Archive

Tribeca Resources acquires option over rare undrilled geophysical target in the Mantoverde District of Northern Chile and reports final drill results from the La Higuera project

| |||||||||

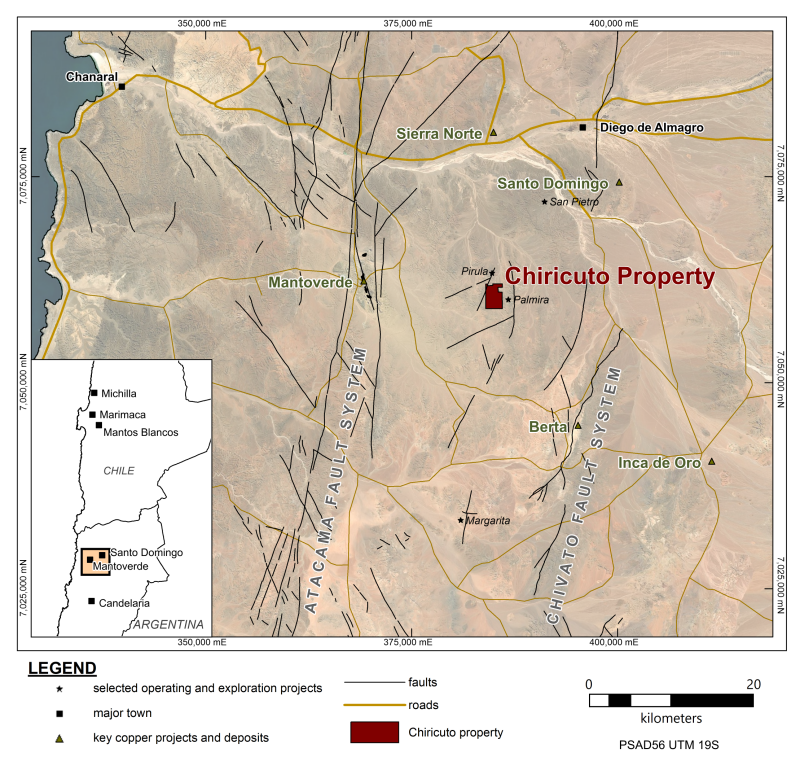

27 MARCH, 2024 / TheNewswire / VANCOUVER, BC - Tribeca Resources Corporation (TSXV: TRBC) (OTCQB: TRRCF) (“Tribeca Resources”, the “Company”) is pleased to announce it has entered into a purchase option agreement (“the Agreement”) with two groups of private owners (the “Project Vendors”) to acquire a 100% interest in a 570 hectare property located in the established Mantoverde district of the Chilean Coastal Belt, 15 km and 21 km from Capstone Copper Corporation’s (“Capstone Copper”) Mantoverde mine and Santo Domingo project, respectively (Figure 1) (the “Chiricuto Property”). Further, final assays from Phase 2 drilling at the Company’s cornerstone La Higuera Project, which has delivered a 40% increase to the size of the Gaby mineralised system, are reported.

-

Binding purchase option executed for acquisition of a 100% interest in the Chiricuto Property, hosting a rare undrilled iron oxide alteration system in the Mantoverde – Santo Domingo district of the Chilean Coastal iron oxide copper-gold (“IOCG") Belt.

-

IP and magnetic surveying results, combined with significant copper workings on adjacent licences suggest the potential presence of a large magnetite ± sulphide system.

-

With a modest up-front payment, Tribeca Resources’ novel “exploration levy” concept applied, and the final purchase price dependent on metal contained in a maiden Mineral Resource Estimate (“MRE”), the Agreement provides Tribeca Resources’ shareholders with a low-cost option on an exciting property with strong IOCG potential.

-

Pre-drilling activities at the Chiricuto Property will be undertaken in parallel with preparation for further drilling at the Company’s flagship La Higuera Project.

-

-

Final drill results from a successful Phase 2 program at the La Higuera Project have now been received and are reported below.

-

Tribeca Resources will continue its pursuit of high-quality exploration properties, seeking to capitalise on the opportunity offered by current market conditions, to incorporate external growth options on sensible commercial terms.

