Archive

Significant Growth in Gold Resource at Diba & Lakanfla Project, Western Mali; Updated PEA Delivers US$150 Million (After-Tax) Net Present Value

| |||||||||

2 August 2022 – TheNewswire - Altus Strategies Plc (AIM:ALS), (TSXV:ALTS), (OTC:ALTUF) announces the publication of an updated independent Mineral Resource Estimate (“MRE”) and Preliminary Economic Assessment (“PEA”) for its 100% owned Diba & Lakanfla gold project (“Diba & Lakanfla” or “the Project”) located in western Mali.

Highlights:

-

Updated MRE and PEA published for Diba Lakanfla in western Mali

-

Open pit heap leach gold mine with low capital expenditure and strong cashflows

-

After-tax Net Present Value (NPV”) of US$150 million with payback of 5.7 months

-

NPV based on 8% discount rate, US$1,700/oz gold (Au”) price and 95% recovery

-

All-in sustaining costs of US$686/oz and a low strip (waste to ore) ratio of 1.22:1

-

4.7 year mine life with average annual gold production of 54,380 ounces (oz”)

-

Diba small scale mining licence hosts a shallow dipping near-surface gold deposit

-

-

Substantial 67% increase in MRE in all categories, comprising:

-

7,800,000 tonnes at 1.24 g/t Au for 312,000 oz in the Indicated category

-

12,700,000 tonnes at 0.87 g/t Au for 362,000 oz in the Inferred category

-

Project hosts numerous targets for further drill testing and potential resource growth

-

-

Project is strategically located in a world-famous gold belt that hosts several mines

-

Altus intends to undertake a process to potentially monetise the Project and create a royalty

Steven Poulton, Chief Executive of Altus, commented:

“We are delighted to announce the significant increase in the MRE at the Company’s 100% owned Diba & Lakanfla gold project in western Mali. The updated PEA generates an impressive US$150 million after-tax NPV8, for the oxide portion alone of the Project. The PEA envisages a simple low-cost and low-strip ratio open-pit gold mine, using standard heap-leach processing for oxide ores. The MRE also identifies approximately 12 million tonnes of fresh sulphide material which could add additional ounces to an enlarged mine.

“With numerous prospects remaining to be adequately drill tested, the Diba & Lakanfla project is strategically positioned to become a potentially significant gold deposit in western Mali. With the publication of the MRE and PEA, Altus now intends to undertake a process to potentially monetise the Project, including the creation of a long-term royalty on any future gold production. We look forward to updating shareholders in due course.”

Updated Preliminary Economic Assessment

The updated PEA describes the potential technical and economic viability of establishing a conventional open-pit gold mine for Diba & Lakanfla. The updated PEA technical report has been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators ("NI 43-101") by independent consulting firm Mining Plus UK Ltd (“Mining Plus”) of Bristol, United Kingdom. The PEA will be filed on SEDAR at www.sedar.com and on the Company’s website at www.altus-strategies.com, shortly after the issuance of this news release. A summary of the economics is provided in Table 1 below.

Table 1: Summary of Economics

|

Pre-Tax NPV at 8% discount rate(1) |

US$213.25M |

|

After-Tax NPV8 |

US$149.78M |

|

Pre-Tax Internal Rate of Return ("IRR") |

1,204% |

|

After-Tax IRR |

683% |

|

Life of Mine (“LOM”) average gold price |

US$1,700/oz |

|

Average All In Sustaining Costs (“AISC”) / oz |

US$686/oz |

|

Throughput |

2.0Mtpa(2) |

|

Gold recovery (oxide heap leach) |

95% |

|

Total capital expenditure |

US$28M |

|

Strip ratio(3) |

1.22:1 |

|

Average annual gold production |

54,380 oz |

|

Total operating cashflow |

US$186M |

|

After-Tax payback |

5.7 months |

|

Average grade (grams per tonne) of mined resource |

0.99 g/t Au |

|

Life of Mine |

4.7 years |

(1) Includes deduction of 3% Net Smelter Return royalty to Mali Government.

(2) Million tonnes per annum.

(3) Strip ratio is defined as tonnes of waste per tonne of potential mineralised inventory (“PMI”).

