Lido Minerals Enters into Business Combination Agreement with CAPPEX Mineral Ventures Inc. and Announces $1.5 Million Private Placement

| |||||||||

|  |  | |||||||

VANCOUVER, BRITISH COLUMBIA - TheNewswire – May 18, 2021 – Lido Minerals Ltd. (“Lido” or the “Company”) (CSE:LIDO) (CNSX:LIDO.CN) is pleased to announce that it has entered into a definitive business combination agreement dated May 18, 2021 (the “Agreement”) with CAPPEX Mineral Ventures Inc. (“CAPPEX”) and 1303554 B.C. Ltd. (“Subco”), a newly incorporated, wholly-owned subsidiary of Lido. Pursuant to the Agreement, Lido will acquire all of the issued and outstanding shares of CAPPEX in exchange for shares of Lido (the “Transaction”). The Transaction will constitute a reverse takeover of Lido by CAPPEX and will be a “fundamental change” of Lido pursuant to the policies of the Canadian Securities Exchange (“CSE”), requiring approval from the CSE. Approval of the shareholders of Lido and CAPPEX will also be required.

Pursuant to the Agreement, the Transaction will be structured as a three-cornered amalgamation, with CAPPEX amalgamating with Subco under the Business Corporations Act (British Columbia), and becoming a wholly-owned subsidiary of Lido. Shareholders of CAPPEX will receive one common share in the capital of Lido in exchange for each outstanding common share of CAPPEX held by them, with Lido expected to issue an aggregate of 37,160,813 Lido shares to the CAPPEX shareholders under the Transaction.

About CAPPEX Mineral Ventures Inc.

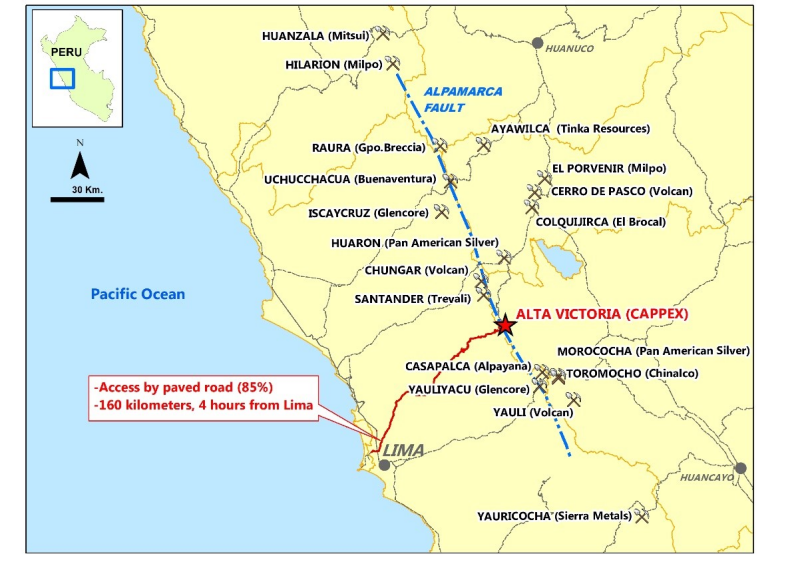

CAPPEX is a mineral exploration company with a highly experienced team focused on the Alta Victoria silver-polymetallic project (“Project”) in central Peru. The Project is located 160 kilometers northeast of Lima and consists of 18 mining concessions over a total area of 71 km2 within the Central Cordillera Polymetallic Mineral Belt, which hosts significant silver and polymetallic mineral deposits. Mining production within the district is from CRD, skarn, vein, manto, and diatreme related deposits, and four of these major mines (Santander, Chungar, Iscaycruz and Casapalca) lie along and/or adjacent to the Alpamarca Fault to the NW and SE of the Project. Concessions controlled by CAPPEX straddle nearly 14 km of the Alpamarca/Chonta Fault at the heart of this district (see Figure 1).

Further technical information on the Project can be found below.