Tribeca Resources CEO, Dr. Paul Gow commented:

“Hosting a strong untested IOCG target under shallow cover, the Chiricuto Property represents exactly the type of opportunity that Tribeca Resources is well positioned to advance. The chance to test – and potentially acquire a 100% stake in – an undrilled geophysical target in the emerging copper producing Mantoverde district, is the type of opportunity that Tribeca Resources was founded to capitalise on. With this announcement, Tribeca Resources has demonstrated its ability to structure a property acquisition that will ensure funding is directed towards on-ground activities, and ultimately discovery, which benefits Tribeca Resources’ shareholders, the Project Vendors and other stakeholders.”

“In addition to this exciting portfolio addition, we are pleased to report completion of the Phase 2 drill program at the flagship La Higuera Project. The drill program provided a 40% increase in the potential size of the mineralised system at the Gaby discovery, representing an important milestone towards building a portfolio of copper properties that aims to attract the producers, once M&A-driven growth strategies return.”

Figure 1. Location of the Chiricuto Property

The Chiricuto Property

Highlights

-

6 exploitation concessions covering 570 hectares

-

Excellent infrastructure in the area including roads, powerlines, port, 50 km from the coast

-

Situated between the Mantoverde IOCG mine and the Santo Domingo IOCG project (both owned by Capstone Copper)

-

One of the few significant iron oxide alteration systems in the Mantoverde district that remain untested by drilling

The Chiricuto Property is located within the andesite-dominated lower unit of the Middle-Upper Jurassic La Negra Formation, which is the same rock unit that hosts Capstone Copper’s Mantoverde deposit (>1 Billion tonnes of oxide and sulphide copper resource, Capstone Copper MRE dated 31 December 2022 - Measured and Indicated categories) 15 km to the west of the Chiricuto Property. The rocks are located in the hanging-wall to a major east-vergent thrust, parallel to, but located between, the regional Atacama and Chivato Fault Systems. Previous mapping in the project area has identified magnetite-scapolite±quartz±chlorite±hematite alteration within the andesites. Other deposits within the La Negra Formation in this area include the Palmira combined oxide-sulphide copper deposit, which is reported to host chalcopyrite-rich hematite-cemented breccias and veins, and the Pirula deposit, both located within 1.5 km of the Chiricuto Property.

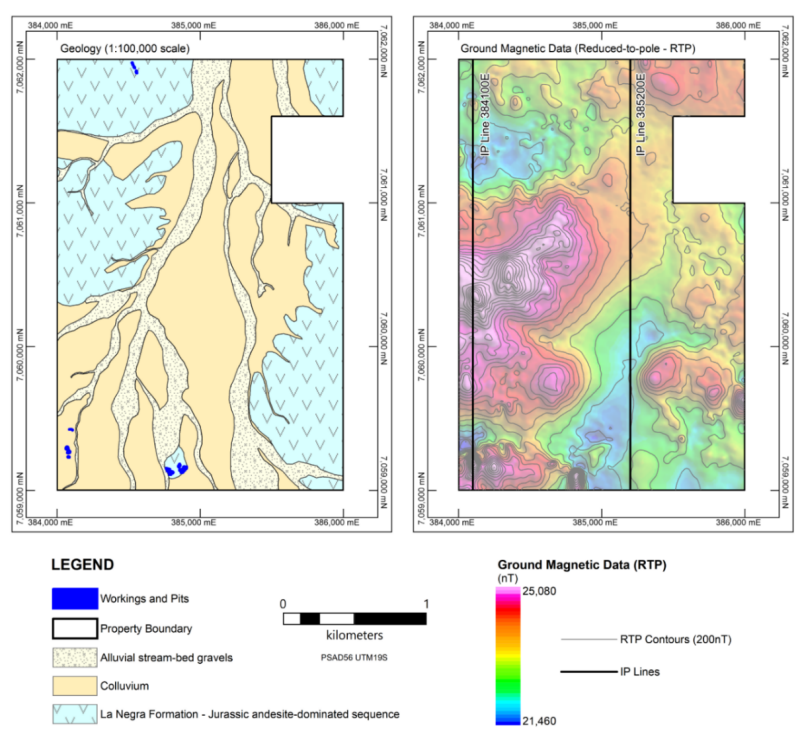

Much of the Chiricuto Property area is located under interpreted thin alluvial or colluvial gravel cover, however outcrop is locally present and hosts several small copper or iron workings and pits. Ground magnetic data has been collected over the area (Figure 2) that suggests the magnetite alteration is widespread, with high intensity anomalies up to 3000nT. Two reconnaissance lines of pole-dipole Induced Polarization (IP) have been surveyed and show high chargeability zones above 20 mV/V.

