Archive

Stellar Africagold Receives TSX-V Acceptance of Royalty Reduction Agreement for Zuenoula Permit Cote D'ivoire

| |||||||||

Vancouver, BC - TheNewswire - April 5, 2023 - J. François Lalonde, President and Chief Executive Officer of Stellar AfricaGold Inc., (TSX-V:SPX) (TGAT:6YP1) (FSE:6YP1) ("Stellar" or the "Company") is pleased to announce:

Modification to Zuénoula Licence Agreement

Stellar has finalized an agreement regarding the Zuénoula Gold Licence (under application) in Côte d’Ivoire with Altus Strategies Ltd, a wholly owned subsidiary of TSX-V listed Elemental Altus Royalties Corp. ("Elemental Altus") to modify the existing property purchase agreement and royalty deed.

Summarized, the significant positive changes to the agreements and royalty deed are:

a) To reduce the current Net Smelter Royalty from 2.5% with the right to buy-back 1% of that royalty for $1,000,000 to a flat 1% Net Smelter Royalty with no buy-back, and

b) To reduce the additional considerations payable from $250,000 in cash or shares upon reaching 500,000 ounces of gold resources with at least 250,000 in the Indicated category and a further $250,000 in cash or shares upon completion of a feasibility study to a flat $500,000 in cash or shares upon reaching 1,000,000 ounces of gold resources with at least 500,000 ounces in the Indicated category provided that shares may only be used as a form of payment if the shares are trading at a price of $0.05 at the time of issuance.

The consideration payable by Stellar for these significant positive amendments is the issuance of 250,000 Stellar shares at $0.05 per share to Elemental Altus upon TSX Venture Exchange acceptance of the amending agreements and an additional 250,000 Stellar shares at $0.05 per share upon final issuance of the Zuénoula Gold Licence by the Côte d’Ivoire authorities. Stellar has filed these amending agreements with the TSX-V as an Expedited Transaction, the TSX-V has accepted the transaction, and the first 250,000 shares are being issued.

About the Zuénoula Gold Licence

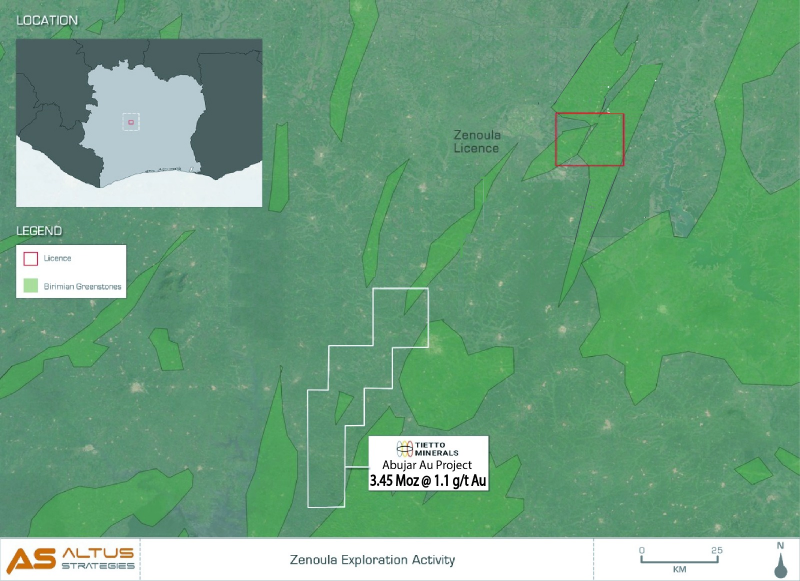

The Zuénoula Gold Licence comprises a single 400km2 permit application which is currently in process with final approval and licence issuance pending. The Zuénoula Gold Licence is in the Marahoue Department in central Côte d’Ivoire, approximately 300 km north of the capital city of Abidjan. The licence is located 100 km north of the town of Yamoussoukro and is accessible by asphalt roads from Abidjan. Zuénoula is centred within a NNE trending Birimian age granite greenstone belt. Zuénoula is located in a desirable gold region that has attracted a number of foreign corporations including ASX listed Tietto Minerals Limited with its new producer, the Abujar Gold Project (see map below). Also active in the region is Perseus Mining with its Yaouré Gold Mine, and Montage Gold with the Koné gold deposit.

Stellar’s Zuénoula gold project targets a 22 km long oblique ENE trending structure, interpreted by historic air magnetic data. Geologically, the project reportedly comprises metasediments, metabasalts and syntectonic granitoid intrusives.

Stellar is fortunate to have access to qualified and experienced African professionals to manage the legal and technical requirements of this acquisition. The exploration team in Côte d’Ivoire will be directly managed by Stellar’s Moroccan director Yassine Belkabir, managing director of African Bureau of Mining Consultants and a Qualified Person as defined in NI 43-101.

