Archive

AbraSilver Announces Robust PEA of Diablillos Including After-Tax NPV of US$364M

| |||||||||

|  | ||||||||

Economics Demonstrate Potential for a Highly Economic Oxide Silver-Gold Development Project

Toronto - TheNewswire – November 29, 2021: AbraSilver Resource Corp. (TSXV:ABRA) (OTC:ABBRF) ("AbraSilver" or the “Company”) is pleased to announce the results of a Preliminary Economic Assessment (“PEA”) for its wholly-owned Diablillos project (“the Project”) in Salta Province, Argentina. The PEA is based on the Mineral Resource estimate, recently reported in a Technical Report titled “NI 43-101 Technical Report Mineral Resource Estimate – Diablillos Project”, effective October 28, 2021.

All dollar ($) figures are presented in US dollars unless otherwise stated. Base Case metal prices used in this analysis are $1,650 per gold (“Au”) ounce (“oz”) and $24.00 per silver (“Ag”) oz.

PEA Study Highlights:

-

Robust Economics:

-

Pre-Tax NPV5% of $678.5 Million (CAD$ 882.1 Million) with an Pre-Tax IRR of 44.3% (Base Case);

-

After-Tax NPV5% of $364.0 Million (CAD$ 473.2 Million) with an After-Tax IRR of 30.2% (Base Case).

-

-

7,000 tonnes per day (“tpd”) production rate with an initial mine life of up to 16 years.

-

Average annual production:

-

Average annual production in first 5 years of 8.0 Moz Ag and 44.3 koz Au, or 11.4 Moz AgEq;

-

Average Life-of-Mine (“LOM”) production of 4.2 Moz Ag and 52.0 koz Au, or 8.5 Moz AgEq.

-

-

Low cash operating costs:

-

All-in Sustaining Cash Costs (“AISC”) during first 5 years of $10.41/oz AgEq;

-

All-in Sustaining Cash Costs (“AISC”) during average Life-of-Mine (“LOM”) of $11.97/oz AgEq.

-

-

Initial Capital Expenditure of $255.0 million, with payback period of 2.6 years.

-

Several potential opportunities have been identified that may significantly further enhance the economic returns as detailed later in this release.

John Miniotis, President and CEO, commented, “We’re very pleased with the results of this PEA which demonstrates that Diablillos is a stand-out, economically robust silver-gold project with significant upside potential. Importantly, this assessment is just a snapshot of the potential value of Diablillos. Our ongoing Phase II exploration program continues to intersect multiple high-grade results which are expected to add significant incremental value. Moreover, we have identified several opportunities to further expand and optimize the PEA case, which we intend to evaluate as we proceed towards a Feasibility Study.”

Table 1 – Commodity Price Sensitivity Analysis

|

Economic Parameters |

Downside (-15%) |

Base Case |

Upside (+15%) |

|

Silver Price ($/oz) |

$20.40 |

$24.00 |

$27.60 |

|

Gold Price ($/oz) |

$1,400 |

$1,650 |

$1,900 |

|

After-tax NPV (5%, US$ million) |

$190 |

$364 |

$538 |

|

After-tax NPV (5%, CAD$ million) |

$247 |

$473 |

$700 |

|

After-Tax IRR (%) |

20% |

30% |

39% |

1Note: Based on USD/CAD F/X rate of: 1:30 : 1

The PEA presents a range of metal pricing scenarios on an after-tax basis to evaluate economics of both upside and downside price scenarios. The economics of the Diablillos Project are very robust and offer significant leverage to both silver and gold price, with an after-tax NPV5% of $538.2 Million (+51%) if prices rise 15% from the Base Case (Table 1).

The PEA was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). The PEA was led by Mining Plus Peru S.A.C. with contributions from Hanlon Engineering & Associates Inc. (a subsidiary of GR Engineering Services Limited) and SAXUM Engineering LLC locally in Argentina.

The Company however cautions that the PEA summarized in this press release is preliminary in nature and is intended to provide an initial, high-level review of the project’s economic potential. The PEA replaces and supersedes the Company's previous 2018 PEA study.

There is no certainty that the results of the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Production Summary

The Diablillos Project has been envisioned as a conventional open pit utilizing contractor-operated truck and shovel operations. The Oculto open pit considered 5 development phases and a total mine life of approximately 16 years of production. Total material mined (excluding rehandle) is 170.3 Mt (37.4 Mt mineralized material and 132.9 Mt waste) at a strip ratio of 3.6 (including pre-production) and 3.1 without pre-stripping included.

