Archive

Goldeneye Signs LOI to Acquire Three Precious and Base Metal Projects in Newfoundland and Reprices Financing

| |||||||||

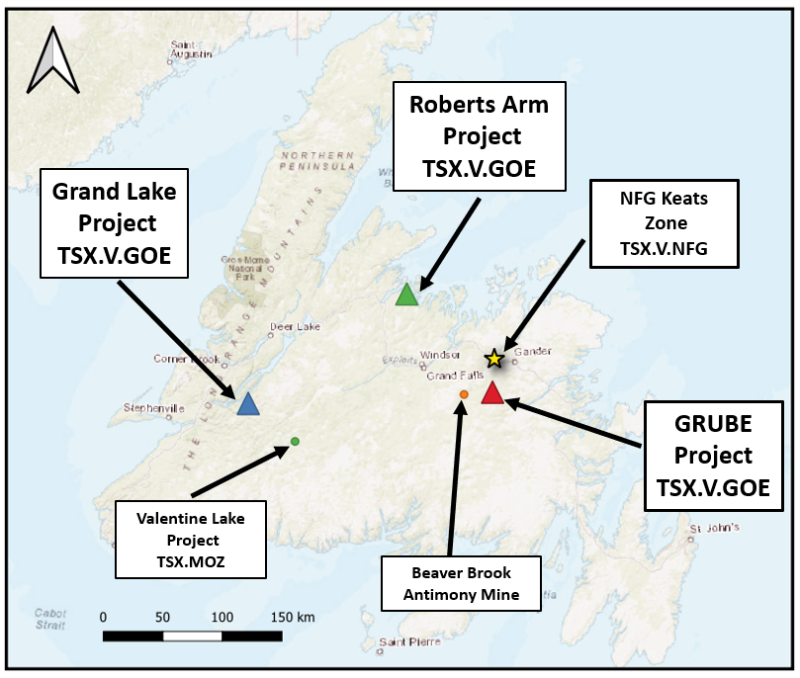

Vancouver, British Columbia – TheNewswire - June 7, 2021 - Goldeneye Resources Corp. (“Goldeneye”) or the “Company”) (TSXV:GOE) is pleased to announce that the Company has signed two letter of Intents (“LOI”s) with Unity Resources Inc. (“Unity”). The first LOI to acquire 100% interest in mineral claims known as the Roberts Arm and Grand Lake Projects and the second to acquire 100% interest in the mineral claims known as the Gander River Ultramafic Belt East (“GRUBE”) Project (together “the Projects”). The Projects are located in the province of Newfoundland and cumulatively encompass a land area of approximately 148 Km² (~14,800 Ha).

Highlights

-

- The GRUBE Project is contiguous to the eastern side of New ound Golds (TSX.V:NFG) Queensway Project, straddling the Gander River Ultramafic Belt (GRUB), which has the potential to be one of the main corridors for the transport of gold mineralization in the area. The project covers geological terrain that has the potential to host mineralization in secondary and tertiary structures following the presumed epizonal geological model at the Keats, Knob and Lotto Zones located 20 km’s to the North.

- The Roberts Arm Project is host to a past producing Cu mine. Historical production data undocumented however ore dumps at the Project were estimated to contain ~4,430 tons at a grade of 0.92% Cu and 0.35 oz/t/Ag The Project also has multiple historical grab samples with up to 2.27 g/t Au and 4.56% Cu. The Project is contiguous and surrounded by Leocor Gold’s (CSE:LECR) Western Exploit District Project.

- The Grand Lake Gold Project hosts a historical high grade grab sample that assayed 1,234 g/t Au. It is also 7 km southwest of the Glover Island Project which is the host to a historical resource estimate of 4.5 million tonnes grading 1.7 g/t Au.

- Following exchange approval, Goldeneye plans to immediately execute a phase one reconnaissance program on each of the three Projects.

*References available below

Jack Bal, Chief Executive Officer of Goldeneye, commented: “Newfoundland has gained a lot of attention with new high-grade gold discoveries such as the Keats Zone. Our GRUBE Project has geologic attributes similar to that area and we are excited to learn more about the project this field season. The Roberts Arm and Grand Lake Projects have proven targets to be followed up on for high grade Copper and Gold. We plan to conduct work on all properties once the definitive agreements have been signed and approved by the regulatory bodies.”

Location Map of the Projects

About the Projects

Gander River Ultramafic Belt East

The GRUBE Project encompasses a land area of approximately 76.5 Km² (7,650 Ha) and is located directly adjacent to the eastern extent of New Found Gold’s Queensway Project.