Updated Mineral Resource Estimate

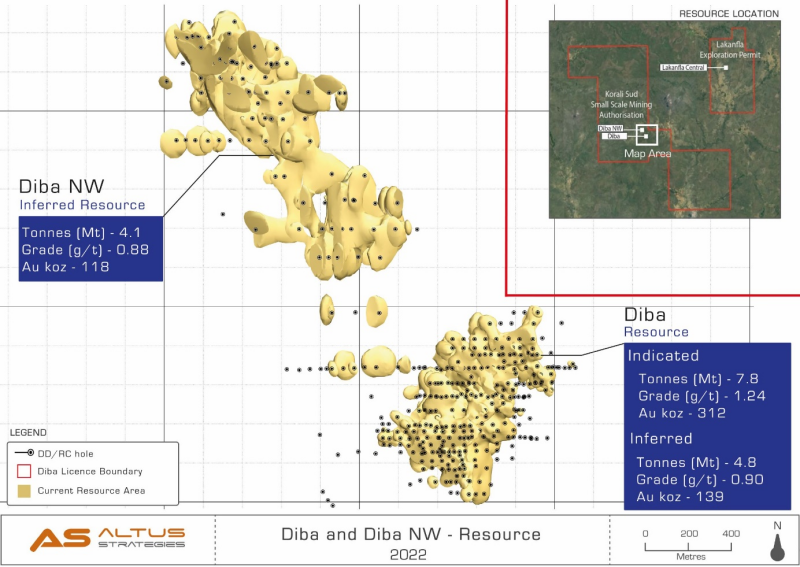

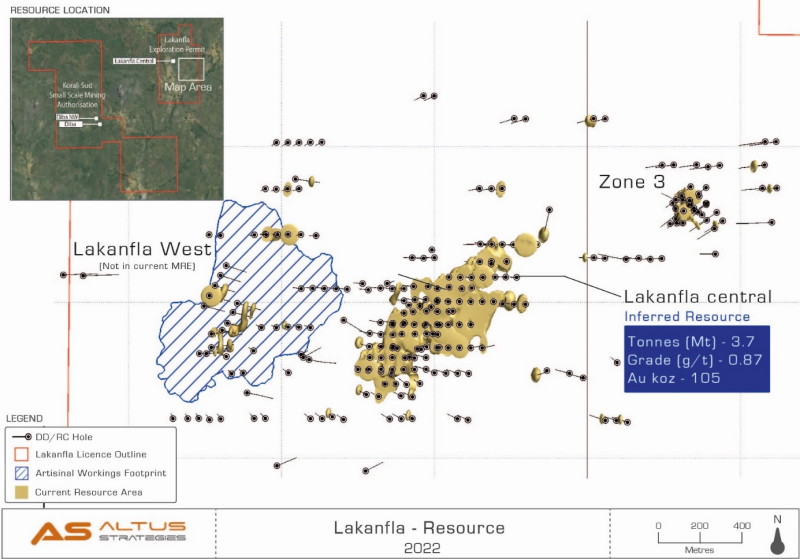

The updated MRE (as detailed in Table 2) comprises 7,800,000 tonnes grading 1.24 g/t Au for 312,000 oz of contained gold in the Indicated category and a further 12,700,000 tonnes grading 0.87 g/t Au for 362,000 oz of contained gold in the Inferred category, representing a 67% increase in both categories when compared to the previous MRE with an effective date of 18 November 2020. This MRE update follows an 11,832 metre (“m”) programme of infill drilling completed by the Company in Q1 2022 across Diba & Lakanfla, with results reported on 17 March 2022 (see news release entitled Further Significant Intercepts from Diba & Lakanfla Gold Project in Western Mali), 15 February 2022 (see news release entitled Altus Intersect 1.23 g/t over 127m at Lakanfla Central Prospect in Western Mali) and 21 January 2022 (see news release entitled Excellent Gold Grades from Drilling at Diba NW Prospect in Western Mali).

