Archive

Star Royalties to Acquire 2% NSR Royalty on Elk Gold Mine in BC, Canada

| |||||||||

|  | ||||||||

All amounts are in U.S. dollars unless otherwise indicated.

SEPTEMBER 28, 2021 - TheNewswire - TORONTO, ON - Star Royalties Ltd. (the “Company” or “Star Royalties”) (TSXV:STRR) (OTC:STRFF) is pleased to announce the execution of a definitive royalty purchase agreement (the “Transaction”) with Almadex Minerals Ltd. (TSXV: DEX) (“Almadex”) to acquire an existing 2% net smelter return royalty (the “Royalty”) on the Elk Gold Mine (“Elk Gold”) located in BC, Canada and owned and operated by Gold Mountain Mining Corp. (TSXV: GMTN, OTCQB: GMTNF, FRA: 5XFA) (“Gold Mountain”) for total consideration of $10,630,000. The Transaction is expected to close on or about September 28, 2021 (the “Closing Date”).

Transaction and Asset Highlights

-

- Imminent revenue: Gold Mountain recently commenced operations at Elk Gold and expects first revenue generation in Q4 2021. Royalty revenue is expected to increase and average $2 million per annum post-year 3 based on prevailing gold prices.

- Value accretion and asset diversification: Transaction is accretive on net asset value and per-share metrics before the consideration of Elk Gold’s expansion and exploration upside.

- World-class jurisdiction: Elk Gold is located in mining-friendly south-central British Columbia, Canada.

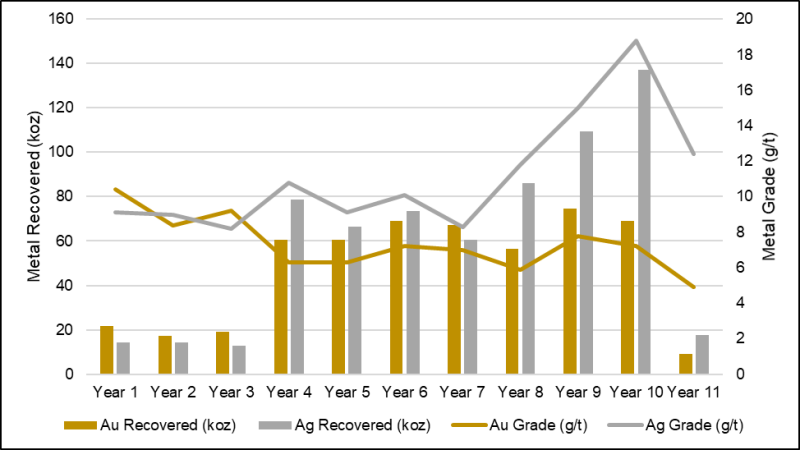

- Long life and strong margins: Gold Mountain’s updated preliminary economic assessment (“PEA”) from May 2021 highlights an 11-year combined open pit and underground operation with life-of-mine all-in sustaining costs of $554 per ounce.

- Reputable partners: Gold Mountain has secured a fixed-price mining services contract with Nhwelmen-Lake LP (Nhwelmen-Lake”) and signed an ore purchase agreement with New Gold Inc. (TSX, NYSE American: NGD) (“New Gold”) to sell Elk Gold’s mineralized material to New Gold’s New Afton processing plant.

- Expansion upside: PEA outlines initial open pit production of approximately 19,000 ounces per annum (years 1-3) and then expanded production of 65,000 ounces per annum (years 4-11) with a further expansion target of 100,000 ounces per annum.

- Wealth creation potential: Gold Mountain’s recent Phase 1 drill program increased Elk Gold’s mineral resource estimate by 49% with all 41 drill holes intercepting significant mineralization. Gold Mountain is targeting to expand its high-grade mineral resource to over 1 million ounces from its current mineral resource estimate (see chart below).

- Funding: Cash component of the Royalty acquisition will be funded from Star Royalties’ existing cash balance. The Company had a cash balance of $14.9 million as of June 30, 2021.

