Archive

Fidelity Acquires a Further 5.5% of Las Huaquillas for Total Ownership of 50% and Announces Exploration Program

| |||||||||

|  |  | |||||||

Vancouver, BC - TheNewswire - July 21st, 2021 - Fidelity Minerals Corp. (TSXV:FMN) (OTC:SAIDF) (FSE:S5GM | SSE:MNYC) (“Fidelity Minerals” or the “Company”) is pleased to announce that its wholly owned, Peruvian subsidiary Minera LBJ SAC has signed a binding agreement with Alexander Ernesto Vidaurre Otayza and Lida Avelina Pimentel Jibaja to acquire an additional 5.5% of Rial Minera SAC (“Rial”) which owns the highly prospective Core Las Huaquillas precious and base metal property (the” Project” or “CLH”) in northern Peru. Upon closing of the transaction, the Company will hold a 50% interest in Rial (and thereby CLH).

On February 11, 2019, the Company acquired a 44.5% interest in Rial which owned the portfolio of mineral concessions that comprise the CLH project. The concessions are located immediately south of the border with Ecuador, where recent exploration success and corporate activity in the Ecuadorian mining sector has demonstrated the potential of an historically underexplored region.

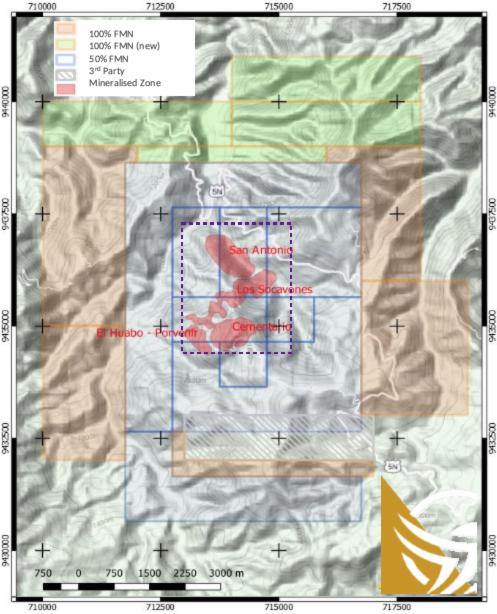

The CLH is located within the Greater Las Huaquillas (“GLH”) Project which comprises a significant land package assembled by the Company. The GLH project consists of:

-

- the 9 CLH concessions that host the historical gold, copper, zinc and lead mineralization totalling approximately 3,600 Ha, and

- 9 additional concessions located contiguous with CLH and staked by Fidelity (100%).

The mineral concessions are shown in Figure 1.

The CLH Project features extensive historical exploration completed through 1999. This work included soil sampling, geophysics and 5,742.9m of diamond drilling (26 drill holes), and the excavation of approx. 1,200m of underground development on three levels in the Los Socavones Zone. This work defined 5 mineralised zones, consisting of 4 mineralisation types including epithermal and porphyry style mineralisation at the Project.

The project has not been the subject of a resource estimate compliant with NI43-101. However, the most advanced of the previously recognised mineralised zones, the Los Socavones Zone, was partially appraised by Sulliden Exploration Inc, (23 June 1998 and Annual Report (1997-98)). Sulliden estimated that a 500m section of the 2,200m long Los Socavones structure hosts a historical near-surface geological resource of 6.57 Mt grading 2.12 g/t Au and 25.2 g/t Ag, equivalent to 446,000 ounces of gold and 5.3 million ounces of silver at a 1 g/t Au cut-off. The historical resource, based on 10 drill holes and 20 mineralized intercepts, was estimated to a depth of 200m, and is reported as an historic resource estimate in an NI 43-101 Technical Report prepared for a party unrelated to Fidelity in August 2011. The Los Socavones Zone remains open down dip and along strike in both directions (northeast and southwest). The historical resource appraisal encountered shallow mineralisation in several drill holes. Drill hole LH97-08 drilled by Sulliden, intercepted 78 metres of 2.7g/t Au from surface, highlighting the potential for low-cost, open to surface mining operations. The significant base metal mineralisation identified during historical exploration within the Los Socavones Zone was not included in the historical resource estimate.

Sulliden concluded that “The overall geological setting suggests that the Las Huaquillas property compares well with other caldera-related, porphyry copper-gold systems of the Circum Pacific Rim. Based on the data presented here, the Los Socovanes zone is interpreted as an epithermal gold-silver-tellurium system … superimposed on a porphyry system. This superposition is an important criterion used in identifying world-class deposits (Sillitoe, 1994, 1995b).”

Following a detailed review of the project, in March 2012, a subsequent operator (Strategic Review and Business Analysis, Inca One Resources Corp, 9 March 2012) published a report indicating that the “Los Socavones zone alone might be able to demonstrate the potential for between 0.6 million and 4.0 million gold and gold equivalent silver ounces respectively through future drilling, based on its historic resource estimate and assumed dip and strike length extensions within the current concession boundary.”