Table 2: Updated Mineral Resource Estimate

|

Domain |

Indicated |

Inferred |

||||

|

Tonnes (Mt) |

Grade (g/t) |

Contained gold (koz) |

Tonnes (Mt) |

Grade (g/t) |

Contained gold (koz) |

|

|

Oxide |

4.1 |

1.52 |

199 |

2.7 |

0.86 |

75 |

|

Transitional |

0.7 |

1.18 |

25 |

1.2 |

0.83 |

33 |

|

Fresh |

3.1 |

0.88 |

88 |

8.8 |

0.90 |

255 |

|

Total |

7.8 |

1.24 |

312 |

12.7 |

0.87 |

362 |

(1) Cut-off grade is 0.5 g/t Au; Mt is million tonnes; and koz is thousand ounces.

(2) Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources estimated will be converted into Mineral Reserves. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

(3) The CIM definitions were followed for the classification of Measured, Indicated, and Inferred Mineral Resources.

(4) The quantity and grade of reported Inferred Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Resources as an Indicated or Measured Mineral Resource and it is uncertain if further exploration will result in upgrading them to an Indicated or Measured Mineral Resource category.

(5) Altus is the operator of, and has a 100% interest in, Diba & Lakanfla.

Cautionary Statement Regarding Preliminary Nature of the PEA

Readers are cautioned that the PEA summarized in this press release is preliminary in nature and is intended to provide an initial, high-level review of the Project’s economic potential and design options. The PEA mine plan and economic model includes numerous assumptions and the use of Indicated and Inferred Resources. Indicated and Inferred Resources are too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves and as such, there is no certainty that the PEA will be realized. Actual results may vary, perhaps materially. The projections, forecasts and estimates presented in the PEA constitute forward-looking statements and readers are urged not to place undue reliance on such forward-looking statements. Additional cautionary and forward-looking statement information is detailed at the end of this news release.

Illustrations

The following figures have been prepared and relate to the disclosures in this announcement and are visible in the version of this announcement on the Company's website (www.altus-strategies.com) or in PDF format by following this link: https://altus-strategies.com/site/assets/files/5769/altus_nr_-_diba_pea-_2_august_2022.pdf

-

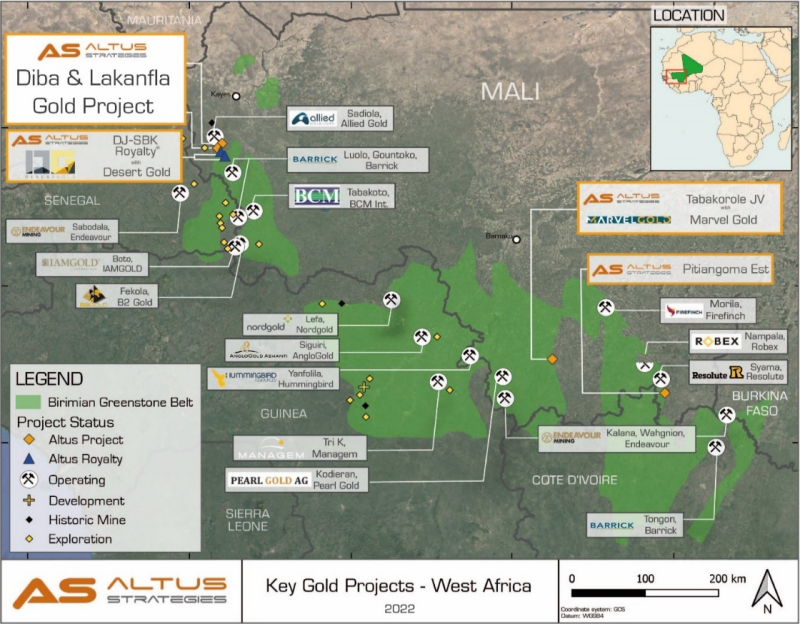

Location of Diba Lakanfla in western Mali is shown in Figure 1.

