon completion of Phase I exploration expenditures of AUD$10,000,000, AngloGold retains the option to convert the expenditures into common shares of Inflection equal to a maximum of 9.9% of the then issued outstanding common shares of the Company, post share issuance, at the time of completion of Phase I. The deemed price of the shares shall be calculated using the 30-day VWAP and the number to be issued shall be capped at the Canadian dollar equivalent of AUD$10,000,000.

If the number of shares issued equals less than 9.9% of Inflection’s outstanding shares, then AngloGold shall retain the further option to purchase additional common shares from the treasury of Inflection at a 10% premium to the 30-day VWAP, up to a combined maximum ownership interest of 9.9% of the then-outstanding common shares.

Phase II:

AngloGold may elect to earn an initial 51% interest in up to five Designated Projects individually by sole funding expenditures of AUD$7,000,000 on each project within 36 months. If AngloGold fails to complete the Phase II earn-in expenditure for a given Designated Project, Inflection will retain 100% ownership with no interest earned by AngloGold.

Phase III:

AngloGold may elect to earn an additional 14% interest in each Designated Project individually, for a total 65% interest, by sole funding additional expenditures of AUD$20,000,000 per Designated Project within 24 months following completion of Phase II. If AngloGold initiates but does not complete Phase III, then its ownership interest in the Designated Project will revert to 49%, which Inflection retains the right to purchase at a mutually agreed price or for fair value if a price cannot be mutually agreed within a specified period.

Phase IV:

AngloGold retains an additional right to earn a further 10% interest in each Designated Project, bringing its potential ownership interest to 75%, by completing the following:

-

Delivering to Inflection a Pre-Feasibility Study in accordance with the CIM Definition Standards on Mineral Resources and Ore Reserves based on a minimum 2,000,000 ounces of gold or gold-copper equivalent Measured and Indicated resources within 36 months after AngloGold provides notice to move to Phase IV; and,

-

Granting to Inflection a 2% NSR on the applicable Designated Project; provided, however, that if the applicable Designated Project has any existing underlying royalties, Inflection will be granted a 1% NSR. AngloGold will have the right to buy back 0.5% of any 2% NSR and 0.25% of any 1% NSR in respect of all or a portion of the respective Designated Project for fair value at any time.

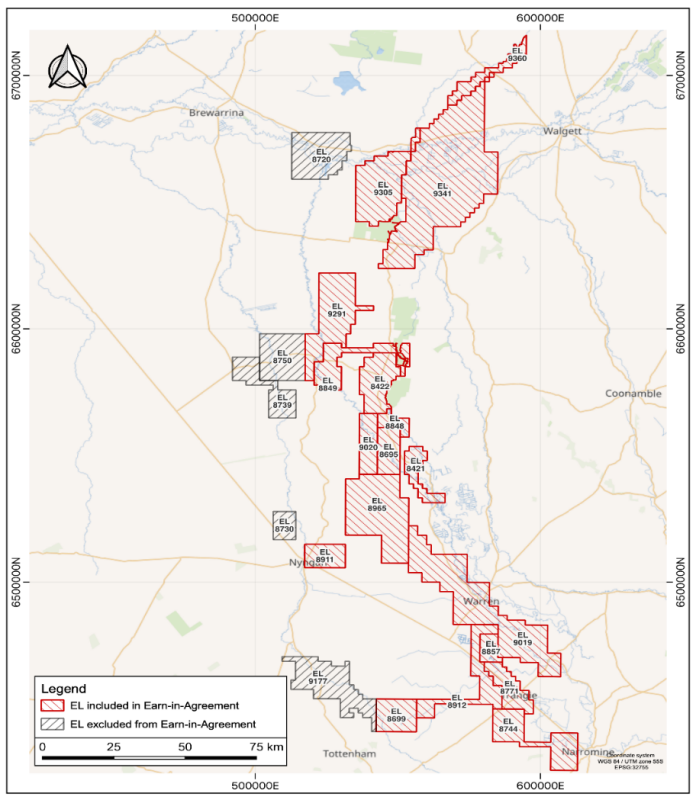

About Inflection’s NSW Projects:

The Company is systematically exploring for large copper-gold and gold deposits in the northern interpreted extension of the Macquarie Arc, part of the Lachlan Fold Belt in New South Wales. The Macquarie Arc is Australia’s premier porphyry copper-gold province being host to Newcrest Mining’s Cadia deposits, the CMOC Northparkes deposits and Evolution Mining’s Cowal deposits plus numerous exploration prospects including Boda, the discovery made by Alkane Resources.

The Company is using cost-effective mud-rotary drilling to cut through unmineralized post-mineral sedimentary cover before transitioning to diamond core drilling once basement is reached. It is well documented that mineralized bodies elsewhere in the belt, in particular porphyry and intrusive related systems, have large district-scale alteration and geochemical halos or footprints surrounding them.

Upon completion of the mud rotary part of the holes, the Company typically completes a series of short diamond drill holes into bedrock rather than just one or two deep and more expensive diamond drill holes. Multiple data points gained from alteration and mineral geochemistry is then used to vector additional deeper drill holes. This is a proven exploration strategy in the covered segments of the Macquarie Arc having been directly responsible for the discovery of the Northparkes and Cowal deposits.

Figure 1: Location map of Inflection’s New South Wales Exploration Licenses (“EL’s”) covered by the Agreement.

Qualified Person:

The scientific and technical information contained in this news release has been reviewed and approved by Mr. Carl Swensson (FAusIMM), a “Qualified Person” (“QP”) as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Inflection Resources Ltd. Inflection is a technically driven copper-gold and gold focused mineral exploration company listed on the Canadian Securities Exchange under the symbol “AUCU” and on the OTCQB under the symbol “AUCUF” with projects in Australia. For more information, please visit the Company website at www.inflectionresources.com.

About AngloGold Ashanti Limited. AngloGold is a global gold mining company listed on the New York, Johannesburg and Australian stock exchanges. The company has a diverse, high-quality portfolio of operations, projects and exploration activities across nine countries on four continents. For more information, please visit the company website at www.anglogoldashanti.com.

On behalf of the Board of Directors

Alistair Waddell

President and CEO

alistair@inflectionresources.com

For further information, please contact:

Brennan Zerb

Investor Relations Manager

+1 (778) 867-5016

Forward-Looking Statements: This news release includes certain forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding future capital expenditures, receipt of the maximum amount of available grant funding, anticipated content, commencement, and cost of exploration programs in respect of the Company's projects and mineral properties, the anticipated execution and acceptance of the CSE of the Farm-in Agreement with AngloGold, AngloGold’s anticipated funding of the Minimum Commitment and timing thereof, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Often, but not always, forward looking information can be identified by words such as "pro forma", "plans", "expects", "may", "should", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", "potential" or variations of such words including negative variations thereof, and phrases that refer to certain actions, events or results that may, could, would, might or will occur or be taken or achieved. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, statements as to the anticipated business plans and timing of future activities of the Company, including the Company's exploration plans. the proposed expenditures for exploration work thereon, the ability of the Company to obtain sufficient financing to fund its business activities and plans, delays in obtaining governmental and regulatory approvals (including of the Canadian Securities Exchange), permits or financing, changes in laws, regulations and policies affecting mining operations, the Company's limited operating history, currency fluctuations, title disputes or claims, environmental issues and liabilities, as well as those factors discussed under the heading "Risk Factors" in the Company's prospectus dated June 12, 2020 and other filings of the Company with the Canadian Securities Authorities, copies of which can be found under the Company's profile on the SEDAR website at www.sedar.com.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements, except as otherwise required by law.