Whilst these resource studies are historical in nature and are not consistent with NI 43-101 standards, they provide the Company with confidence that the Project represents a large mineralised system, with opportunities to potentially delineate a significant mineral resource. In addition to the precious metal endowment, preliminary reviews of historical studies by past operators as well as the Geological, Mining and Metallurgical Institute of Peru (INGEMMET- Pre-Evaluation of the Tecto-economic Potential of the Epithermal Gold Resource at Las Huaquillas, INGEMMET, 31 January 1999) by Fidelity, have also identified significant base metal prospectivity. An historical report by INGEMMET outlining encouraging metallurgical recoveries for gold and silver from samples sourced from the Los Socavones Zone, also highlights the potential to produce a zinc concentrate, from broad zones of zinc mineralisation with reported grades as high as 2-3% Zn.

In addition to the Los Socavones epithermal gold zone and associated base metal prospectivity, historic drilling outside the Los Socavones Zone also identified two potentially large porphyry copper-gold zones, Cementerio and San Antonio. These targets are well defined by geophysics (ground magnetics and Induced Polarization) and are coincident with geochemical and geological features similar to known mined porphyry style copper deposits. Although historical exploration of these targets has confirmed the presence of copper-gold mineralisation, these targets have not been sufficiently appraised to have supported the preparation of resource estimates by prior operators.

The Company has not conducted any work to establish the relevance & reliability of the historical estimate. There has not been sufficient drilling and/or sufficient previous exploration at Las Huaquillas upon which to base a mineral resource or mineral reserve estimate compliant with the standards of National Instrument 43-101. It should be noted that the historical resource related information outlined in this announcement has been derived from: NI 43-101 Technical Report (the “Technical Report”) on the Las Huaquillas Au, Ag, Cu Property, Cajamarca, Peru (15 August 2011).

For additional information, refer to the Disclaimer & Forward-Looking Statements section of this announcement. The technical information in this announcement has been prepared in accordance with the Canadian regulatory requirements set out in National Instrument 43-101 (“NI 43-101”) and has been reviewed and approved on behalf of the Company by Luc Pigeon B.Sc., M.Sc., P.Geo., a Qualified Person under NI 43-101.

Per the terms of the agreement, the Company can acquire an additional 5.5% ownership of the Project by completing the following;

-

- Total cash consideration of $500,000 US payable in two instalments. The first instalment of $300,000 US to be paid upon signing the agreement. An additional $200,000 US to be paid three months after signing.

- The Company will fund up to $3,000,000 US in underground sampling and exploration drilling to underwrite the publication of a new NI 43-101 technical report aimed at declaring inferred resources and to be completed within 18 months following receipt of drilling permit approvals.

Rial Minera SAC, led by Fidelity, will immediately commence planning for the upcoming exploration program to include community relations, environmental permitting, geologic mapping and sampling, underground sampling and metallurgical testing, geophysics, 5,000m to 7,500m of diamond drilling, to culminate with an NI 43-101 technical report. Once the NI 43-101 is completed, the Company will have earned it’s 50% ownership in the CLH Project and the partners in Rial will enter into a participating Joint Venture (“JV”) for the operation and financing of Rial.

Once the JV is established, the JV partners will define further exploration programs and other value accretive activities. In the event of negotiation for the sale of all or part of the Project, the JV partners will establish a consideration sale price in line with standard project acquisition valuations based upon ‘in the ground’ gold equivalent values being realised in the market for resource projects. Each JV partner will hold a right of first refusal on any sale of any of the other’s interest in the JV (“Preferential Acquisition Right”). In addition, the JV partners agree to a “Right of Co-sale (Tag Along)” provision whereby if the Preferential Acquisition Right is not exercised, each partner will have the right to participate in the sale for the same price and under the same conditions as the other partner. Any sale will be subject to a 2.5% NSR, which will accrue to the JV partners in proportion to their ownership. No buydown clause was included at this time.

Mr. Pekeski commented: "The acquisition of this additional interest in the mineralized, world-class Las Huaquillas Project provides the Company with a significant resource appraisal opportunity which we expect to immediately advance. Fidelity`s goal is to rapidly unlock value from Las Huaquillas, by completing meaningful, systematic exploration that we are confident the market will reward as we delineate substantial gold and copper resources. This will start with planning and permitting the drilling program and re-establishing the underground workings on the property so they can be accessed for metallurgical sampling. I believe that through successful exploration, Fidelity`s value will be rerated in line with the valuations of larger peers with similar stage Projects."