-

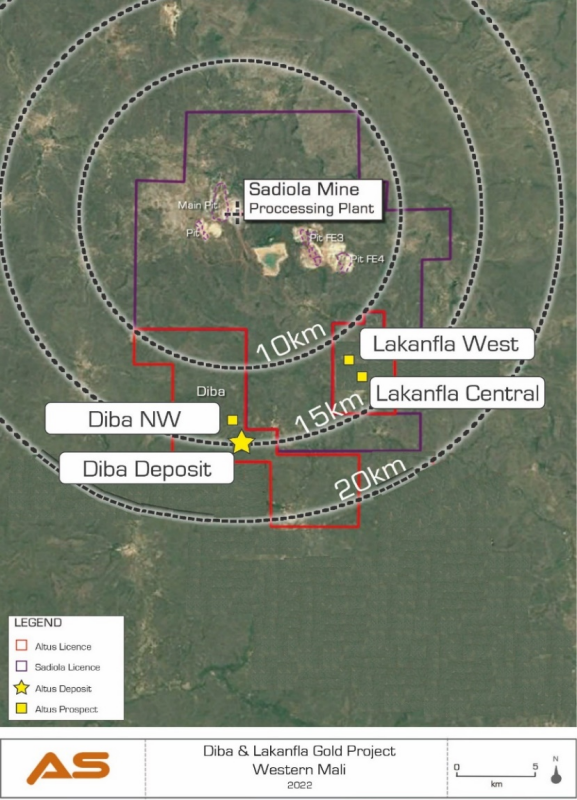

Main prospects on Diba Lakanfla are shown in Figure 2.

-

Location of Diba Diba NW Mineral Resource is shown in Figure 3.

-

Location of Lakanfla Central Mineral Resource and additional targets is shown in Figure 4.

-

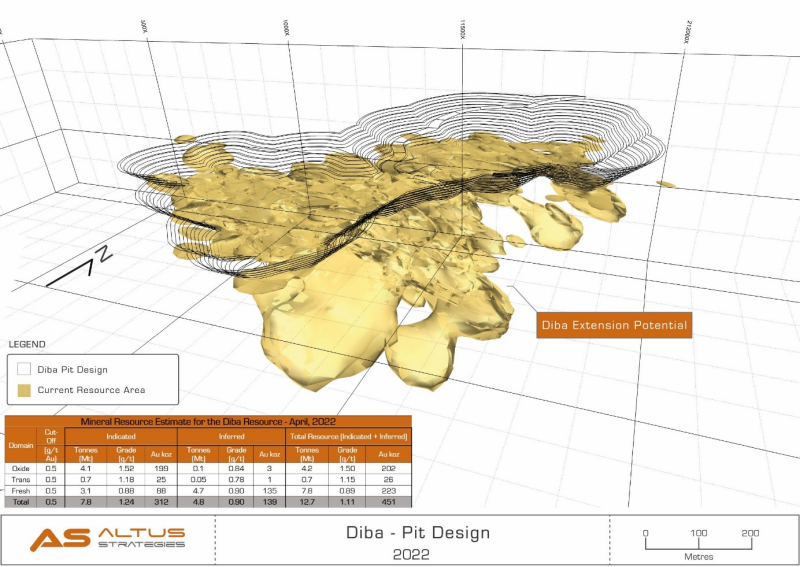

3D Model of MRE and conceptual open pit is shown in Figure 5.

Figure 1:

Location of Diba & Lakanfla in western Mali

Figure 2: Main prospects on Diba & Lakanfla

Figure 3: Location of Diba & Diba NW Mineral Resource

Figure 4: Location of Lakanfla Central Mineral Resource and additional targets

Figure 5: 3D Model of MRE and conceptual open pit

Diba & Lakanfla: Location

The 81km2 Diba licence (Korali Sud) and the 24km2 Lakanfla licence are located 5km apart in the Kayes region of western Mali, approximately 450km northwest of the capital city of Bamako. Diba & Lakanfla is located adjacent to the multi-million ounce Sadiola gold mine licence and 35km south of the multi-million ounce Yatela former gold mine, both acquired by Allied Gold Corporation from the previous operators AngloGold Ashanti (JSE: ANG, NYSE: AU and ASX: AGG) and IAMGOLD Corporation (TSX: IMG and NYSE: IAG). Mineralisation hosted at these mines is not necessarily indicative of mineralisation hosted at Diba & Lakanfla.