Tribeca Resources has, in large part due to our local networks and a growing reputation as a dynamic IOCG-focused copper explorer in the Chilean Coastal IOCG Belt, positioned itself as a partner of choice for the Project Vendors.

Tribeca Resources plans to undertake mapping, surface sampling and additional geophysics prior to proceeding with drilling at the Chiricuto Property.

Figure 2. Summary geology and ground magnetic data from the Chiricuto property.

Key Transaction Terms

The key terms under which Tribeca Resources has the right, but not the obligation, to acquire a 100% interest in the Chiricuto Property (the "Purchase Option”) are as follows:

-

Duration: 5-year option to purchase a 100% interest in the Chiricuto Property

-

Option cost: Cash payment of US$20,000 upon execution of the Agreement (paid)

-

Purchase price: US$0.01 per pound of contained copper equivalent metal contained in the Measured Indicated categories of an independent NI 43-101 compliant MRE. Purchase price will be at least US$1 million and will be capped at US$10 million

-

Holding costs: Tribeca Resources to pay annual concession fees (less than US$20,000/year)

-

Past annual concessions fees:Payment or reimbursement of certain past licence fees totalling approximately US$23,000.

-

Exploration Levy payments: Annual 5% Exploration Levy cash payments to the Project Vendors with guaranteed minimum payment of US$20,000 and cumulative amount paid to the Project Vendors during the option period capped at US$1 million

-

Deliverables: To exercise its Purchase Option, Tribeca must have delivered an NI 43-101 compliant MRE (to a minimum Inferred level of confidence), and have completed at least 3,000 metres of drilling over the geophysical anomaly identified at the Chiricuto Property

-

Extension right: Option period extendible to 6 years by paying the Project Vendors US$50,000 and increasing the purchase price from US$0.01 to US$0.011 per pound of contained copper equivalent in the MRE

-

NSR Royalty: If the Purchase Option is exercised, the Project Vendors retain a 0.5% NSR Royalty over the Chiricuto Property. No repurchase rights are included. 50% of Chiricuto Property purchase price to count as credit towards the NSR Royalty.

With the exception of the initial cash payment of US$20,000 to the Project Vendors and the reimbursement of past concession fees, the foregoing exploration expenditures, payments and work commitments are optional; Tribeca Resources will not be obliged to make any payments, complete any work or deliver the MRE should it elect not to execute the Purchase Option.

Tribeca Resources will be the operator of the project. The Agreement is subject to approval of the TSX Venture Exchange.

La Higuera Project drill results

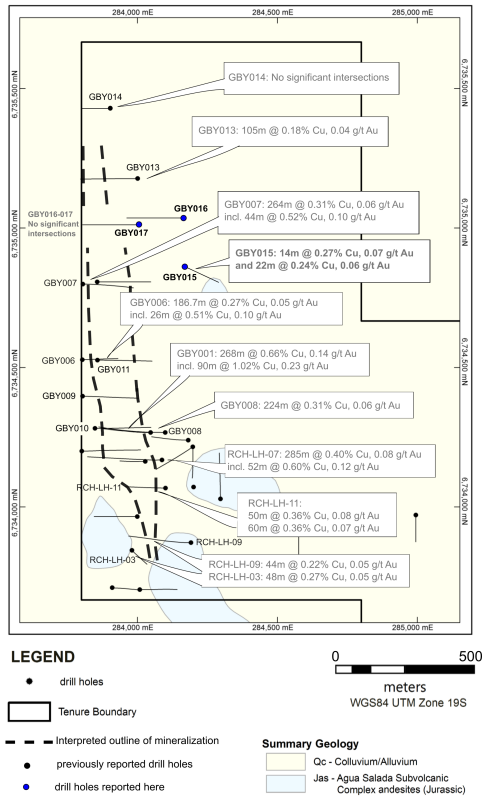

Final assay results from Phase 2 drilling at the Gaby target have now been received and are reported below. Drill holes GBY015 and GBY016 were sited to test two geophysical anomalies (gravity and IP, respectively) to the east of the main trend, and GBY017 was sited within a 400m undrilled gap in the main north-south trend.