CLH Project - Historical Resource Appraisal

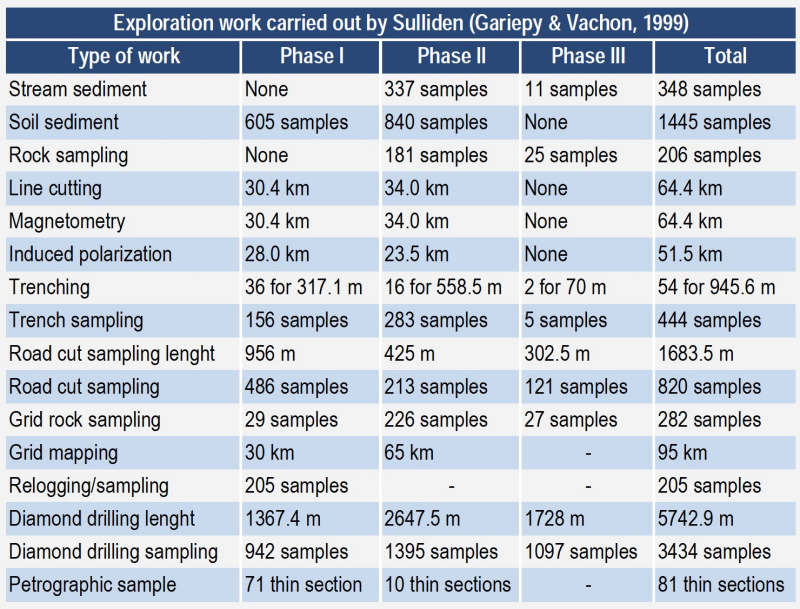

In 1997 and 1998, Sulliden carried out an integrated two phase exploration program including; line cutting, geophysics, soil, stream, rock geochemical and geological surveys, and 26 diamond drill holes (DDH) were drilled by Sulliden, for a total of 5,671m (refer Fig. 2). The gold-silver epithermal mineralization discovered along the Socavones trend was followed for at least 2.1 kilometres via geophysics, soil and rock sampling and drilling. Five significant mineralized zones were identified at the project as follows: (i) Los Socavones, (ii) El Huabo, (iii) Las Huaquillas, (iv) Cementerio and (v) San Antonio (refer Fig. 1). Four deposit types have been identified at the Las Huaquillas project:

-

- Epithermal Au-Ag; low sulphidation at the El Huabo and Las Huaquillas showings of the Los Socavones zone.

- Epithermal Au-Ag-Cu; high sulphidation at the Porvenir- Huabo Alto silicified ridge.

- Au, Ag, Zn. Pb-quartz stockwork at the Los Socavones.

- Porphyry Cu ± Mo ± Au within the Cementerio and San Antonio intrusions.

Sulliden estimated that a 500m section of the 2,200m long Los Socavones structure hosts a historical near-surface geological resource of 6.57 Mt grading 2.12 g/t Au and 25.2 g/t Ag, equivalent to 446,000 ounces of gold and 5.3 million ounces of silver at a 1 g/t Au cut-off. The historical resource, based on 10 drill holes and 20 mineralized intercepts, was estimated to a depth of 200m, and is reported as an historic resource estimate in an NI 43-101 Technical Report prepared for a party unrelated to Fidelity in August 2011. The Los Socavones Zone remains open down dip and along strike in both directions (northeast and southwest). The historical resource appraisal encountered shallow mineralisation in several drill holes.

Significant Mineralised Zones – Historical

The Los Socavones anomaly is a major NE-SW trending mineralized fault zone that extends for at least 2.5km and has a width of approximately 100m. The anomalous zone consists of two distinct Au-enriched pyrite-sphalerite-galena quartz stock-work zones surrounded by a low-grade gold zone composed of disseminated and narrow stringers of pyrite with minor sphalerite and chalcopyrite.

To date, 1,000m of its strike length has been drill tested and 400m underground workings including 100m vertical development has been carried out. Drilling has intersected the mineralization at a depth of approximately 200m. The mineralized zone average true thickness is approximately 19 m with a maximum thickness of 65m within the zone’s centre.

The Cementerio Cu-Au porphyry system is located 1,000m south of the Los Socavones zone. It comprises extensive argillic, phyllic and hematitic alteration partly visible along the road leading to the Las Huaquillas village. A 600m by 900m sub-circular multi-phase diorite intrusion characterized by equigranular and porphyritic textures is spatially related with the mineralization.

The San Antonio porphyry system is located 1,000m NW of the Los Socavones zone. It coincides with a prominent copper- gold soil geochemical anomaly and is hosted in a calc-alkaline quartz diorite intrusion measuring 500m x 900m. The host rock is massive, homogeneous and is composed of 15% well-formed 2-mm plagioclase phenocrysts lying in a finer groundmass composed of amphibole feldspar-quartz-chlorite- biotite-magnetite-sericite.