Diba & Lakanfla: Geology and Mineralisation

Diba Licence

Mineralisation at the Diba Deposit on the Diba licence is sediment-hosted within a series of stacked quartz lenses, typically between 20m and 40m thick. The lenses are shallow-dipping at approximately 30 degrees angled to the east/east-southeast. The Diba Deposit is considered to be controlled by a number of northwest and northeast orientated structures, with gold occurring as fine-grained disseminations in localised high-grade, calcite-quartz veinlets. Alteration at the Diba Deposit is typically albite-hematite+/-pyrite, although pyrite content is generally very low (<1%). The weathering profile at the Diba Deposit is estimated to be up to 70m vertical depth, resulting in extensive oxidation from surface. The oxide gold mineralisation at the Diba Deposit is predominantly found in saprolite within 50m of surface and across a compact 700m x 700m area.

Lakanfla Licence

The Lakanfla licence hosts a significant number of active and historic artisanal gold workings coincident with significant geochemical and gravity anomalies. The workings surround the Kantela granodiorite intrusion and cover an area of approximately 900m x 500m. The gold mineralisation at Lakanfla is typically hosted within breccia zones which cut the granodiorite and surrounding carbonate metasediments. Drilling by the Company has intersected 1.23 g/t Au over 127m (not true widths) at the Lakanfla Central prospect, while historic intersections by previous operators include 9.78 g/t Au over 12m and 5.20 g/t Au over 16m (not true widths) as well as having intersected voids and unconsolidated sand from 165-171m depth. The Company has not verified the historic drilling data at the Lakanfla licence.

Sensitivities

Diba & Lakanfla is expected to be a robust mining operation that is profitable at a variety of gold prices. The PEA modelled sensitivities to the NPV8, with gold prices and metallurgical recoveries shown to be the two most sensitive inputs. A summary of the results of this sensitivity analysis is presented in Table 3 and Table 4.

Table 3: Gold Price Sensitivity (pre-tax)

|

Gold Price (US$/oz) |

2.0 Mtpa(1) operation |

|

|

NPV8 (US$000) |

IRR% |

|

|

US$1,600 |

190,545 |

962% |

|

US$1,650 |

201,895 |

1,077% |

|

US$1,700 |

213,245 |

1,204% |

|

US$1,750 |

224,595 |

1,343% |

|

US$1,800 |

235,945 |

1,494% |

Table 4: Metallurgical Recovery Sensitivity (pre-tax)

|

Metallurgical recovery |

2.0 Mtpa(1) operation |

|

|

NPV8 (US$000) |

IRR% |

|

|

80% |

162,230 |

715% |

|

85% |

183,018 |

891% |

|

90% |

203,807 |

1,098% |

|

95% (Base Case) |

224,595 |

1,343% |

|

100% |

245,383 |

1,631% |

(1) million tonnes per annum

Mine Plan

Oxide and transitional ore from Diba & Lakanfla is proposed to be mined by a contractor in a phased sequence of open pits which prioritises extraction of higher grade ore. The mine plan could deliver an annual production rate of 2.0Mtpa over a mine life of 4.7 years. Approximately 85% of the oxide ore is expected to be free digging although some localised blasting may be required where there is harder material (e.g. ferrocrete/duricrust) and has been included in operating costs. At Diba, a total of four open pits is proposed while at Lakanfla a total of two open pits is proposed.

From the open pits, ore would be loaded and hauled to the leach pad using excavators and dump trucks. Ore is proposed to be mined at a rate of 167,000 tonnes per month. From the second month of mining and following advanced clearing and preliminary waste stripping, sufficient ore is expected to be exposed within the open pits in order to maintain the required production levels. Waste would be hauled to a Waste Rock Storage Facility (“WRSF”) located adjacent the open pits. Over the life of mine, the strip ratio is expected to average 1.22 tonnes of waste per tonne of ore.

Metallurgy and Processing

Heap Leach

In the PEA, the gold extraction method envisaged is heap leaching with gold recovery via Carbon-in-Column processing. A recovery rate of 95% is estimated based on two key studies undertaken by Grinding Solutions Limited of Truro (United Kingdom).

On 28 October 2020, the Company announced the results of a comprehensive PEA level metallurgical analysis completed by Grinding Solutions on 130kg of drill core collected from representative oxide and fresh zones within the envelope of the Diba MRE. The results indicate a recovery of 95.8 % of gold from oxide material at a coarse (6.3 mm) crush size for the heap leach scenario.