About the Combined Company

Upon completion of the Transaction, the resulting company (the “Combined Company”) will continue to carry on the business of CAPPEX and the exploration of the Project as well as targeting the acquisition of additional mineral projects by leveraging the team’s significant experience in Peru and South America more widely. The board and management of Lido will be reconstituted on close of the Transaction and is expected to be comprised of the following:

Ronald Stewart, Chief Executive Officer – Mr. Stewart is a mining professional with over 30 years of international experience in exploration, project development, operations and capital markets. Early in his career he led the discovery team at the 5 million-ounce Musselwhite deposit in Ontario and was an integral team member involved in the discovery and advancement of Wallaby in West Australia and Volte Grande in Brazil. Mr. Stewart was President and CEO of Beaufield Resources Corp., which was acquired by Osisko Mining Inc. He spent eight years as an award-winning equity analyst and investment banker at Dundee Capital Markets, Clarus Securities Inc. and Macquarie Capital Markets. Mr. Stewart holds an H.BSc. in geology from Lakehead University and is a registered Professional Geoscientist (P.Geo.) in Ontario.

Paul Ténière, President – Mr. Ténière is a Professional Geologist (P.Geo.) and currently the CEO of Lido. Mr. Ténière has over 20 years of diverse experience in the mining and oil & gas sectors in Canada, United States, and internationally taking projects from exploration stage to mine development. Mr. Ténière has held senior to executive roles with junior to major mining companies developing precious metal, base metal, and metallurgical coal deposits, and has significant capital markets and corporate finance experience through his past senior roles with the TSX and TSX Venture Exchange. Mr. Ténière has also worked on MVT lead-zinc deposits, porphyry-style copper-lead-zinc deposits, and gold-PGM deposits in Canada, United States, and Europe. Mr. Ténière also serves as the CEO and Director of Metallica Metals Corp., Director of Monarca Minerals Inc., and President of Major Precious Metals Corp. Mr. Ténière holds an M.Sc. in Geology from Acadia University and a B.Sc. (Honours) from Dalhousie University in Nova Scotia.

Stephen Brohman, Chief Financial Officer, Corporate Secretary – Mr. Brohman is currently CFO and Corporate Secretary of Lido. Mr. Brohman has ten years of working experience in a variety of roles with public companies and has become experienced in corporate finance, project acquisition, executive management, corporate communications, corporate branding, shareholder relations and investor lead generation. Mr. Brohman has extensive experience in the audit of publicly traded companies, and has worked with mining and exploration, oil and gas, real estate investment, and merchant banking companies during his time in public practice. Mr. Brohman has served as director and/or executive officer for several publicly traded mineral exploration companies. Mr. Brohman obtained a BBA from Capilano University in 2008 and obtained his CPA, CA (Chartered Professional Accountant) designation in 2011.

Philip Anderson, Director – Mr. Anderson is the founder and current President and director of CAPPEX. Starting his career in Alaska, his work in exploration spans 40 years in over a dozen countries since graduating from Colorado School of Mines in Geological Engineering in 1981. As an independent explorationist, he has been based in South America since the early 1990’s. Leadership roles include VP Exploration with Canadian Shield Resources Ltd. from 2007 to 2010 and Chile-Peru exploration manager for Brett Resources Inc. from 1996 to 2003 where his early work led to the discovery and development of the Pallancata Mine in Peru, a primary silver producer. In 2017 Mr. Anderson formed CAPPEX, financed the acquisition and initial groundwork on the Project, and subsequently raised an additional C$2.5M privately, to advance the project to its present stage.

Fabian Baker, Director – Mr. Baker is currently a director of CAPPEX and CEO of ASX-listed Kingsrose Mining Ltd. Mr. Baker is a geologist, with a Bachelor of Science in Applied Geology from the Camborne School of Mines. He was the founder and CEO of Tethyan Resource Corp., a mineral exploration company that was listed on the TSX Venture Exchange. Under his leadership, Tethyan identified and negotiated the acquisition of significant gold, copper, and base metal exploration assets in Serbia. In October 2020, Tethyan was acquired by ASX and LSE-listed mining company Adriatic Metals plc. Prior to Tethyan, Mr. Baker was Chief Geologist at Lydian International where he played a key role in the growth and advancement of the 5 million-ounce Amulsar gold deposit to completion of a feasibility study.