Table 1. Summary of significant mineralized intersections in drill hole GBY015.

|

HoleID |

From (m) |

To (m) |

Downhole |

Cu |

Au |

Co (ppm) |

CuEq |

|

GBY015 |

20 |

34 |

14 |

0.27 |

0.07 |

75 |

0.30 |

|

GBY015 |

96 |

118 |

22 |

0.24 |

0.06 |

59 |

0.27 |

Note: The grade intersections are calculated over intervals >0.20% Cu with maximum internal dilution of 10m @ 0.05% Cu and a minimum interval width of 10m. CuEq (%) grades have been calculated using recoveries from metallurgical test work undertaken in 2006 on drill core from the Project, which are 90% for copper, 65% for gold and 50% for cobalt. Metal prices utilised were US$3.50/lb copper, US$1,900/oz gold and US$15.88/lb cobalt.

Drill hole GBY015 intersected intervals of copper-gold mineralisation from 20m and 96m downhole depth (Table 1). The cover thickness in this location, which is approximately 200m east of the main trend, is 14m downhole depth. The mineralization is dominantly associated with magnetite breccias in andesite, but some late cross-cutting hematite-chalcopyrite veins are also present.

Drill hole GBY016 and GBY017 intersected pyrite alteration and local zones of 0.1-0.5% copper, but no significant copper intersections greater than 10m width. The magnetic signature is lower in the zone of the north-south trend where these holes are located (Section 5000N – Figure 3) reinforcing the importance of the magnetic data in targeting higher grade mineralization.

GBY015 to GBY017 are the final holes from the Phase 2 drill program, which comprised 10 holes for 3,806m. With the completion of this program the mineralization at Gaby has now been intersected in most holes over a strike length of approximately 1.4 km, with significant thicknesses of mineralization ranging from 0.18% - 0.66% copper plus significant gold, cobalt and iron.

The logging, assay and other data from the Phase 2 program is now being integrated with previous drilling, geological and geophysical information to update the geological model at the Gaby target. Together with work on additional targets from the La Higuera Project, this is being utilised to plan the next phase of drilling.

The drill hole collar information from both the Phase 1 and Phase 2 drill programs is included in Appendix A.

Figure 3. Location of drill holes GBY015-017 with outline of key previously reported drill intersections.

Qualified Person

All scientific and technical information in this press release has been prepared by, or approved by, Dr. Paul Gow, who is the CEO of Tribeca Resources. He is a Member of the Australian Institute of Geoscientists (MAIG), a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM) and a qualified person for the purposes of NI 43-101. Dr. Gow has not verified any of the information regarding any of the properties or projects referred to herein other than the La Higuera Property and the Chiricuto Property. Mineralization on any other properties referred to herein is not necessarily indicative of mineralization on the La Higuera Property and the Chiricuto Property.

About Tribeca Resources

Tribeca Resources is a copper exploration company focused on discovering and developing assets in the Coastal IOCG Belt of northern Chile. The Company’s management team, whose members are significant shareholders of the Company, has world-leading expertise and a discovery history with iron oxide copper-gold deposits in the world’s great IOCG Belts of the Carajás district in Brazil and the Gawler and Cloncurry provinces of Australia.

Tribeca Resources’ objective is to provide the mineral resources for the next generation of copper mines in Chile. It is focused on building a portfolio of projects, with emphasis on mid to advanced-stage copper exploration and resource development projects. To this end, mineral targets are regularly assessed in pursuit of acquisition, strategic exploration and significant discovery.

