Archive

Colossus Resources Signs Letter of Intent with Austral Gold Limited to Acquire the Calvario and Mirador Copper Porphyry Projects in Chile

| |||||||||

Vancouver, BC - TheNewswire - April 5, 2023 - Colossus Resources Corp. (“Colossus” or the “Company”) (TSX-V:CLUS) is pleased to announce it has entered into a Letter of Intent (the “LOI”) dated April 5, 2023 with arm’s-length parties Austral Gold Limited and its subsidiaries Minera Mena Chile Ltda and Revelo Resources Corp. to acquire an undivided 100% interest in the Calvario and Mirador projects in the Republic of Chile. The Company has requested a trading halt, which will remain in effect until lifted by the TSX Venture Exchange.

About the Calvario and Mirador Projects (the “Projects”)

The Calvario and Mirador projects are located approximately 80 km northeast of the coastal city of La Serena in the Coquimbo Region of central-northern Chile in South America. The exploration targets within the Projects are primarily porphyry copper (+/- Molybdenum, +/- Gold) systems. The Projects lie along the southern extensions of the highly productive Paleocene magmatic belt of northern Chile that hosts some of the most important copper and precious metals deposits in the country, such as Spence and Cerro Colorado (BHP), Sierra Gorda (KGHM) and Relincho/Nueva Reunion (Teck-Newmont Goldcorp). The Calvario and Mirador projects comprise an important strategic land position with multiple copper targets controlled by the same regional thrust faults. The Projects are located approximately 115 km south of the 50-50 Teck - Newmont Goldcorp’s Relincho/Nueva Reunion Joint Venture advanced Project, one of the largest undeveloped copper-gold-molybdemum projects in the Americas.

-

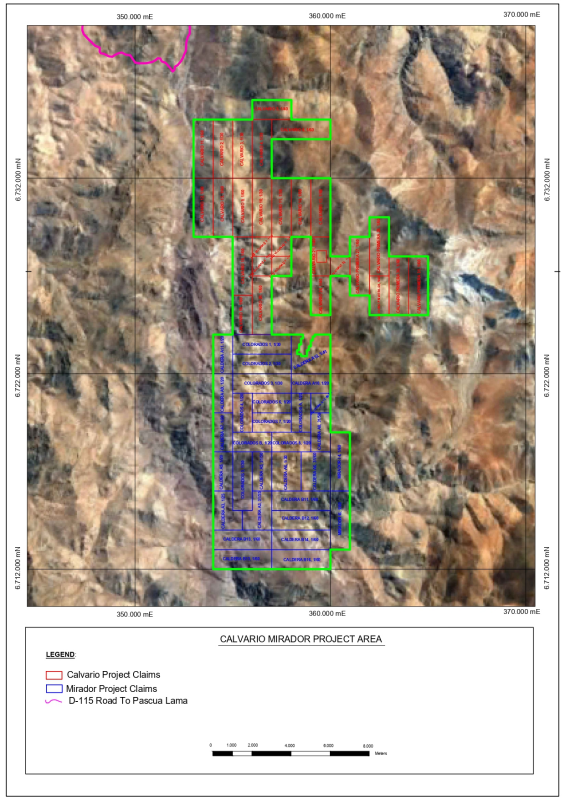

The Calvario Project (see Figure 1) consists of 28 titles (Title type: Exploitation) covering 6,870 hectares. A portion of the Calvario Project (2,200 hectares) are subject to a 2% base metals Net Smelter Rotalty (“NSR”) and an 1% precious metals NSR in favour of Mineral Global Copper Chile S.A., a wholly owned subsidiary of the major royalties corporation, Franco Nevada Corporation (Canada). The balance of the Calvario titles (4,470 hectares) are free of any royalties.

-

The Mirador Project consists of 31 titles (Title Type: Exploitation) covering 7,744 hectares. Ten of the Mirador titles (covering 2,400 hectares) are subject to a 2% base metals Net Smelter Rotalty (“NSR”) and an 1% precious metals NSR in favour of Mineral Global Copper Chile S.A. Nineteen of the other Mirador titles (covering 4,744 hectares) are subject to a 2% base metals Net Smelter Rotalty (“NSR”) and an 1% precious metals NSR in favour of Sumitomo Metals Mining Chile Ltda., a wholly owned subsidiary of the major mining corporation, Sumitomo Metals Mining Co. (Japan). Two titles (covering the balance 600 hectares) are free of any royalties.

Colossus’ technical Director Ioannis (Yannis) Tsitos states: “With this acquisition, Colossus Resources secures a significant and strategic mineral rights position in one of the most prospective belts, still underexplored, of central-northern Chile associated with significant copper and precious metals mineralization. The Project has good access to year-round field work and represents an exceptional opportunity for the Company. Subject to the successful conclusion of Definitive Agreements and the necessary approval of the transaction by the regulatory authorities, Colossus is looking forward to work closely with Austral Gold and its experienced technical team to advance both Calvario and Mirador projects towards a major copper (± Mo ± Au) discovery. Austral Gold will become the biggest single shareholder of Colossus.”

