Archive

Volcanic Gold intersects 11.4 g/t Au and 1,150 g/t Ag over 1.52 m within a broader interval of 10.68 m grading 2.07 g/t Au and 389 g/t Ag in the La Pena vein at Holly

| |||||||||

|  |  |  |  | |||||

Shares issued 45,543,710

VG close - C$0.265, W/C +$7.5 million cash

Vancouver, British Columbia – TheNewswire – May 3, 2022 - Volcanic Gold Mines Inc. (TSXV:VG) (“Volcanic” or “the Company”) is pleased to report additional drill results from the Holly Property, Guatemala. Complete assays have been received for all previously pending drill holes. Full results tables and additional maps and geological sections are available on the Volcanic website.

Highlights from recent drill results include:

La Peña vein Hole HDD-22-030 intersected 11 .4 g/t Au and 1,150 g/t Ag over 1.52m within a broader interval of 10.68 m grading 2.07 g/t Au and 389 g/t Ag.

La Peña vein additional sampling of Hole HDD-22-022 reported 11.2 g/t Au and 522 g/t Ag over 1.53m

“The gold and silver discovery we have made at Holly is significant. The new high-grade intercepts demonstrate continuity within the La Peña vein system. With final results in hand the Company is working to complete a maiden resource calculation with the aim of showing the high value and minimal impact of developing these resources and the concrete benefits and sustainable employment for our local communities,” stated Simon Ridgway, President and CEO of Volcanic.

Drilling at Holly focused on extending the La Peña high-grade system at depth and along strike with a goal of establishing a significant high-grade resource and improving understanding of the controls on high-grade mineralization. The La Peña vein remains open in all directions. Several holes also cut high grade gold in the Amber vein and Pino target at a shallow depth. The Amber vein, Pino veins, Alpha vein and Jocotan splay targets all have significant potential and will be tested in future drill programs.

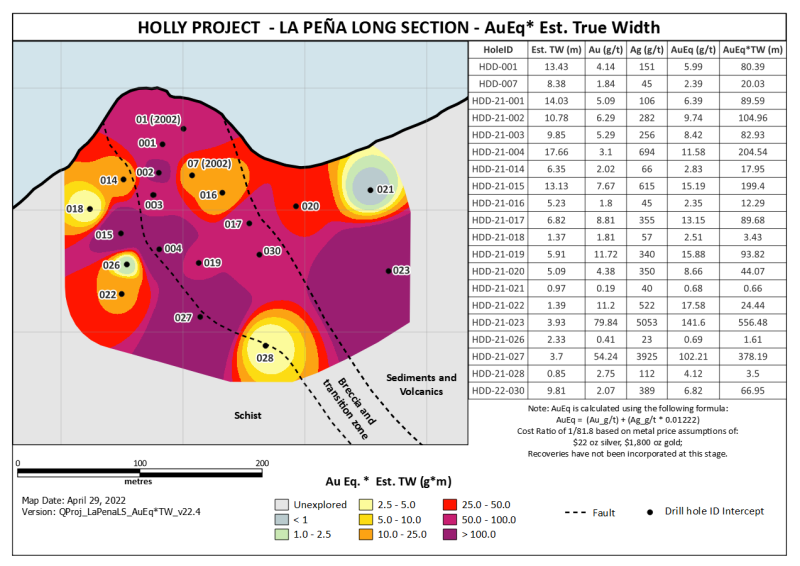

Figure 1: La Peña Long Section with AuEq x Estimated True Width

Table 1: Holly Project: Recent drill hole assay results (HDD21-022* new results from additional sampling)