Nate Brewer, Director – Mr. Brewer’s experience spans 40 years in over 20 countries as an exploration geologist for major mining companies. He started his career in Alaska with BP Minerals and Anaconda Minerals Company after graduating with a B.A. in Geology from University of California at Santa Barbara in 1975. Starting in the early 1990’s, Mr. Brewer worked for 25 years in Latin America principally with Homestake Mining Company and Gold Fields Limited, where he played a leadership role in the evaluation and acquisition of the Veladero gold-silver deposit in Argentina and the Cerro Corona deposit in Peru. Mr. Brewer and his team were directly responsible for the discovery and advancement through to feasibility of the Chucupaca deposit in Peru and Salares Norte deposit in Chile.

Hannah Jin, Director – Ms. Jin is a Professional Geologist (P.Geo.) and currently a director of Lido. Ms. Jin is also the Director of Corporate Development for VRB Energy, a privately-held battery technology innovator and energy storage system manufacturer, and a director of Gold Lion Resources. Ms. Jin has over 15 years of technical and business development experience specializing in project evaluation, due diligence, and valuation analysis of precious and base metal projects. Ms. Jin holds an M.Sc. in Geology from Western University and an M.B.A. from the University of British Columbia.

Patrick O’Flaherty, Director – Mr. O’Flaherty is currently a director of Lido and is a Chartered Accountant and a Chartered Financial Analyst. He also holds a degree in Economics from Union College, in Schenectady, NY. Mr. O’Flaherty has several years of experience in financial services, including public accounting and wealth management. He has worked for a recognized accounting firm and two recognized banking institutions and has served as an officer and director of several Canadian publicly traded companies.

Private Placement

In connection with the Transaction, Lido also announces that it has completed a non-brokered private placement of 10,000,000 subscription receipts (the “Subscription Receipts”). The Subscription Receipts were issued at a price of $0.15 per Subscription Receipt for gross proceeds of $1,500,000. Each Subscription Receipt will, on closing of the Transaction on or before November 15, 2021, be automatically converted into one common share and one warrant of the Combined Company. Each warrant will be exercisable into one common share of the Combined Company at an exercise price of $0.25 per share for a period of two years from the date of issuance.

On close of the Transaction, it is anticipated that former shareholders of CAPPEX will hold approximately 61.5% of the Combined Company, shareholders of Lido will hold approximately 22.0% of the Combined Company, and 16.5% of the Combined Company will be held by subscribers to the private placement.

The proceeds of the private placement will be held in escrow and released to the Combined Company on close of the Transaction. The proceeds of the private placement will be used to fund the exploration of the Project and for general working capital purposes.

Paul Ténière, CEO of Lido, commented, “Lido has spent the past year searching for a significant high grade silver project with a high calibre exploration and management team that could transform the Company into a leading precious metals explorer in North and South America. CAPPEX and the Alta Victoria Silver Project fit that bill and also bring a management team with a track record of significant value creation across South America and around the world. I look forward to welcoming the new executives and directors to our team and working with them to develop precious metal projects in Peru.”

Phil Anderson, President of CAPPEX, added, “this combination with Lido is the critical and timely step needed to take CAPPEX and the Alta Victoria Project forward and continue adding value for all shareholders of CAPPEX and Lido. The team we have managed to bring together has been directly involved with the discovery of tens of millions of ounces of gold and silver across the globe over the last 3 decades and will provide an unusually high probability of further exploration success going forward. My thanks go out to those on both sides that have worked so diligently over the past months to help bring this transaction along and to CAPPEX shareholders for their unwavering support over the last 3 years.”