On 29 June 2022, the Company received results of a second comprehensive PEA level metallurgical analysis completed by Grinding Solutions on 143kg of drill core collected from representative oxide and fresh zones within the envelope of the Lakanfla MRE. The results indicate a recovery of between 92.75 % and 98.49 % of gold from oxide material at coarse crush sizes (6.7 mm and 12.5 mm) for the heap leach scenario.

The following key factors have been considered in the decision to assume heap leaching rather than agitated leaching:

-

Lower capital and operating costs

-

Reduced Projectcomplexity and shorter time required for Project construction and implementation

At this preliminary stage, no detailed design for the heap leaching has been prepared. The proposed mining system must therefore be considered as only conceptual at this point. The proposed heap leaching system is similar to existing and operating heap leach mines processing similar material under comparable conditions. The processing facilities proposed for Diba & Lakanfla would include:

-

Two-stage crushing, screening, and agglomeration

-

Heap stacking and leaching using a lined 3,000,000m heap leach facility with berms

-

Gold recovery by Carbon-in-Column processing.

Waste

Waste rock would be hauled to a designated area to form the WRSF located west of the open pit. The locations of the WRSF will require detailed geotechnical investigation during the next phases of Diba & Lakanfla to determine the suitability of the proposed area.

Access

Access roads and haul roads will be required around the site. These are planned to be maintained laterite roads. The locations and specification of the roads will require further investigation during the next phases of Diba & Lakanfla.

Tailings

The Project envisions utilising a heap leach processing operation and as such no tailings would be produced from the operation. Therefore, a tailings containment and storage facility would not be required.

Operating Costs

Estimated life of mine operating costs (per tonne processed) inclusive of ore, overburden and waste rock are summarised in Table 5. The average Total Operating Cost over the life of the mine has been estimated at US$20.50/tonne per tonne of ore processed. Total Operating Costs include mine operations, process plant operations, general and administrative costs (“G&A”), selling costs and royalties.

Table 5: Operating Cost Assumptions

|

Cost item for 2.0Mtpa |

US$ per tonne ore |

|

Mining |

US$8.55 |

|

Processing |

US$6.94 |

|

G&A |

US$3.13 |

|

Selling, Refining and Royalties |

US$1.88 |

|

Total Operating Cost |

US$20.50 |

Risks

As with all mining ventures, a large number of risks and opportunities can affect the outcome of the Project. Most of these risks and opportunities are based on uncertainty, such as lack of scientific information (test results, drill results, etc.) or the lack of control over external factors (metal prices, exchange rates, etc.). Subsequent higher-level engineering studies would be required to further refine these risks and opportunities, identify new risks and opportunities, and define strategies for risk mitigation or opportunity implementation.

Qualified Persons

Matthew Field, Pr.Sci.Nat., Principal Geology Consultant, Mining Plus UK Ltd is the main author of the PEA and is responsible for the technical part of this press release and is a Qualified Person under the terms of NI 43-101.

Adriano Carmensi Carneiro, FAusIMM, Principal Mining Consultant, Mining Plus UK Ltd is a contributing author of the PEA, and is a Qualified Person under the terms of NI 43-101.

Nick Wilshaw, FIMMM, Principal Consultant, Grinding Solutions Ltd is a contributing author of the PEA, and is a Qualified Person under the terms of NI 43-101.

The technical disclosure in this announcement has been approved by Steven Poulton, Chief Executive of Altus. A graduate of the University of Southampton in Geology (Hons), he also holds a Master's degree from the Camborne School of Mines (Exeter University) in Mining Geology. He is a Fellow of the Institute of Materials, Minerals and Mining and has over 20 years of experience in mineral exploration and is a Qualified Person under the AIM rules and NI 43-101.