|

DRILLHOLE |

FROM (m) |

TO (m) |

INTERVAL (m) |

Est. True Width |

GOLD (g/t) |

SILVER (g/t) |

Target |

|

HDD-21-022* |

199.77 |

201.30 |

1.53 |

1.39 |

11.20 |

522 |

La Peña |

|

HDD-21-024 |

56.42 |

57.95 |

1.53 |

0.011 |

207 |

NE |

|

|

HDD-21-025 |

no significant intercepts |

NE |

|||||

|

HDD-21-026 |

127 |

130 |

3.00 |

2.33 |

0.41 |

23 |

La Peña |

|

HDD-21-028 |

55.6 |

57.95 |

2.35 |

2.14 |

97 |

Peña splay |

|

|

and |

247.7 |

248.75 |

1.05 |

0.85 |

2.75 |

112 |

La Peña |

|

HDD-21-029 |

7.62 |

10.67 |

3.05 |

1.17 |

344 |

Pino |

|

|

HDD-22-030 |

7.62 |

14.3 |

6.68 |

1.92 |

3 |

Peña splay |

|

|

Including |

9.15 |

12.6 |

3.45 |

3.54 |

3 |

Peña splay |

|

|

HDD-22-030 |

28.8 |

29.8 |

1.00 |

0.71 |

8.64 |

10 |

Amber |

|

HDD-22-030 |

160.12 |

170.8 |

10.68 |

9.81 |

2.07 |

389 |

La Peña |

|

including |

161.65 |

163.17 |

1.52 |

1.40 |

11.40 |

1150 |

|

Future work

The Company is working on a maiden resource calculation and will follow that with a preliminary economic analysis aimed to show that the high-grade La Peña vein deposit could be mined from underground, causing minimal surface disruption. It is envisaged that trucking of high-grade ore to a nearby mill could minimise on-site processing and associated costs and impacts. The Company’s strategy is to calculate an approximate value of the deposit and potential income and be able to offer concrete benefits and much needed long term employment opportunities to the local communities. The Company expects the Holly project can grow significantly through exploration, but at this time it is important to define clearly the opportunity and potential impact of the project to all stakeholders. We plan to establish significant value at Holly for all the stakeholders.

Elsewhere in Guatemala the Company is evaluating the land position optioned from Radius Gold Inc. in May 2020. Several areas of significant promise have been identified and the Company is in the process of getting those concessions granted and drill permitted.

Technical Information

Bruce Smith, M.Sc. (Geology), a member of the Australian Institute of Geoscientists, is Volcanic’s Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Smith has 28 years of mineral exploration experience and has prepared and approved the technical information contained in this news release.

Quality Assurance and Quality Control

Volcanic follows industry standard procedures for diamond core drilling and analysis. Drilling is carried out using NQ and HQ size tooling. Drill core is cut in half using a rock saw with one-half of the core then taken as a sample for analysis. Sample intervals are generally 1m intervals, producing samples of between 2 to 9 kg. Half-core samples were initially processed at a Volcanic Gold preparation facility. The half core samples underwent primary crushing and split to produce a 250g sample under the supervision of a company geologist and qualified person. The split sample was then air shipped to certified ALS laboratories in Vancouver for further preparation and assay. All samples are fire assayed for Au and are analyzed for Ag and multi-elements using method code ICP following a four-acid digestion. Overlimits are analyzed using an appropriate method. Multi-element geochemical standards and blanks are routinely entered into the drill core sample stream to monitor laboratory performance. Quality control samples submitted were returned within acceptable limits.

Terms of Guatemala Radius Gold and Volcanic Gold Mines option

Pursuant to an option agreement signed in May 2020 with Radius Gold Inc. (TSXV: RDU), Volcanic can earn a 60% interest in the Holly and Banderas projects by spending the cumulative amount of US$7.0 million on exploration of the properties within 48 months from the date of the agreement. In accordance with the Option terms, Volcanic spent an initial US$1M on exploration within the 12 months of receiving the required drill permits, which expenditures included a minimum 3,000m of drilling on the properties.

Following the exercise of the Option, Volcanic will enter into a standard 60/40 Joint Venture in order to further develop the Properties. Volcanic has also been granted an exclusive right to evaluate all other property interests of Radius in Guatemala with a right to acquire an interest in any or all other such properties on reasonable terms.

Volcanic brings together an experienced and successful mining, exploration and capital markets team focused on building multi-million-ounce gold and silver resources in underexplored countries. Through the strategic acquisition of mineral properties with demonstrated potential for hosting gold and silver resources, and by undertaking effective exploration and drill programs, Volcanic intends to become a leading gold-silver company.

For further information, visit our website at www.volgold.com.

Volcanic Gold Mines Inc.

Simon Ridgway, President and CEO

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

Certain statements contained in this news release constitute forward-looking statements within the meaning of Canadian securities legislation. All statements included herein, other than statements of historical fact, are forward- looking statements and include, without limitation, statements about the Company’s plans for exploration work in Guatemala. Often, but not always, these forward looking statements can be identified by the use of words such as “estimate”, “estimates”, “estimated”, “potential”, “open”, “future”, “assumed”, “projected”, “used”, “detailed”, “has been”, “gain”, “upgraded”, “offset”, “limited”, “contained”, “reflecting”, “containing”, “remaining”, “to be”, “periodically”, or statements that events, “could” or “should” occur or be achieved and similar expressions, including negative variations.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any results, performance or achievements expressed or implied by forward-looking statements. Such uncertainties and factors include, among others, whether the Company’s planned exploration work will be proceed as intended; changes in general economic conditions and financial markets; the Company or any joint venture partner not having the financial ability to meet its exploration and development goals; risks associated with the results of exploration and development activities, estimation of mineral resources and the geology, grade and continuity of mineral deposits; unanticipated costs and expenses; and such other risks detailed from time to time in the Company’s quarterly and annual filings with securities regulators and available under the Company’s profile on SEDAR at www.sedar.com. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended.

Forward-looking statements contained herein are based on the assumptions, beliefs, expectations and opinions of management, including but not limited to: that the Company’s stated goals and planned exploration and development activities will be achieved; that there will be no material adverse change affecting the Company or its properties; and such other assumptions as set out herein. Forward-looking statements are made as of the date hereof and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by law. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, investors should not place undue reliance on forward-looking statements.