Alta Victoria Silver-Polymetallic Project Details

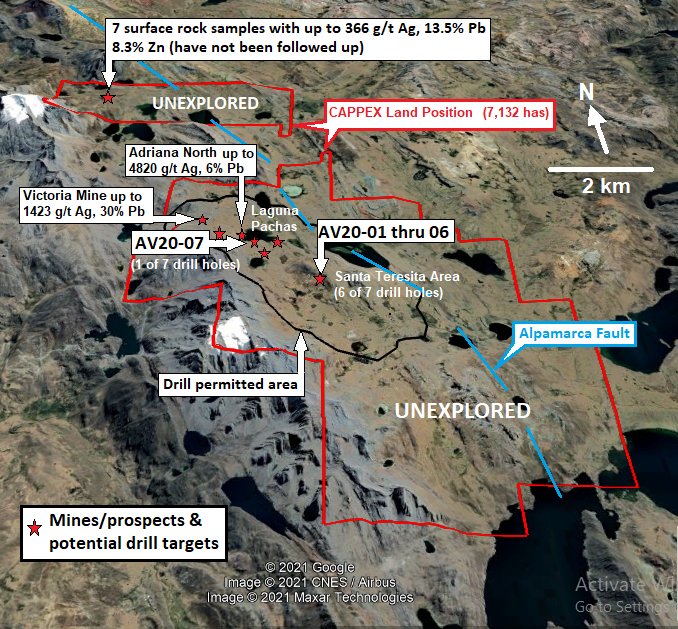

Silver-polymetallic mineralization is widespread throughout the Project area (Figure 1) and is controlled by structure and stratigraphy, exposed as outcropping veins and breccias as well as mantos that form at stratigraphic contacts. Mineralization at surface and within underground artisanal mine workings on the Project extends over an area of approximately 4 km x 1 km and forms a series of exposed exploration targets, yet very little modern exploration has been completed to date. Mineralization shows a marked zonation from more distal silver-gold-manganese veins and mantos at the Santa Teresita target to gold-silver-copper-molybdenum mineralization hosted in veins, breccias and mantos in the Lagunas Pachas area, suggesting closer proximity to a mineralizing source that may represent a porphyry target. Rock-chip sampling from the five prospects around Laguna Pachas returned numerous high-grade results with grades up to 6.2 g/t Au, 4,800 g/t Ag (154 opt), 18.7 % Pb, 30.1 % Zn, 0.64 % Cu and 0.14 % Mo.

Of the 18 mining concessions that make up the Project, ten are held by CAPPEX’s Peruvian subsidiary, Minera CAPPEX S.A.C., and Minera CAPPEX S.A.C. holds an option to acquire the remaining eight mining concessions through an option agreement to acquire Minera Yantac S.A.C. (“Yantac”).

Exploration and Drilling Activities

Since acquiring the Project four years ago, CAPPEX has completed geological mapping and geochemical sampling of surface and underground workings, soil geochemical surveys, and an Induced Polarization (IP) survey totaling 39.7 line-km. IP chargeability was a significant factor in determining drill hole targets for a the first ever 7-hole scout drilling program on the Project that was completed between September 11, 2020 and November 8, 2020 and totaled 2,300 metres (Table 1 and Figure 2). Two main target zones were tested; Santa Teresita where six of the seven holes were collared, and Sanguinetti where one hole was collared. Drilling encountered significant silver and gold mineralization localized in zones of stratigraphic and/or structural controls (Table 2).

Figure 1: Location of Alta Victoria Project within the Central Cordillera Polymetallic Mineral Belt

