Archive

HELIX BIOPHARMA Corp. Announces Fiscal 2022 Third Quarter Results

| |||||||||

(Toronto Hill, Ontario) – TheNewswire – June 14, 2022 - Helix BioPharma Corp. (TSX:HBP), (“Helix” or the “Company”), a clinical-stage biopharmaceutical company developing unique therapies in the field of immuno-oncology based on its proprietary technological platform DOS47, today announced fiscal 2022 third quarter results for the period ending April 30, 2022.

OVERVIEW

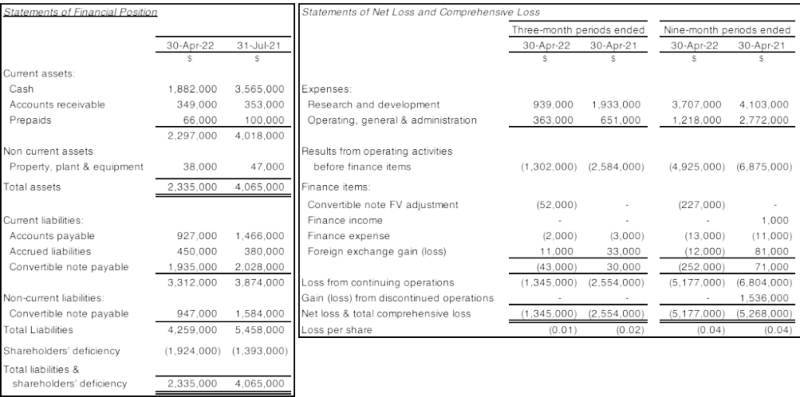

The Company reported a net loss and total comprehensive loss of $1,345,000 and 5,177,000 for the three and nine-month periods ended April 30, 2022. For the three and nine-month periods ended April 30, 2021, net loss and total comprehensive loss totaled $2,554,000 and $5,268,000, respectively. The net loss and total comprehensive loss for the nine-month period ending April 30, 2021, included a net gain of $1,536,000 as a result of the loss of control of a subsidiary and ultimately, a final tranche disposition on December 22, 2020, for gross proceeds of $2,308,000.

On March 11, 2022, the Company closed a private placement financing for gross proceeds of $1,001,000 from the issuance of 3,850,000 common share at a price of $0.26 per common share. On April 21, 2022, the Company closed a private placement financing for net proceeds of $2,002,000 from the issuance of 7,700,000 common shares at a price of $0.26 per common share.

On April 13, 2022, the Company announced that it has received conditional approval from the Toronto Stock Exchange to extend its previously announced Early Warrant Exercise Incentive Program from April 28, 2022, to May 31, 2022. The Incentive Program is a period during which holders of the Company’s eligible common share purchase warrants (“Eligible Warrants”) may take advantage of a temporary reduction in the exercise price of the Eligible Warrants to a price of C$0.26. The Eligible Warrants include an aggregate of 49,806,469 warrants that if exercised at the Incentive Exercise Price will result in the Company receiving gross proceeds of up to $12,949,682. As of the date of this press release, shareholders, in April and May of this year, exercised 12,346,938 warrants for total proceeds of $3,210,204.

Clinical development

-

Phase I combination therapy study in lung cancer (LDOS001):

-

The Company completed the LDOS001 Phase I LDOS-47 pemetrexed/carboplatin combination study clinical report and expects to notify the U.S. Food and Drug Administration (“FDA”) and update the results into the www.clinicaltrials.gov portal in the near future.

-

-

Phase II combination therapy trial in lung cancer (LDOS003):

-

The recent escalation of war in Ukraine, where the Company has enrolled virtually all its patients in this clinical study, has complicated matters. It is currently uncertain as to when the clinical study reports will be completed, if at all, due to the potential inability to access or verify certain key data.

-

-

-

The Company ceased patient enrolment into the trial in 2020 and sites were notified to conclude final patient survival follow-up visits.

-

-

-

As previously announced, the Company will not be advancing the randomized portion of the study without third-party partner funding. To date, no third-party partner has been identified.

-

-

-

The Company continues to be in discussion with the CRO over billings concerning the LDOS003 dose-escalation portion of the LDOS-47 vinorelbine/cisplatin combination study.

-

-

Phase Ib/II combination trial in pancreatic cancer (LDSOS006):

-

On March 3, 2022, Helix submitted an additional protocol amendment to the FDA, updating exclusion criteria to further restrict patients with cardiac medical histories that would put them at higher risk of adverse events from doxorubicin treatment, which is a chemotherapy agent with known cardiotoxicities. On May 5, 2022, patient screening re-opened for dosing cohort 2 (6 g/kg). One patient is currently in active screening.