For further information you are invited to visit the Company’s website www.altus-strategies.com or contact:

|

Altus Strategies Plc Steven Poulton, Chief Executive |

Tel: +44 (0) 1235 511 767 E-mail: info@altus-strategies.com |

|

SP Angel (Nominated Adviser) Richard Morrison / Adam Cowl |

Tel: +44 (0) 20 3470 0470 |

|

SP Angel (Broker) Grant Barker Rob Rees |

Tel: +44 (0) 20 3470 0471 Tel: +44 (0) 20 3470 0535 |

|

Shard Capital (Broker) Isabella Pierre / Damon Heath |

Tel: +44 (0) 20 7186 9927 |

|

Yellow Jersey PR (Financial PR & IR) Charles Goodwin / Henry Wilkinson |

Tel: +44 (0) 20 3004 9512 E-mail: altus@yellowjerseypr.com |

About Altus Strategies Plc

Altus Strategies (AIM: ALS, TSX-V: ALTS & OTCQX: ALTUF) is an income generating mining royalty company, with a diversified portfolio of production, pre-production and discovery stage assets. The Company’s differentiated approach of generating royalties on its own discoveries in Africa and acquiring royalties globally through financings and acquisitions with third parties has attracted key institutional investor backing. Altus has established a global portfolio comprising 33 royalty interests and 26 project interests across nine countries and nine metals. The Company engages constructively with all stakeholders, working diligently to minimise its environmental impact and to promote positive economic and social outcomes in the communities where it operates. For further information, please visit www.altus-strategies.com.

Cautionary Note Regarding Forward-Looking Statements

Certain information included in this announcement, including information relating to future financial or operating performance and other statements that express the expectations of the Directors or estimates of future performance constitute "forward-looking statements". These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include without limitation the completion of planned expenditures, the ability to complete exploration programmes on schedule and the success of exploration programmes. Readers are cautioned not to place undue reliance on the forward-looking information, which speak only as of the date of this announcement and the forward-looking statements contained in this announcement are expressly qualified in their entirety by this cautionary statement.

All of the results of the Diba & Lakanfla Preliminary Economic Assessment constitute forward-looking information, including estimates of internal rates of return, net present value, future production, estimates of cash cost, assumed long term price for gold of US$1,750 per ounce, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, and estimates of capital and operating costs. Furthermore, with respect to this specific forward-looking information concerning the development of the Diba & Lakanfla Project, the Company has based its assumptions and analysis on certain factors that are inherently uncertain. Uncertainties include among others: (i) the adequacy of infrastructure; (ii) unforeseen changes in geological characteristics; (iii) changes in the metallurgical characteristics of the mineralisation; (iv) the ability to develop adequate processing capacity; (v) the price of gold; (vi) the availability of equipment and facilities necessary to complete development; (vii) the size of future processing plants and future mining rates, (viii) the cost of consumables and mining and processing equipment; (ix) unforeseen technological and engineering problems; (x) accidents or acts of sabotage or terrorism; (xi) currency fluctuations; (xii) changes in laws or regulations; (xiii) the availability and productivity of skilled labour; (xiv) the regulation of the mining industry by various governmental agencies; (xv) political factors, including political stability.

Where the Company expresses or implies an expectation or belief as to future events or results, such expectation or belief is based on assumptions made in good faith and believed to have a reasonable basis. The forward-looking statements contained in this announcement are made as at the date hereof and the Company assumes no obligation to publicly update or revise any forward-looking information or any forward-looking statements contained in any other announcements whether as a result of new information, future events or otherwise, except as required under applicable law and regulations.

TSX Venture Exchange Disclaimer

Neither the TSX Venture Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Glossary of Terms

The following is a glossary of technical terms:

“AISC” means All-In Sustaining Cost

“Au” means gold

“CIM” means the Canadian Institute of Mining, Metallurgy and Petroleum

“g” means grams

“g/t” means grams per tonne

“grade(s)” means the quantity of ore or metal in a specified quantity of rock

“IRR” means internal rate of return

“km” means kilometres

“LOM” means life of mine

“m” means metres

“MRE” means Mineral Resource Estimate

“NI 43-101” means National Instrument 43-101 “Standards of Disclosure for Mineral Projects” of the Canadian Securities Administrators

“NPV8” means net present value using an 8% discount rate

“PEA” means Preliminary Economic Assessment, as a study that includes a preliminary economic analysis of the potential viability of a project’s mineral resources

“PMI” means potential mineralised inventory

“Qualified Person” means a person that has the education, skills and professional credentials to qualify as a qualified person under NI 43-101

“RC” means Reverse Circulation drilling

“RL” means Reduced Level (a level once it has been reduced to a datum)

“t” means tonne (metric ton)

**END**