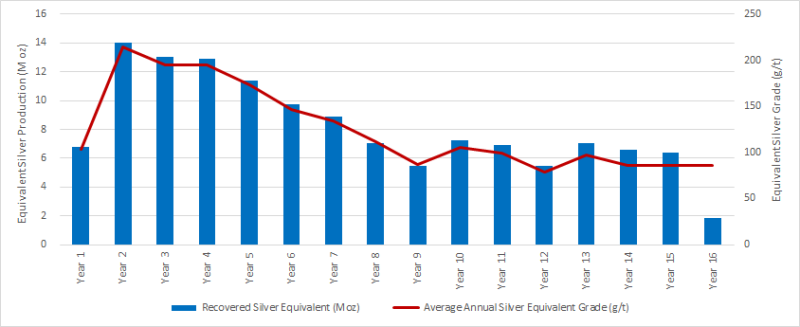

The open pit consists of a single pit with a mining sequence to maximize grade. Additionally, it provides suitable construction material for the project infrastructure, waste, and tailings management facilities. Limited supplies of mineralized material will be available for commissioning purposes in the pre-production year. The annual production and grade profile is shown in Figure 1.

Figure 1 – Diablillos Project Annual Silver Equivalent Production and Grade Profile

Processing

Metallurgical test work has been carried out in a range of different laboratories between 1996 and 2021. Initial test work was supported by subsequent phases of testing which showed that the mineralisation is amenable to conventional cyanide leaching techniques with the silver and gold extractable from finely ground samples. However, at coarser crush sizes such as those used for heap leaching, the precious metal extractions were noted to decrease. Alternative processing routes including gravity recovery and flotation were also studied.

A conventional silver/gold processing plant flowsheet was developed from the test work results incorporating crushing, grinding, cyanide leaching with oxygen addition, counter-current decantation thickeners, Merrill Crowe precious metal recovery from solution followed by on-site smelting to dore bars. The leached solids are detoxified, thickened and pumped to a tailings storage facility for permanent disposal.

The design basis for the process plant is 7,000 tonnes of mineralized material per day (“tpd”), or 2.45 million tonnes per annum considering 350 days a year of operation. Alternative throughput options will be considered in future studies.

This feed rate represents a moderate increase to the prior 2018 study based on additional Mineral Resources. The plant front-end design has been simplified to a primary crusher and Semi-Autogenous Ball Mill Crusher (“SABC”) circuit which is better suited to the variability of ore types that will be seen from time to time.

Recoveries

Test work conducted to date has shown that reasonable precious metal extractions can be achieved using sodium cyanide leaching for 24 hours of slurries ground to between 50 and 200 microns with moderate reagent consumptions. The 2021 test program demonstrated no net economic benefit in sizes less than 150 microns. Future optimization work will determine if a still coarser size further improves projected economic results. The high silver to gold ratios evident in the Measured and Indicated Resources and confirmed in the majority of variability samples suggest that following the leaching process, the precious metals should be recovered by a Merrill Crowe zinc precipitation process rather than CIP or CIL.

The 2021 metallurgical program at ALS Metallurgy Kamloops on 56 intercepts of quarter core has been used as the basis of precious metal extraction estimations, together with the representative results of earlier test programs. The results demonstrated a reasonable relationship between leach residue grades and leach head grades for both gold and silver and the derived linear regressions have been used to predict leach extractions of both metals. Some samples have exhibited variable leach behavior, either consuming more cyanide or oxygen or both, and sometimes resulting in higher leach residue grades. Such results are not considered refractory as the industry generally uses that term, but further work is being carried out to understand the causes of these additional consumptions. Using the Mineral Resource grades and the mining schedule, overall life of mine recoveries of silver and gold have been estimated to be 73.4% and 86.0% respectively including an allowance for small losses from the Merrill Crowe circuit.

Project Capital Costs

The initial capital expenditures for the project are summarized in Table 2. Capital expenditures to be incurred after the start-up of operations are assigned to sustaining capital and are projected to be covered by operating cash flows.