Tribeca Resources’ flagship property is the La Higuera Project that comprises 4,147 hectares of granted mining and exploration licences and is located towards the southern end of the Chilean Coastal IOCG Belt in the Coquimbo Region of northern Chile. Further information about the project can be found in the NI 43-101 Technical Report lodged by Tribeca Resources on SEDAR on 24 October 2022.

On behalf of Tribeca Resources Corporation

|

Paul Gow |

Thomas Schmidt |

|

|

CEO and Director |

President and Director |

|

|

admin@tribecaresources.com |

admin@tribecaresources.com |

|

|

+1 604 685 9316 |

+1 604 685 9316 |

Cautionary Note

Neither the TSX Venture Exchange Inc. nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange Inc.) accepts responsibility for the adequacy or accuracy of this press release.

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act (“Regulation S”), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Forward Looking Information

This press release contains forward-looking statements and information that are based on the beliefs of management and reflect the Company's current expectations. When used in this press release, the words "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include statements regarding the Agreement and the Company’s Purchase Option in the Chiricuto Property, the ability of the Company to develop and define suitable drill targets at the Chiricuto Property, the relationship between geophysical survey results and potential mineralization, the ability of the Company to raise appropriate funding to complete the work program at the Chiricuto Property and other future plans and objectives of the Company, including exploration projects.

Such statements and information reflect the current view of the Company. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others,: the ability of the Company to obtain TSX Venture Exchange approval of the Agreement, the ability of the Company to pay the purchase price as well as any other payments required by the Agreement, risks associated with mineral exploration, including the risk that actual results of exploration will be different from those expected by management, and the risk that new laws or regulations could adversely affect the business and results of operations of the Company and anticipated work on the Company’s projects.

There are several important factors that could cause the Company’s actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: reliance on key management; changes in the credit or security markets; results of operation activities; unanticipated costs and expenses; fluctuations in commodity prices; and general market and industry conditions. The Company cautions that the foregoing list of material factors is not exhaustive. When relying on the Company's forward-looking statements and information to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events.

The Company has assumed that the material factors referred to in the previous paragraph will not cause such forward-looking statements and information to differ materially from actual results or events. The forward-looking information contained in this press release represents the expectations of the Company as of the date of this press release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While the Company may elect to, it does not undertake to update this information at any particular time except as required in accordance with applicable laws.

APPENDIX A.

Details of the drill collars from the Phase 1 and Phase 2 drill programs at the Gaby target. Collar coordinates provided using datum/projection WGS84 Zone 19S.

|

HoleID |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Total Depth |

|

GBY001 |

284047 |

6734267 |

454 |

267.3 |

-60 |

376.80 |

|

GBY002 |

284198 |

6734216 |

458 |

232.3 |

-60 |

348.00 |

|

GBY003 |

284182 |

6734239 |

458 |

267.3 |

-60 |

291.05 |

|

GBY004 |

284028 |

6734164 |

453 |

267.3 |

-60 |

202.70 |

|

GBY005 |

283802 |

6734200 |

446 |

87.3 |

-60 |

408.95 |

|

GBY006 |

283803 |

6734528 |

446 |

87.3 |

-60 |

262.70 |

|

GBY007 |

283805 |

6734799 |

441 |

87.3 |

-60 |

365.85 |

|

GBY008 |

284099 |

6734267 |

456 |

267.3 |

-60 |

445.50 |

|

GBY009 |

283804 |

6734397 |

446 |

87.3 |

-60 |

401.75 |

|

GBY010 |

283848 |

6734282 |

448 |

87.3 |

-60 |

401.75 |

|

GBY011 |

283856 |

6734518 |

447 |

87.3 |

-61 |

401.75 |

|

GBY012 |

283855 |

6734797 |

442 |

87.3 |

-60 |

401.75 |

|

GBY013 |

284000 |

6735177 |

437 |

267.3 |

-60 |

462.70 |

|

GBY014 |

283899 |

6735371 |

431 |

267.3 |

-60 |

218.65 |

|

GBY015 |

284140 |

6734833 |

447 |

97.3 |

-60 |

287.65 |

|

GBY016 |

284159 |

6735017 |

445 |

267.3 |

-65 |

383.65 |

|

GBY017 |

284011 |

6735002 |

439 |

267.3 |

-60 |

401.75 |