Alex Pernin, Chief Executive Officer of Star Royalties, commented: "This transformative investment represents imminent cash flow in a tier-one jurisdiction from a high-margin gold mine operated by a proven and highly capable team at Gold Mountain. We expect to double our revenue while diversifying and de-risking our portfolio with this attractive and accretive acquisition. The Royalty will complement our existing Copperstone gold stream that is under construction, our producing Keysbrook mineral sands royalty and our growing green royalty portfolio. Gold Mountain’s strong relationships with surrounding Indigenous communities, including three signed memoranda of understanding, and partnership with majority Indigenous-owned Nhwelmen-Lake also align with our environmental, social and governance principles when allocating capital. Moreover, given the exploration and production expansion upside, we see excellent wealth creation potential from Elk Gold’s addition to our investment portfolio.”

Transaction Terms

Star Royalties has agreed to acquire the Royalty from Almadex for a total consideration of:

-

- $10 million in cash;

- 1,659,304 common shares of the Company at a notional issue price per share equal to the 20-day volume weighted average price of the common shares on the TSX Venture Exchange (the Consideration Shares”); and

- 829,652 common share purchase warrants (each, a Warrant”), where each Warrant will be exercisable for one common share of Star Royalties at an exercise price of C$0.70 for a period of 24 months from the Closing Date.

Upon issue, the Consideration Shares and the Warrants will be subject to a customary four month hold period under applicable securities laws.

The Royalty covers all 16,716 hectares of mining leases and mineral claims as outlined in Gold Mountain’s PEA, titled “Updated Preliminary Economic Assessment on the Elk Gold Project”, dated June 21, 2021 and available on SEDAR at www.sedar.com. The Royalty is calculated as 2% of the gross metal revenues realized by Gold Mountain from the New Afton mineralized material sales, less certain allowable deductions.

Elk Gold, a past-producing gold mine and Gold Mountain’s flagship asset, is located in south-central British Columbia, Canada, approximately 325 km northeast of Vancouver and 55 km west of Okanagan Lake, midway between the cities of Merritt and West Kelowna. Given its proximity to skilled labour, no site camp is required.

Gold Mountain released the results of its updated PEA on May 27, 2021 that incorporated the increased mineral resource estimate announced on May 14, 2021, the ore purchase agreement with New Gold announced on January 26, 2021, and the mining services contract with Nhwelmen-Lake announced on January 19, 2021. New Gold is an intermediate mining company with a market capitalization of C$1 billion, and Nhwelmen-Lake is a construction and mining services contractor 51% owned by Nlaka'pamux Nation Tribal Council and 49% owned by Lake Excavating, operator of similar projects including at Teck Resources Limited’s (TSX: TECK.A and TECK.B, NYSE: TECK) Highland Valley Copper Mine and New Gold’s New Afton Mine.

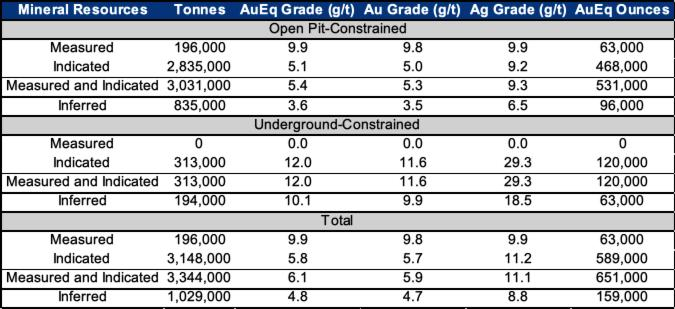

The PEA outlines an 11-year combined open pit and underground operation with an initial capital cost of approximately C$9 million and an after-tax NPV5 of C$231 million using a long-term $1,600 per ounce gold price. As per the PEA, Elk Gold is expected to produce approximately 19,000 ounces in years 1-3 from an open pit-only operation and then expand production to 65,000 ounces in years 4-11 with the expansion of the open pits and addition of an underground operation, for total life-of-mine production of 525,000 ounces at an all-in sustaining cost of $554 per ounce. The underground component currently accounts for roughly 18% of the total measured and indicated contained gold equivalent ounces. Following revenue generation, Gold Mountain will apply for an Environmental Assessment certificate and any other required permits to expand production starting in year 4. Gold Mountain’s ore purchase agreement with New Gold allows Gold Mountain to both operate and scale mine operations without the need for an on-site mill. Under this agreement, Gold Mountain will deliver to New Gold 70,000 tonnes per annum in years 1-3 and then up to 350,000 tonnes per annum in years 4-11 with the ore being processed at the New Afton processing facility 133 km from Elk Gold. The metal payable split from the ore purchase agreement is 89% to Gold Mountain and 11% to New Gold. Elk Gold’s life-of-mine processed gold grade is estimated in the PEA to be 6.98 g/t with a 92% gold recovery.