Map showing location of Zuénoula Gold Permit

Relative to Tietto’s Abujar Gold Project

(*Abujar updated ore reserves: Source: Abujar: West Africa's next gold mine (weblink.com.au). “ JORC 2012 Resource contained within 3 deposits: • AG – 55.2Mt at 1.4 g/t Au for 2.43Moz: • 7.7Mt at 1.4 g/t Au for 0.35Moz (Measured) • 30.4Mt at 1.3 g/t Au for 1.27Moz (Indicated) • 17.1Mt at 1.5 g/t Au for 0.81Moz (Inferred) • APG – 41.9Mt at 0.7 g/t Au for 0.96Moz: • 8.5Mt at 0.7 g/t Au for 0.20Moz (Indicated) • 33.3Mt at 0.7 g/t Au for 0.76Moz (Inferred) • SG – 1.6Mt at 1.2 g/t Au for 0.06Moz (Inferred)”

Stellar AfricaGold Inc. is a Canadian exploration company listed on the TSX Venture Exchange symbol TSX.V: SPX, the Tradegate Exchange TGAT: 6YP1 and the Frankfurt Stock Exchange FSE: 6YP1.

The Company maintains offices in Vancouver, BC and in Montreal, QC and has a representative office in Casablanca, Morocco. Stellar’s principal exploration projects are its gold discovery at the Tichka Est Gold Project in Morocco, and the Namarana gold Project in Mali.

The Tichka Est Gold Project is a grouping of seven permits covering an area of 82 km2. The Tichka Est Property lies within the High Atlas Western Domain about 80 km SSW of the city of Marrakech. The area is accessible year-round by road to the village of Analghi located near the mineralized gold zone. The mineralized zone is accessible via an eight-kilometer gravel mountain road constructed by Stellar. Follow up on gold sampling results reported by ONHYM lead Stellar to the discovery of 4 extensive gold mineralized structures A, B and C and recently C2.

Stellar also holds the drill ready Namarana Gold Project in Mali. Namarana is a 52 Km2 licence that is 100% owned by Stellar’s Mali subsidiary, Stellar Pacific Mali SARL. Namarana is located 130 km NW of the capital city of Bamako in the Kankaba Circle of the Koulikoro district.

The technical content of this press release has been reviewed and approved by M. Yassine Belkabir, MScDIC, CEng, MIMMM, a Stellar director and a Qualified Person as defined in NI 43-101.

Stellar’s President J. François Lalonde can be contacted at 514-994-0654 or by email at lalondejf@stellarafricagold.com.

Additional information is available on the Company’s website at www.stellarafricagold.com.

On Behalf of the Board

“J. François Lalonde”

President & CEO

This release contains certain "forward-looking information" under applicable Canadian securities laws. Forward-looking information reflects the Company’s current internal expectations or beliefs and is based on information currently available to the Company. In some cases forward-looking information can be identified by terminology such as "may", "will", "should", "expect", "intend", "plan", "anticipate", "believe", "estimate", "projects", "potential", "scheduled", "forecast", "budget" or the negative of those terms or other comparable terminology. Forward looking information contained in this news release includes, without limitation, statements relating to the completion of the Opawica Transaction and the exploration and development potential of the Balandougou II permit. Forward looking information are based on assumptions made by the Company. Many of these assumptions are based on factors and events that are not within the control of the Company, and there is no assurance they will prove to be correct or accurate. Risk factors that could cause actual results to differ materially from those predicted herein include, without limitation: the failure of Stellar to obtain TSX-V approval of the Opawica Transaction, the failure of Mosaic to complete the Mosaic Concurrent Financing, that the business prospects and opportunities of the Company will not proceed as anticipated; changes in the global prices for gold or certain other commodities (such as diesel, aluminum and electricity); changes in U.S. dollar and other currency exchange rates, interest rates or gold lease rates; risks arising from holding derivative instruments; the level of liquidity and capital resources; access to capital markets, financing and interest rates; mining tax regimes; ability to successfully integrate acquired assets; legislative, political or economic developments in the jurisdictions in which the Company carries on business; operating or technical difficulties in connection with mining or development activities; laws and regulations governing the protection of the environment; employee relations; availability and increasing costs associated with mining inputs and labour; the speculative nature of exploration and development; contests over title to properties, particularly title to undeveloped properties; and the risks involved in the exploration, development and mining business. Risks and unknowns inherent in all projects include the inaccuracy of estimated reserves and resources, metallurgical recoveries, capital and operating costs of such projects, and the future prices for the relevant minerals.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.