Figure 2: 2020 scout drill hole locations for Alta Victoria Project

Table 1: 2020 Scout Drill Hole Locations – Alta Victoria Project

|

Drillhole ID |

Target Area |

UTM WGS 84-18S |

Elevation (m) |

Azimuth |

Dip |

Depth (m) |

|

|

Easting |

Northing |

||||||

|

AV20-01 |

Santa Teresita |

346703 |

8744096 |

4,833 |

45 |

-60 |

416.3 |

|

AV20-02 |

Santa Teresita |

346743 |

8744173 |

4,850 |

225 |

-75 |

474.1 |

|

AV20-03 |

Santa Teresita |

346839 |

8744096 |

4,857 |

10 |

-60 |

210.5 |

|

AV20-04 |

Santa Teresita |

346729 |

8744363 |

4,816 |

295 |

-70 |

99.3 |

|

AV20-05 |

Santa Teresita |

346671 |

8744322 |

4,828 |

215 |

-70 |

320.2 |

|

AV20-06 |

Santa Teresita |

346765 |

8743840 |

4,733 |

0 |

-90 |

443.7 |

|

AV20-07 |

Sanguinetti |

345080 |

8745359 |

4,679 |

95 |

-65 |

336.2 |

Table 2: Alta Victoria Project - Significant Drilling Intercepts

|

Drill hole |

From |

To |

Interval |

Au |

Ag |

Cu |

Pb |

Zn |

AgEq* |

Remarks |

|

AV20-01 |

92 |

96 |

4 |

0.21 |

48.6 |

0.04 |

0.07 |

0.23 |

2.3 |

4.0m @ 2.3 opt AgEq |

|

110 |

113 |

3 |

0.02 |

22.3 |

- |

0.72 |

1.44 |

2.8 |

3.0m @ 2.8 opt AgEq |

|

|

179.2 |

184.2 |

5 |

0.63 |

7.8 |

- |

0.06 |

0.25 |

1.9 |

5.0m @ 1.9 opt AgEq |

|

|

incl |

179.2 |

180.2 |

1 |

1.97 |

30.4 |

- |

0.07 |

0.26 |

5.6 |

1.0m @ 5.6 opt AgEq |

|

AV20-02 |

23.3 |

36 |

12.7 |

0.09 |

2.7 |

- |

- |

- |

1.4 |

12.7m @ 1.4 opt AgEq |

|

incl |

26.1 |

27.6 |

1.5 |

0.1 |

91.4 |

- |

0.07 |

- |

3.2 |

1.5m @ 3.2 opt AgEq |

|

incl |

33.1 |

34.6 |

1.5 |

0.3 |

108 |

- |

0.06 |

0.11 |

4.3 |

1.5m @ 4.3 opt AgEq |

|

108.2 |

109.2 |

1 |

0.04 |

29.9 |

0.12 |

0.218 |

0.63 |

2.2 |

1.0m @ 2.2 opt AgEq |

|

|

AV20-02 |

190.4 |

192.1 |

1.7 |

4.3 |

14.4 |

0.02 |

0.88 |

0.53 |

11 |

1.7m @ 11.0 opt AgEq |

|

AV20-02 |

232 |

248 |

16 |

0.56 |

6.3 |

- |

0.04 |

0.14 |

1.6 |

16.0m @ 1.6 opt AgEq |

|

incl |

236 |

238 |

2 |

0.53 |

31.7 |

0.03 |

0.13 |

0.38 |

2.7 |

2.0m @ 2.7 opt AgEq |

|

incl |

242 |

246 |

4 |

1.1 |

4.3 |

- |

0.03 |

0.13 |

2.7 |

4.0m @ 2.7 opt AgEq |

|

AV20-03 |

0 |

20 |

20 |

0.02 |

86.6 |

0.03 |

0.11 |

0.2 |

3.2 |

20.0m @ 3.2 opt AgEq |

|

incl |

2 |

10 |

8 |

0.02 |

108.2 |

0.04 |

0.11 |

0.16 |

3.4 |

8.0m @ 3.7 opt AgEq |

|

AV20-03 |

118.3 |

119 |

0.7 |

1.81 |

0.85 |

- |

- |

- |

4 |

0.7m @ 4.0 opt AgEq |

|

AV20-04 |

No significant intercepts |

|||||||||

|

AV20-05 |

37 |

42.5 |

5.5 |

0.02 |

12.2 |

- |

0.28 |

0.41 |

1.1 |

5.5m @ 1.1 opt AgEq |

|

AV20-06 |

No significant intercepts |

|||||||||

|

AV20-07 |

No significant intercepts |

|||||||||

Notes:

-

- *AgEq was calculated using the following price assumptions: Au=$1838/oz, Ag= $27.00/oz, Cu=$3.71/lb, Pb= $0.94/lb, Zn= $1.22/lb. AqEq reported in ounces per ton (opt).

- Reported intervals do not represent true thickness. True thickness is unknown at this time.

- Numbers in this table may not add exactly as numbers have been rounded to the nearest decimal.

Drilling was completed using a track-mounted diamond drilling rig and supervised by CAPPEX geological staff. HQ-sized core was collected and transported to CAPPEX’s core facility, where it was logged and sampled at either 2 metre intervals or with the aid of a handheld XRF spectrometer. Sample intervals were also based on structural and lithological contacts. Core recovery levels were generally near 100%, however, poor recoveries were encountered in zones of intense faulting or due to voids from historical mine workings.