Figure 1: Outline of Calvario (in red) and Mirador (in blue) Concessions, located in the Coquimbo Region, Chile.

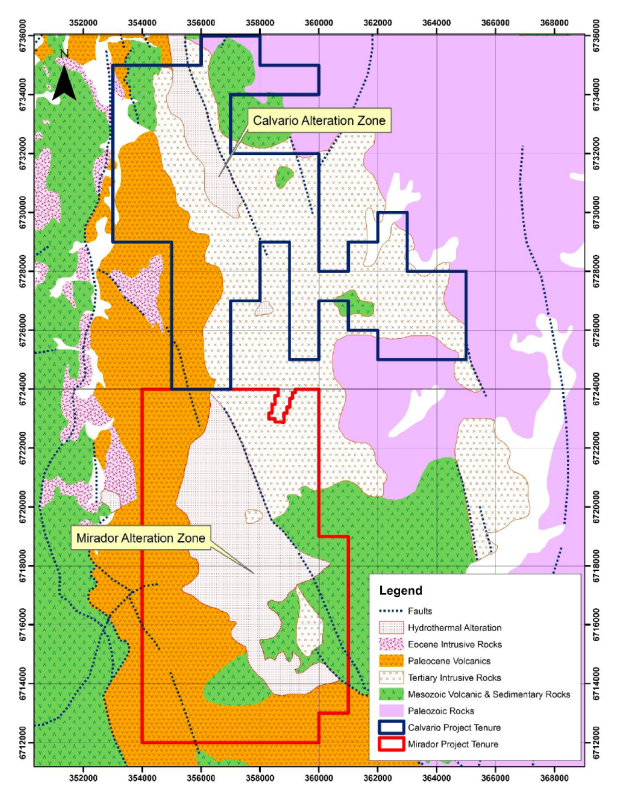

Calvario is a porphyry copper (± Mo ± Au) system characterised by a structurally controlled quartz-sericite alteration zone oriented NNW-SSE some 6.0 km x 1.0 km in size, hosted within monzonite and quartz-feldspar porphyry intrusions and other rocks. Relict sulphides (pyrite and chalcopyrite) in the leached and oxidised surface exposures, minor copper oxides and associated Mo (>10 ppm) and Cu (>600 ppm) geochemical anomalies in soils and talus fines samples, together with stockwork quartz D-type veins have defined a principal target area around 1,500 m x 700 m in size at the southern end of the alteration zone, which may reflect a possible hypogene copper target at depth. Two secondary targets occur further to the north along the principal alteration zone mapped. The priority target area coincides with three of the six relatively shallow historic diamond drill holes drilled by Minera Fuego Ltda (now Mineral Global Copper S.A.) in 2008. They display moderate quartz-sericite alteration with minor copper oxides as coatings on pyrite and in fractures, and minor chalcocite mineralization indicating weak secondary enrichment. Best intersections include Hole# FCAR-07 reporting 92m @ 0.23% CuT (Total Copper) & 21 ppm MoT (Total Molybdenum), including 20m @ 0.54% CuT & 24 ppm MoT and Hole # FCAR-14 reporting 62m @ 0.20% CuT & 22 ppm MoT, including 28m @ 0.30% CuT & 20 ppm MoT. Information from surface exposures and drill holes suggests that erosional levels are not sufficiently deep to have produced significant secondary enrichment, with essentially relatively high-level phyllic alteration exposed at surface. Hypogene copper mineralisation has not been specifically targeted by the limited historical drilling, and comprises the target for future drill testing. The property has been structurally uplifted by a series of regional thrust faults related to the San Felix – Vicuña fault system.

Exploration activities to date have included geological mapping of outcropping areas, alteration mapping, mineralogical studies, limited rock-chip surface sampling, limited ground magnetics and relatively shallow drill testing (4,314m of drilling in 20 holes, mostly Reverse Circulation) of certain targets. No work has been done over Calvario in recent years.

The property is easily accessed, being located close to the new paved highway that connects the main paved Pan-American Highway, through Tres Cruces, to the Pascua-Lama project (Barrick Gold). A short, well maintained dirt road links the project to the paved highway. A new high-tension power line has been installed along the Pascua-Lama highway. The project is located at altitudes ranging from about 3,000m to 3,300m.

Although Calvario is a drill-stage ready exploration project, the Company believes that historical data needs to become NI43-101 compliant, some detailed geochemistry and geophysical surveys should be conducted in order to vector to the most productive parts of the porphyry system/s, prior to any drilling, to take place within 8 months from execution of Definitive Agreements.

Mirador is a porphyry copper (± Mo ± Au) and high-sulphidation epithermal copper-gold exploration target and it is the southernmost of the two (with Calvario) large hydrothermal alteration systems located within the Properties. Mirador also lies along the same highly productive Paleocene belt of Chile.

The Mirador project and identified targets within its titles, have never been drilled to date!