-

-

Clinical drug product strategic review:

-

In August 2021, the Company retained the services of Cello Healthcare (Cello”), a highly experienced oncology consultancy group, to assess the Company’s drug product candidate with a focus on identifying value propositions and positioning strategies that would enable clinical adoption of L-DOS47, including broad clinical development key opinion leader input on the positioning of possible combination therapies and the prioritization of current and/or any additional clinical indications.

-

-

-

Interviews conducted by Cello with key opinion leaders since its engagement with the Company helped validate the utility of certain of the clinical work completed by Helix to date and has assisted the Company identify additional opportunities to further strengthen and de-risk the Company's clinical drug candidate program, including optimal selection of patients for trials (stratification) based on objective biomarkers, among other criteria. The Company anticipates that these activities may assist to initiate dialogue with potential market participants in cancer treatment, and that the additional preclinical data obtained could further enhance the Company's clinical program design.

-

Research and development

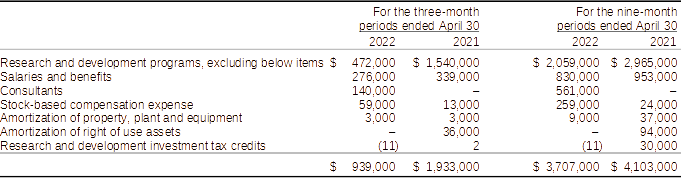

Research and development expense for the three and nine-month periods ended April 30, 2022, totalled $939,000 and $3,707,000, respectively, as compared to $1,933,000 and $4,103,000 respectively for the three and nine-month periods ended April 30, 2021, respectively.

Components of research and development expenses:

Research and development expenditures for the three and nine-month periods ended April 30, 2022, when compared to the three and nine-month period ended April 30, 2021, were lower by $994,000 and $396,000, respectively. The decreases in spending are mainly the result of lower expenditures associated with research and development activities by 69% partially offsetting the increases in consulting services and stock-based compensation which were higher due to expense of stock options granted to consultants. When compared to the nine-month period ended April 30, 2021, the Company also incurred spent $906,000 less on research and development activities or 31%. Salaries and benefits were lower by $123,000 or 13% while consulting and stock-based compensation were higher by $796,000.

The Company hired biotechnology consultants to assess the Company’s drug product candidate with a focus on identifying value propositions and positioning strategies that would enable clinical adoption of L-DOS47. See “Overview” above for additional information.

Operating, general and administration

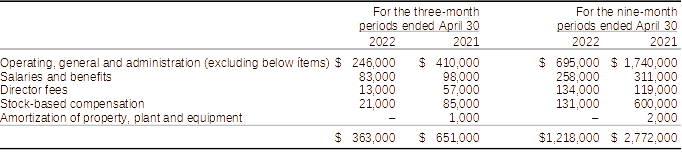

Operating, general and administration expenses for the three and nine-month periods ended April 30, 2022, totalled $363,000 and $1,218,000 respectively (2021 - $651,000 and $2,772,000).

Components of operating, general and administration expenses for the three-month periods ended April 30:

Operating, general and administration expenditures for the three and nine-month periods ended April 30, 2022, when compared to the three and nine-month period ended April 30, 2021, were lower by $288,000 (44%) and $1,554,000 (56%), respectively.

The decreases in spending reflect the Company’s efforts to control and reduce its overheads expenditures. The savings apply to various activities including salaries, rent, and other operational expenditures. Further measures are being taken which will result in more reductions in the next two quarters. Some expenditures in the comparative period relates to the Company’s attempt to raise additional capital as part of a qualifying transaction to list its common shares on a U.S. stock exchange, the termination, the termination of an investor relations agreement with ACM Alpha Consulting Management EST (“ACMest”) and stock-based compensation expenses of stock options granted to directors.

Several factors materialized that resulted in the Company abandoning its plans to list on a U.S. stock exchange. These include but are not limited to the increase in the percentage ownership of the Common Shares by new insiders; a decline in the price of the Common Shares making it extremely challenging for the Company to leverage the Multijurisdictional Disclosure System; and the resignation of the Company’s previous auditors.