A total of 772 samples were analyzed during the 2020 scout drilling program on the Project. The QAQC protocol by CAPPEX included 24 Certified Reference Materials (standards), 16 coarse blanks and 8 duplicate samples that were inserted into 14 sample batches. QAQC materials comprised approximately 7% of the total samples. Assay results of standards and duplicates were within the range of tolerance. Of the 16 coarse blank samples, results were within the tolerance range for all elements with the exception of copper which varied outside tolerance levels. Analytical work was done by ALS Global located in Lima, Peru. ALS Global is ISO 9002 certified and independent of CAPPEX. All samples submitted were analyzed for 48 elements using a four-acid digestion and ICP-MS and ore grade gold using 30g charge Fire Assay/AA finish. Overlimit analysis was done on Ag, Pb, Zn using four acid digestion, ICP-AES. In addition, 5 pulp duplicate samples were sent for check assays to CERTIMIN S.A., also a certified independent laboratory located in Lima, Peru.

Summary

Overall, the 2020 scout drilling program confirmed manto style replacement and structurally-controlled polymetallic mineralization on the Project with silver grades up to 108 g/t Ag in holes AV20-01 to AV20-03. The thickest, highest grade intercept (20m @ 86.6 g/t Ag – see Table 2) was encountered in a calcareous sandstone unit, the apparent base of the Pariahuanca Formation limestone. Other altered and mineralized zones within in siliciclastic units demonstrate that permeability contrast between siltstone and coarser grain sandstone, with or without a carbonate component, are essential in providing conduits for fluid flow and mineralized manto formation.

CAPPEX plans to complete an additional 3,000 metres of diamond drilling and detailed mapping and ground geophysics over other target areas in the Project with known polymetallic mineralization.

Data Verification

Both Mr. Paul Ténière, P.Geo., and Mr. Walter La Torre, MAusIMM (CP), have verified the scientific and technical information disclosed in this news release including all sampling, analytical, and drilling data underlying the information disclosed above. Mr. La Torre verified all technical information while authoring an independent NI 43-101 technical report for the Project. This included the completion of a database audit of all sample and drilling assay data disclosed and completion of a site visit (personal inspection) of the Project in July 2020, where Mr. La Torre verified the geology, mineralization, and historical mine workings. Mr. Ténière has verified the technical information disclosed through a detailed technical due diligence review over the past four months, which included a full review of the sampling, analytical, and drilling data from the CAPPEX exploration and drilling programs.

Conditions to Closing Transaction

Lido and CAPPEX will conduct meetings of their shareholders for purposes of obtaining shareholder approval of the Transaction and related matters. Further details about the Transaction and the Combined Company will be provided in the information circulars and a listing statement of Lido to be prepared and filed in respect of the Transaction. Investors are cautioned that, except as disclosed in the information circulars or listing statement, any information released or received with respect to the Transaction may not be accurate or complete and should not be relied upon.

Completion of the Transaction is subject to a number of conditions, including, but not limited to, receipt of regulatory approval, compliance with applicable securities laws, and the receipt of all requisite shareholder approvals. Trading in the common shares of Lido will remain halted pending review of the Transaction by the CSE. There can be no assurance that trading in the common shares will resume prior to completion of the Transaction.

Qualified Person Statement

All scientific and technical information contained in this news release was prepared and approved by Paul Ténière, M.Sc., P.Geo., CEO of Lido Minerals Ltd. who is a non-independent Qualified Person as defined in NI 43-101, and Walter La Torre, MAusIMM (CP), who is an independent Qualified Person as defined in NI 43-101.

For further information, please contact:

Paul Ténière, M.Sc., P.Geo.

Chief Executive Officer

(604) 687-2038

teniereconsulting@gmail.com

The CSE has not, in any way, passed upon the merits of the Transaction and associated transactions and has not, in any way, approved or disapproved of the contents of this news release. The CSE has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.

Forward-Looking Information

Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the Transaction, the completion thereof and the use of proceeds. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “will” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including the receipt of all necessary regulatory and shareholder approvals. Although management of the Company have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.