Initial capital costs are estimated at $255.0 million, including $51.6 million in pre-stripping and contingencies of $26.5 million. Importantly, pre-stripping costs have seen a material reduction of approximately 45% from $93.3 million in the 2018 PEA study. The amount of initial waste stripping material is now estimated at 15.9 million tonnes (compared to 28.7 million tonnes previously). Ongoing drilling continues to intersect shallow gold dominant resources extending close to the surface, which may result in a further improvement to reduce prestrip volumes and increase Resources.

Table 2 – Summary of Capital Cost Estimates ($ Million)

|

Description |

2018 PEA Study |

Updated Estimate (2021 PEA) |

Change 2018 PEA >> 2021 PEA |

|

|

$ M |

$ M |

% Change |

$ Change |

|

|

Surface Mining |

93.3 |

51.6 |

-45% |

-41.7 |

|

Processing |

69.2 |

76.9 |

11% |

7.7 |

|

Site Infrastructure |

35.2 |

53.7 |

53% |

18.5 |

|

Owners Costs & Indirect Costs |

63.0 |

46.3 |

-27% |

-16.7 |

|

Contingency & Other Provisions |

32.3 |

26.5 |

-18% |

-5.8 |

|

Initial Capital Costs |

293.0 |

255.0 |

-13% |

-38.0 |

|

Sustaining Capital |

5.0 |

15.2 |

204% |

10.2 |

|

Closure |

13.0 |

8.2 |

-37% |

-4.8 |

|

Total Capital Costs |

311.0 |

278.4 |

-10% |

-32.5 |

Notes on capital cost variations:

-

Surface Mining:Discovery and definition of a shallow mineralization has greatly reduced pre-stripping requirements and contributed to an increase in Mineral Resources.

-

Processing: The 2021 PEA process plant includes addition of a coarse ore stockpile and extra equipment for the grinding area, such as a SAG Mill, a Pebble crusher and three conveyors.

-

Site Infrastructure: The 2021 PEA considers additional ancillary buildings and an increase of $13.2 M in comparison to capital breakdowns from the 2018 PEA. This includes Water Treatment, Truck Shop, Warehouse, Security Guard Gate, Explosive Storage, Laboratory, Infirmary, Sewage Treatment, Hazardous Waste, Sample Storage and Reagent Storage. Additionally, another major variance is the temporary camp construction in the 2018 PEA costed at $0.4 M while current estimates accommodate 700 workers at a cost of $3.2 M.

-

Owners Costs Indirect CostsThe difference in cost is largely due to EPCM costs. The 2018 PEA capital breakdowns reviewed considered $26.4 M with additional costs of $6 M for Processing, Infrastructure and Mining. A total of $32.4 M in contrast to the current estimate of $19.5 M. Secondly in the 2018 PEA spare parts and first fills were considered Owners Costs. The 2021 PEA considers these expenses as indirect costs.

-

Contingency Other ProvisionsThe contingency percentage set in the 2018 PEA was 18%, meanwhile after greater definition this has been reduced in the 2021 PEA to 15%.

-

Sustaining Capital The increases in cost are due to a difference in the second stage of the tailing storage facility ($4.9 M in 2018 PEA versus $7.6 M currently). In addition, the 2021 PEA considers a miscellaneous allowance of $0.5 M per year of operation.

-

Closure The closure cost was estimated a 5% of direct cost. Due to lower direct costs the amount has also been reduced.

Operating Costs

The operating cost estimate is based on a contractor-operated truck and shovel mining operation, conventional processing facility, and Tailings Storage Facility. Mine operating cost estimates are provided in Table 3 and unit costs per ounce produced is shown in Table 4. The PEA estimates that the operating costs will average $9.8/oz of AgEq (or US$816/oz of AuEq).

Table 3 – Mine Operating Cost Estimates

|

Operating Costs |

$/tonne |

Basis |

|

Mining - Waste |

3.00 |

tonne mined |

|

Mining - Mineralized Material |

3.60 |

tonne mined |

|

Mining - Total |

12.64 |

tonne milled |

|

Processing |

17.87 |

tonne milled |

|

G&A |

2.51 |

tonne milled |

Table 4 – Operating Cost per Ounce Produced

|

Operating Costs |

$/oz AgEq |

$/oz AuEq |

|

Mining - Total |

3.61 |

299.87 |

|

Processing |

5.11 |

423.82 |

|

G&A |

0.72 |

59.53 |

|

Salta Province Royalty |

0.39 |

32.23 |

|

Total Operating Cost |

9.83 |

815.45 |

Taxes and Royalties

Taxes and royalties are based on Argentinean legislated tax rates and reviewed by an independent tax consultant. The current rates included are:

-

Argentina corporate income tax: 35%

-

Municipal taxes: 0.6%

-

Provincial mining royalty: 3%

-

Gold/Silver export duties: 8% / 4.5%

-

An additional 1% NSR royalty is payable to EMX Royalty Corporation.