Fig 1: Significant Mineralised Zones at Las Huaquillas

The El Huabo Au-Ag anomaly is located near the Los Socavones structure within altered plagioclase porphyritic volcanic rocks members of the Oyotún Formation.

The Las Huaquillas anomaly is located some 850m to the NE of the El Huabo anomaly. The mineralization is hosted in strongly sericitized and argillic altered Oyotún Formation rocks that are crosscut by narrow quartz veins and accompanied by fine quartz vug filling. The geological similarities between the Las Huaquillas and the El Huabo anomalies indicate that both are part of the same low-sulphidation epithermal system developed along the Los Socavones structure.

Table 1: Historical Exploration Activities

Significant Intercepts

Historical drilling at the Los Socavones Zone report significant mineralized intercepts, the best of which is Sulliden DDH intersection (LH97-08): 67.5m core length (approximately 53m true width) grading 2.7 g/t Au and 15.3 g/t Ag. Hole LH-97-04, which returned 0.47% Cu, 0.11 g/t Au and 4.5 g/t Ag over 99.5m (drill length), demonstrated the size potential of Cementerio’s phyllic ring. Similarly, San Antonio drilling (LH97-17) also intersected significant mineralization; up to 0.32% Cu, 0.45 g/t Au and 3.0 g/t Ag over 69.0 m (drill length), including an interval grading 0.46 % Cu, 0.74 g/t Au and 4.9 g/t Ag over 21.0m.

Luc Pigeon B.Sc., M.Sc., P.Geo., a Qualified Person in the context of National Instrument 43-101, has read and approved the technical content of this News Release.

About Fidelity Minerals Corp.

Fidelity Minerals Corp. has assembled a portfolio of high-quality mining assets in Peru and aims to delineate major deposits on these properties that could attract the interest of mid-tier and major mining companies. Fidelity has a portfolio of four key assets in Peru and is currently focused on progressing its two most advanced projects – Greater Las Huaquillas (GLH) and Las Brujas. Fidelity is also looking to opportunistically expand its project portfolio with accretive acquisitions. The company is backed by an experienced management team with diverse technical, market, and commercial expertise and is supported by committed and sophisticated investors focused on building long term value.

On behalf of the Board of Fidelity Minerals.

Dean Pekeski

CEO, President and Director

Tel: +1.778.828.9724

Email: dean@fidelityminerals.com

For more information, please visit the corporate website at http://www.fidelityminerals.com or contact:

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS NEWS RELEASE.

Disclaimer & Forward-Looking Statements: This news release contains forward-looking statements. Forward-looking statements are statements that relate to future events or future financial performance. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “intend”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “project”, “predict”, “potential”, or “continue” or the negative of these terms or other comparable terminology. These statements speak only as of the date of this news release. This news release may also contain inferences to future oriented financial information (“FOFI”) within the meaning of applicable securities laws. The information in this news release has been prepared by our management to provide a context for the further acquisition of 5.5% of Las Huaquillas and to provide the reader with an outlook for our future activities and anticipated key milestones and may not be appropriate for other purposes. Forward-looking statements in this announcement include, (but are not limited to) advancing certain key project activities that could represent important milestones which the Company expects may represent material valuation catalysts, such as the expectation that through the assembling of a portfolio of high-quality mining assets in Peru, the Company aims to delineate major deposits on these properties that could attract the interest of mid-tier and major mining companies. Further, forward-looking statements in this release include that Fidelity Minerals Corp. is also looking to opportunistically expand its project portfolio with accretive acquisitions.

There has not been sufficient drilling and/or sufficient previous exploration at Las Huaquillas upon which to base a mineral resource or mineral reserve estimate compliant to the standards of National Instrument 43-101. It should be noted that the historical resource related information outlined has been derived from: NI 43-101 Technical Report (the “Technical Report”) on the Las Huaquillas Au, Ag, Cu Property, Cajamarca, Peru (15 August 2011).The historical estimate is based upon Gariepy and Vachon (both registered in 1999) and the estimate was performed using the vertical longitudinal section method including seventeen mineralized intersections where a specific gravity of 2.8 g/cm3 and a cut-off grade of 1.0 g/t Au over a minimum width of 3 metres were applied. Gariepy & Vachon (1999) disclosed what they call a “geological resource” which is not a category accepted by prevailing disclosure standards, and at best corresponds to an Inferred Resource in today’s nomenclature. The work did not estimate the zinc, lead or copper contained within the Socavones zone. No more recent estimates or data is available to the issuer; at a minimum, several holes would need to be twinned, and certain historical intercepts re-assayed, to verify the historical estimate as a current mineral resource. For clarity, a qualified person has not done sufficient work to classify the historical estimate as a current mineral resources or mineral reserve, and the Company is not treating the historical estimate as a current mineral resource or mineral reserve.