Elk Gold: Siwash North Mineral Resource Estimate

Source: Gold Mountain disclosures.

Notes:

-

CIM definitions were followed for classification of Mineral Resources.

-

Mineral Resources are not Mineral Reserves and have not demonstrated economic viability.

-

Results are presented in-situ and undiluted.

-

Mineral resources are reported at a cut-off grade of 0.3 g/t Au for pit-constrained resources and 3.0 g/t for underground resources.

-

The number of tonnes and metal ounces are rounded to the nearest thousand.

-

The Resource Estimate includes both gold and silver assays. The formula used to combine the metals is: AuEq = ((Au_Cap*55.81*0.96) + (Ag_Cap*0.76*0.86))/(55.81*0.96).

-

The Resource Estimate is effective as of May 1, 2021.

Elk Gold: PEA Production and Grades

Source: Gold Mountain disclosures.

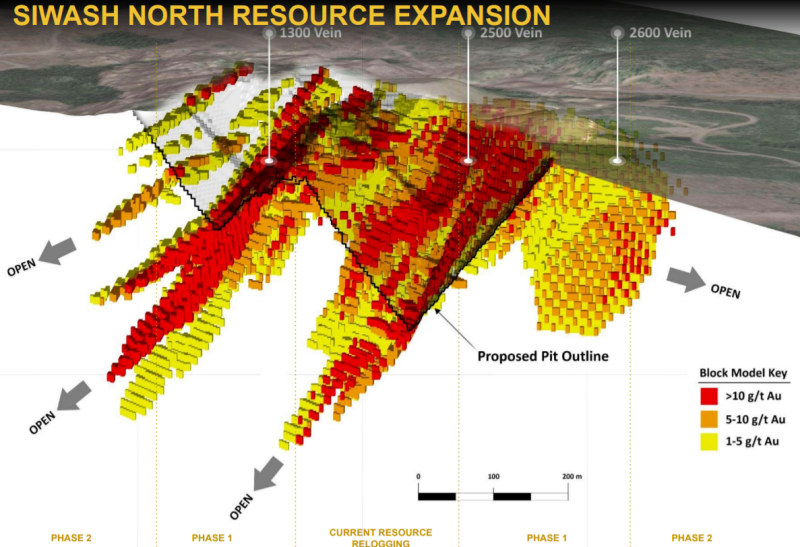

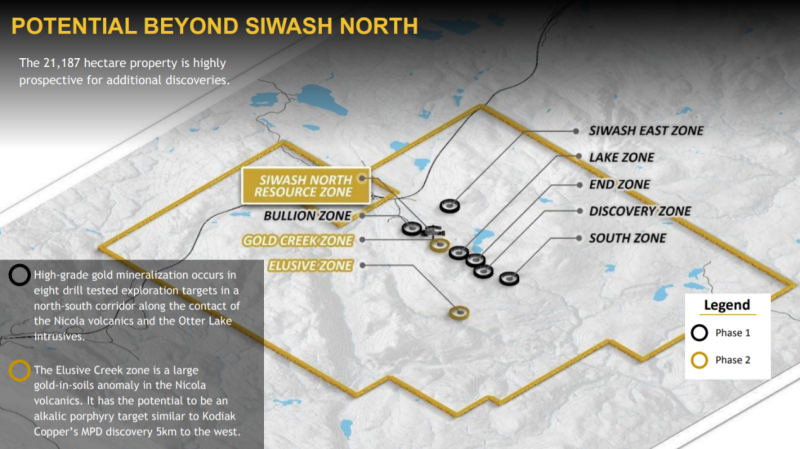

According to the PEA, Gold Mountain’s Phase 1 drill program expanded the strike of known mineralized zones beyond its current resource model. The program also demonstrated the potential of significant mineralization down dip. Phase 1 consisted of 41 drill holes that all intercepted significant mineralization and highlighted Elk Gold’s scalability and continuity. The Phase 1 drilling program resulted in a 49% increase in Elk Gold’s mineral resource estimate. Gold Mountain recently completed a 10,000 m Phase 2 drill program to further test mineralization at depth, while also exploring satellite zones outside of the Siwash North Zone. A Phase 3 program will test six additional high-grade targets with significant expansion potential showing similar geological attributes as Siwash North. Furthermore, Gold Mountain is relogging over 127,000 m of historical core. Phase 1 relogging successfully identified several new high-grade intercepts while Phase 2 relogging is now underway with the objective of discovering additional high-grade intercepts.