Summary of Economic Results

The table below summarizes the key economic results and parameters of the PEA study.

Table 5 – Summary of Project Economics

|

Metrics |

Units |

Results |

|

Life of mine |

years |

16 |

|

Total mineralized material mined |

M tonnes |

37.4 |

|

Total contained silver |

M oz |

86.9 |

|

Total contained gold |

k oz |

939.8 |

|

Strip ratio |

Waste : ore |

3.6 |

|

Throughput |

tpd |

7,000 |

|

Head grade – silver (first 5 years / LOM) |

g/t |

130.5 / 72.2 |

|

Head grade – gold (first 5 years / LOM) |

g/t |

0.65 / 0.78 |

|

Recoveries – silver (first 5 years / LOM) |

% |

77.4 / 73.4 |

|

Recoveries – gold (first 5 years / LOM) |

% |

85.9 / 86.0 |

|

Average Production – silver (first 5 years / LOM) |

M oz |

8.0 / 4.2 |

|

Average Production – gold (first 5 years / LOM) |

k oz |

44.3 / 52.0 |

|

Operating cash costs LOM – silver equivalent |

$/oz AgEq |

9.83 |

|

Operating cash costs LOM – gold equivalent |

$/oz AuEq |

816 |

|

AISC (LOM) – silver equivalent (first 5 years / LOM) |

$/oz AgEq |

10.41 / 11.97 |

|

AISC (LOM) – gold equivalent (first 5 years / LOM) |

$/oz AuEq |

818 / 993 |

|

Initial Capital Costs |

$ M |

255.0 |

|

Sustaining Capital Costs |

$ M |

23.4 |

|

Pre-Tax NPV5% |

$ M |

678.5 |

|

After-Tax NPV5% |

$ M |

364.0 |

Significant Opportunities to Enhance Value

Several potential opportunities have been identified that may significantly enhance the economic return outlined in the PEA. Significant opportunities include but are not limited to the following:

-

Expansion of Oculto pit to the northeast:

Current modelling suggests the mineralization extends to the Northeast and drilling is ongoing to quantify the opportunity.

-

Expansion of shallow mineralization towards Fantasma:

Specifically, the shallow mineralization appears to extend in the direction of Fantasma. Drilling is underway to quantify the opportunity.

-

Expansion of Mineral Resources at depth:

Additional drilling is being conducted to understand the mineralization at depth.

-

Expansion of annualized throughput:

Analysis is currently being undertaken to determine the optimum production that is possible from the Oculto pit coupled with expanded processing plant throughputs. This may increase again with any material from satellite pits.

-

Inclusion of Fantasma and Laderas pits:

Work is ongoing to quantify these deposits which may also be exploitable by open pit methods.

-

Inclusion of other exploration targets:

Delineating additional high-grade Mineral Resources through the ongoing exploration program.

-

Mining Costs:

It is expected that stripping costs can be further reduced by defining the upper horizon of unconsolidated scree that will likely not require blasting. Current analysis likely overestimates the cost of removing this material.

-

Metallurgy:

Increasing metallurgical recoveries with additional test work and optimization of process. This includes analysis of options for selective processing of the distinct mineralization styles.

-

Mining equipment selection:

A flat contract rate is currently being considered with equipment in line with the prior 2018 PEA study. There is scope with the expansion to look at both different equipment and trade of studies regarding owner operations.

-

Blending and selective processing:

A limited analysis went into stockpile options for this study. Additional work could improve revenues by processing high grade areas preferentially while stockpiling lower grade material.