Mirador represents a porphyry copper (± Mo ± Au) system, currently exposed at the upper-porphyry to epithermal levels, probably representing the base of a lithocap overlying the proposed porphyry copper target(s). Potential for high-sulphidation, epithermal copper-gold also exists. Extensive quartz-sericite and argillic alteration characterise the northern sector of the alteration zone. The alteration area (see Figure 2) extends over more than 7.0 x 3.0 Km, with superimposed advanced argillic alteration dominated by quartz-alunite in the central and southern sectors. Intense hydrothermal alteration is hosted principally within dacitic rocks. Phreatic breccias have been recognised, also suggesting the upper portions of a porphyry copper system. Surface outcrops are intensely leached. Limited copper oxides coincident with fine quartz veinlets at lower elevations to the north, suggest proximity to porphyry copper levels. Multi-element geochemical anomalies in rocks (Mo-Cu-Bi-Au – with Mo >24 ppm to 153 ppm, and Cu >92 ppm to 500 ppm) suggest porphyry copper potential in the northern and possibly southern portions of the alteration zone, while the central areas (As-Sb geochemistry) more closely suggests a high-sulphidation epithermal environment with potential for copper-gold mineralisation and possibly gold and silver. The property has been structurally uplifted by a series of regional thrust faults related to the San Felix – Vicuña fault system. Mirador together with contiguous Calvario project, form an important pair of copper targets controlled by the same regional thrust faults.

Figure 2: Calvario & Mirador Regional Geology and major copper porphyry related alteration areas.

Exploration activities to date have included detailed geological mapping of outcropping areas, detailed mapping of alteration mineralogy, and minor geochemical sampling of rocks. Further detailed alteration mapping and geochemical sampling to aid vectorisation towards potential productive levels, supported by geophysical testing (magnetics and IP), is required prior to drill testing of the principal targets.

Terms of the Acquisition

Terms of the LOI provide for funding by the Company of not less than USD$2.5 million in exploration expenditures on the Projects over a period of two years, of which at least USD$1.5 million must be incurred in the first 18 months. The Company will also issue to Minera Mena Chile Ltda (a wholly owned subsidiary of Austral Gold Limited) or its nominee, such number of common shares in the capital of Colossus (“Colossus Shares”) as to be equal to 19.9% of the post-issuance Colossus Shares outstanding, and one million share purchase warrants, each of which shall entitle the holder to purchase one Colossus Share for an exercise price of C$0.50 for three years.

The Company paid the sum of USD$100,000.00 to Austral Gold Limited on execution of the LOI. If a definitive option agreement is not entered into by the Company by May 30, 2023, or such later date as is agreed upon by the parties, Austral Gold Limited shall refund USD$37,500.00 to the Company.

The Projects are subject to net smelter return royalties over base and precious metals, of which Minera Mena Chile Ltda will retain the right to purchase half the royalties.

The transaction is subject to all applicable regulatory approvals, including acceptance by the TSXV, and, if required, shareholder approval.

Qualified Person

The Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects for this news release is Marco Carrasco G, Reg. N° 400, Comisión Minera de Chile, who has reviewed and approved its contents.

About Colossus Resources Corp.

Colossus Resources is a relatively young junior mineral exploration company focused on maximizing shareholder value through the acquisition, discovery and advancement of high-quality copper – gold projects in the Americas.

About Austral Gold Ltd.

Austral Gold is a gold and silver explorer and mining producer whose strategy is to expand the life of its cash-generating assets in Chile, restart its Casposo-Manantiales mine complex in Argentina, and build a portfolio of quality assets in Chile, the United States and Argentina organically through exploration and through acquisitions and strategic partnerships. Austral owns a 100-per-cent interest in the Guanaco/Amancaya mines in Chile and the Casposo-Manantiales mine complex (currently on care and maintenance) in Argentina; a non-controlling interest in the Rawhide mine in Nevada, United States; and a non-controlling interest in Ensign Gold, which holds the Mercur project in Utah, United States. In addition, Austral owns and has options on an attractive portfolio of exploration projects in the Paleocene belt in Chile (including the Jaguelito project in San Juan, Argentina, and projects acquired in the 2021 acquisition of Revelo Resources Corp.), a non-controlling interest in Pampa Metals and a 51-per-cent interest in the Sierra Blanca project in Santa Cruz, Argentina. Austral Gold is listed on the TSX Venture Exchange and the Australian Securities Exchange.

ON BEHALF OF THE BOARD OF DIRECTORS

“Harry Katevatis”

1.CEO & Director

Colossus Resources Corp.

For more information contact Ioannis (Yannis) Tsitos, Technical Director of Colossus Resources Corp.

Neither TSX Venture Exchange nor its regulation services provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain of the statements made and information contained herein may contain forward- looking information within the meaning of applicable Canadian securities laws. Forward-looking information includes, but is not limited to, information concerning the Company's intentions with respect to the development of its mineral properties. Forward-looking information is based on the views, opinions, intentions and estimates of management at the date the information is made, and is based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated or projected in the forward-looking information (including the actions of other parties who have agreed to do certain things and the approval of certain regulatory bodies). Many of these assumptions are based on factors and events that are not within the control of the Company and there is no assurance they will prove to be correct. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of the Company, its financial or operating results or its securities. The reader is cautioned not to place undue reliance on forward-looking information.