Source: Gold Mountain disclosures.

CONTACT INFORMATION

For more information, please visit our website at starroyalties.com or contact:

|

Alex Pernin, P.Geo. |

Peter Bures |

|

|

Chief Executive Officer and Director |

Chief Business Development Officer |

|

|

apernin@starroyalties.com |

pbures@starroyalties.com |

|

|

+1 647 801 3549 |

+1 437 997 8088 |

ABOUT STAR ROYALTIES LTD.

Star Royalties Ltd. is a precious metals royalty and streaming investment company. The Company’s objective is to provide wealth creation through accretive transaction structuring and asset life extension with superior alignment to both counterparties and shareholders. With a strategy to also invest in green opportunities, Star Royalties pioneered one of the first forest carbon offset credit royalties and is pursuing a pipeline of additional green investments.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Certain statements in this news release may constitute "forward-looking statements", including those regarding future market conditions for metals and minerals, the completion of the Acquisition, expected timing and quantum of revenue generation from Elk Gold, the anticipated life-of-mine of Elk Gold, the future production estimates of Elk Gold, Gold Mountain’s anticipated drill program, sources of funding for the Acquisition, future plans of Gold Mountain with respect to Elk Gold, the ability of Gold Mountain to expand production of Elk Gold and successfully receive the necessary permits to do so and estimated gold grade of ore extracted from Elk Gold. Forward-looking statements are statements that address or discuss activities, events or developments that the Company expects or anticipates may occur in the future. When used in this news release, words such as "estimates", "expects", "plans", "anticipates", "will", "believes", "intends" "should", "could", "may" and other similar terminology are intended to identify such forward-looking statements. Forward-looking statements are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performances or achievements of Star Royalties to be materially different from future results, performances or achievements expressed or implied by such statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be an accurate indication of whether or not such results will be achieved. A number of factors could cause actual results, performances or achievements to differ materially from such forward-looking statements, including, without limitation, the ability of the parties of the Acquisition to complete the transaction, changes in business plans and strategies, market conditions, share price, best use of available cash, the ability of the Company to identify and execute future acquisitions on acceptable terms or at all, risks inherent to royalty and streaming companies, title and permitting matters, metal and mineral commodity price volatility, discrepancies between actual and estimated production, mineral reserves and resources and metallurgical recoveries, mining operation and development risks relating to the parties which produce the metals and minerals Star Royalties will purchase or from which it will receive royalty or streaming payments, regulatory restrictions, activities by governmental authorities (including changes in taxation), currency fluctuations, the global social and economic climate, natural disasters and global pandemics, including COVID-19, dilution, and competition. These risks, as well as others, could cause actual results and events to vary significantly. Accordingly, readers should exercise caution in relying upon forward-looking statements and the Company undertakes no obligation to publicly revise them to reflect subsequent events or circumstances, except as required by law.

CAUTIONARY NOTE REGARDING SCIENTIFIC AND TECHNICAL INFORMATION

The technical and scientific information contained in this press release in respect of the Elk Gold Mine, is based on the technical report entitled “NI 43-101 Technical Report, Updated Preliminary Economic Assessment on the Elk Gold Project” with an effective date of May 14, 2021 and report date of June 21, 2021 (the “Technical Report”), which technical report was prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) for Gold Mountain Mining Corp., and filed under Gold Mountain’s SEDAR profile on June 22, 2021, and on additional publicly disclosed information relating to the Elk Gold Mine after the date of the Technical Report, including Gold Mountain’s news releases entitled “Gold Mountain Signs Letter of Intent with New Gold to Increase its Tonnage Limit in its Ore Purchase Agreement” dated June 17, 2021, and “Gold Mountain Hits Additional High-Grade Intercepts in its Phase 2, 10,000m Drill Program” dated June 30, 2021. The technical and scientific information contained in this news release has been reviewed and approved in accordance with NI 43-101 by Timothy Strong, MIMMM, a “qualified person” as defined in NI 43-101 and independent of the Company.