Mineral Resource Estimate

Table 6 – Oculto Mineral Resource Estimate – As of September 8, 2021

|

Zone |

Category |

Tonnage (000 t) |

Ag (g/t) |

Au (g/t) |

Contained Ag (000 oz Ag) |

Contained Au (000 oz Au) |

|

Oxides |

Measured |

7,484 |

127 |

0.91 |

30,638 |

219 |

|

Indicated |

29,810 |

56 |

0.66 |

53,501 |

629 |

|

|

Measured & Indicated |

37,294 |

70 |

0.71 |

84,139 |

848 |

|

|

Inferred |

2,529 |

32 |

0.6 |

2,599 |

45 |

|

|

Transition Zone |

Measured |

751 |

85 |

1.65 |

2,063 |

40 |

|

Indicated |

3,148 |

39 |

1.13 |

3,963 |

115 |

|

|

Measured & Indicated |

3,899 |

48 |

1.23 |

6,026 |

155 |

|

|

Inferred |

355 |

51 |

1.9 |

582 |

21 |

|

|

Total |

Measured |

8,235 |

124 |

0.98 |

32,701 |

259 |

|

Indicated |

32,958 |

54 |

0.70 |

57,464 |

744 |

|

|

Measured & Indicated |

41,193 |

68 |

0.76 |

90,165 |

1,002 |

|

|

Inferred |

2,884 |

34 |

0.7 |

3,181 |

66 |

Notes for Mineral Resource Estimate:

-

Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

-

The Mineral Resource Estimate has been categorized in accordance with the CIM Definition Standards (CIM, 2014).

-

All figures are rounded to reflect the relative accuracy of the estimates. Minor discrepancies may occur due to rounding to appropriate significant figures.

-

The Mineral Resource was estimated by Ms. Muñoz QP(Geo) of Mining Plus, Independent Qualified Person under NI 43-101.

-

The Mineral Resource is sub-horizontal with sub-vertical feeders and a reasonable prospect for eventual economic extraction by open pit methods.

-

The Mineral Resource is reported inside a whittle pit shell with a cut-off grade of 35 g/t silver equivalent, estimated using a gold price of US $1750 and silver price of US $25.

-

The silver equivalent is based in the following formula AgEq = Ag + Au*70.

-

The resource models used ordinary kriging (“OK”) grade estimation within a three-dimensional block model and mineralized zones defined by wireframed solids and constrained by a Whittle pit shell. The 2m composite grades were capped where appropriate.

-

All tonnages reported are dry metric tonnes and ounces of contained gold are troy ounces.

-

In-situ bulk density was assigned to the block model as averages of the oxidation zone subset by alteration.

-

Average in-situ bulk density for the Oxides is 2.18 t/m for the MI categories and 2.14 t/m for the Inferred category.

-

Average in-situ bulk density for the Transition Zone is 2.41 t/m for both the MI and Inferred category.

-

Average in-situ bulk density is 1.82 t/m for cover material, and 2.15 t/m for waste material.

-

Mining Plus is not aware of any environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the potential development of the Mineral Resource.

Qualified Persons and Technical Information

David O’Connor P.Geo., Chief Geologist for AbraSilver, is a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects. He has reviewed and approved the scientific and technical information in this news release. The Preliminary Economic Assessment Technical Report will be filed on SEDAR within 45 days of this news release.

About AbraSilver

AbraSilver is a well-funded silver-gold focused advanced-stage exploration company. The Company is rapidly advancing its 100%-owned Diablillos silver-gold project in the mining-friendly Salta province of Argentina, which has a Measured and Indicated resource base of over 160Moz on a silver-equivalent basis or 2.3Moz on a gold-equivalent basis. The Company is led by an experienced management team and has long-term supportive shareholders including Mr. Eric Sprott and SSR Mining. In addition, AbraSilver owns a portfolio of earlier-stage copper-gold projects, including the Arcas project in Chile where Rio Tinto has an option to earn up to a 75% interest by funding up to US$25 million in exploration. AbraSilver is listed on the TSX-V under the symbol “ABRA” and in the U.S. under the symbol “ABBRF”.

For further information please visit the AbraSilver Resource website at www.abrasilver.com, our LinkedIn page at AbraSilver Resource Corp., and follow us on Twitter at www.twitter.com/abrasilver

Alternatively, please contact:

John Miniotis, President and CEO

Tel: +1 416-306-8334

Cautionary Statements

This news release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. All statements that address future plans, activities, events, or developments that the Company believes, expects or anticipates will or may occur are forward-looking information. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release