The Company’s Statements of Financial Position as at April 30, 2022 and July 31, 2021 in addition to the Statements of Net Loss and Comprehensive Loss for the three and nine-month periods ended April 30, 2022 and 2021 are summarized below:

The Company’s Interim Condensed Financial Statements and Management’s Discussion and Analysis will be filed under the Company’s profile on SEDAR at www.sedar.com, as well as on the Company’s website at www.helixbiopharma.com.

About Helix BioPharma Corp.

Helix BioPharma Corp. is a clinical-stage biopharmaceutical company developing unique therapies in the field of immune-oncology for the prevention and treatment of cancer based on our proprietary technological platform DOS47. Helix is listed on the TSX under the symbol “HBP”.

For more information, please contact:

Helix BioPharma Corp.

401 Bay Street, Suite 2704

Toronto, Ontario, M5H 2Y4

Tel: 416-642-1807 x 304

Hatem Kawar, Chief Financial Officer

Forward-Looking Statements and Risks and Uncertainties

This news release contains forward-looking statements and information (collectively, “forward-looking statements”) within the meaning of applicable Canadian securities laws. Forward-looking statements are statements and information that are not historical facts but instead include financial projections and estimates, statements regarding plans, goals, objectives, intentions and expectations with respect to the Company’s future business, operations, research and development, including the focus of the Company’s primary drug product candidate L-DOS47 and other information relating to future periods.

Forward-looking statements include, without limitation, statements concerning (i) the Company’s ability to operate on a going concern being dependent mainly on obtaining additional financing; (ii) the Company’s priority continuing to be L-DOS47; (ii) the Company’s development programs, clinical studies, trials and reports for DOS-47 and L-DOS47; (iii) the Company’s development programs for DOS47 and L-DOS47; (iv) future expenditures, the insufficiency of the Company’s current cash resources and the need for financing; (v) future financing requirements, and the seeking of additional funding, and (vi) forecasts and future projections regarding development programs and expenditures. Forward-looking statements can further be identified by the use of forward-looking terminology such as “ongoing”, “estimates”, “expects”, or the negative thereof or any other variations thereon or comparable terminology referring to future events or results, or that events or conditions “will”, “may”, “could”, or “should” occur or be achieved, or comparable terminology referring to future events or results.

Forward-looking statements are statements about the future and are inherently uncertain and are necessarily based upon a number of estimates and assumptions that are also uncertain. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, such statements involve risks and uncertainties, and undue reliance should not be placed on such statements. Forward-looking statements, including financial outlooks, are intended to provide information about management’s current plans and expectations regarding future operations, including without limitation, future financing requirements, and may not be appropriate for other purposes. Certain material factors, estimates or assumptions have been applied in making forward-looking statements in this news release, including, but not limited to, the safety and efficacy of L-DOS47; that sufficient financing will be obtained in a timely manner to allow the Company to continue operations and implement its clinical trials in the manner and on the timelines anticipated; the timely provision of services and supplies or other performance of contracts by third parties; future costs; the absence of any material changes in business strategy or plans; and the timely receipt of required regulatory approvals and strategic partner support.

The Company’s actual results could differ materially from those anticipated in the forward-looking statements contained in this news release as a result of numerous known and unknown risks and uncertainties, including without limitation, the risk that the Company’s assumptions may prove to be incorrect; the risk that additional financing may not be obtainable in a timely manner, or at all, and that clinical trials may not commence or complete within anticipated timelines or the anticipated budget or may fail; third party suppliers of necessary services or of drug product and other materials may fail to perform or be unwilling or unable to supply the Company, which could cause delay or cancellation of the Company’s research and development activities; necessary regulatory approvals may not be granted or may be withdrawn; the Company may not be able to secure necessary strategic partner support; general economic conditions, intellectual property and insurance risks; changes in business strategy or plans; and other risks and uncertainties referred to elsewhere in this news release, any of which could cause actual results to vary materially from current results or the Company’s anticipated future results. Certain of these risks and uncertainties, and others affecting the Company, are more fully described in the Company’s annual management’s discussion and analysis for the year ended July 31, 2021 under the heading “Risks and Uncertainty” and Helix’s Annual Information Form, in particular under the headings “Forward-looking Statements” and “Risk Factors”, and other reports filed under the Company’s profile on SEDAR at www.sedar.com from time to time. Forward-looking statements and information are based on the beliefs, assumptions, opinions and expectations of Helix’s management on the date of this new release, and the Company does not assume any obligation to update any forward-looking statement or information should those beliefs, assumptions, opinions or expectations, or other circumstances change, except as required by law.

__________