The Projects geology consists of polydeformed psammites and pelites of the Lower Ordovician or earlier Gander Group, and a greywacke, siltstone, shale sequence which is part of the Middle Ordovician and later Davidsville Group. In certain areas the Davidsville Group sediments may lie conformably on the Gander Group metasediments, but as typified in the north the two are often separated by the Gander River Ultramafic Belt (GRUB line), a dismembered ophiolite tectonically emplaced on the Gander Group (Blackwood, 1980 or MODS 002D/10/Be 001).

The GRUB line is thought to be a potential corridor for the transportation of gold mineralization in the area. Gold is currently being discovered at the Keats, Knob, and Lotto Zones approximately 20 km’s to the north in secondary and tertiary structures potentially following a epizonal gold deposit model. The GRUBE Project has geology that suggests the potential to host similar structures associated with the GRUB line regional fault zone.

Grand Lake

The Grand Lake Project encompasses a land area of approximately 52 Km² (5,200 Ha) and is located 33 km southwest of the town of Corner Brook, Newfoundland. Access to the Project is by helicopter or by boat from Grand Lake plus a 2.5 km traverse up Ridge Creek.

The Project is host to the Ridge Creek Gold Showing (012A/12/Au 001) where a few angular 1' to 2' size blocks of cherty, silicified sedimentary drift (in place) are reported by Hamilton (1966) to contain from 2% to 3% sulphides, dominantly pyrite. Assay results yielded one high Au value of 1,234.3 g/t.

The Project is also located approximately 7 km southwest of the Glover Island Gold Project which has a historical resource estimate 4.5 million tonnes grading 1.7 g/t Au (1993 press release by New Island Minerals and Newfoundland Goldbar Resources or see MOD 012A/12/Au 021)

Roberts Arm

The Roberts Arm Project is located directly adjacent to the town of Roberts Arm and encompasses a land area of approximately 19.5 Km² (1,950 Ha). The property has 100% access by paved roads and forest service roads 1 km east of Roberts Arm. The property hosts eight historical Cu and Au mineral occurrences as outlined by the Newfoundland & Labrador Government Mineral occurrences data system.

Descriptions of five of the most significant MODS on the property are as follows:

Crescent Lake Mine (002E/05/Cu 013):

Grab sample DE-95-08 (quartz vein) collected from the Crescent Lake mine dump assayed 4.84% Cu, <0.01 %Pb, 0.06% Zn, 22 ppb Au, 8.5 ppm Ag, 50 ppm Ba, 143.0 ppm As and 2.8 ppm Sb (Evans,1996). Two ore dumps on the property have been chip sampled along cross lines 9.1 m and 7.6 m apart. The assay results on each cross-line were weighted according to the cross-sectional area which each sample represented. From this, the average grade of each cross section of the dump was calculated. Each of these average grades was weighted according to the volume which each cross- section represented. Thus the overall average grade of the dumps was calculated:

Dump Number 1 2670 tons 1.02% Cu 0.6 oz/T/Ag

Dump Number 2 1760 tons 0.78% Cu 0.33 oz/T/Ag

Total 4430 tons 0.92% Cu 0.35 oz/T/Ag

(Howse and McArthur, 1977, p. 58 - 60).

Crescent Lake Vein C (002E/05/Cu 012):

Grab sample assays include: 4.56% Cu and 1.00 oz/t Ag (MacQuarrie, 1976).

DE-95-16B returned 3.22% Cu, <0.01% Pb, 0.07% Zn, 29 ppb Au, 14.6 ppm Ag, 290 ppm Ba, 5560.0 ppm As, 1730.0 ppm Sb (Evans, 1996). DE-95-16C returned 4.69% Cu, <.01% Pb, 0.15% Zn, 51 ppb Au, 23.4 ppm Ag, 520 ppm Ba, 9670.0 ppm As and 3340.0 ppm Sb (Evans, 1996).

RAF Showing (002E/05/Au 005):

In 2002 grab sample 7355JB01-75 returned 5720 ppb Au (Thurlow and Woods, 2002).

Fifields Pond South (002E/05/Au 002):

Grab sample assays include: 1410 ppb Au and 5920 As (Pickett and Clarke, 1989) 1470 ppb Au and >10,000 As (Clarke, 1990). A grab sample in 1996 from outcrop assayed 2.27 g/t Au (Saunders and Harris, 1996).

About the LOI

The terms of the LOI to acquire the North Arm Project and Grand Lake Gold Project:

|

Date |

Cash Payment |

Share Issuance |

|

|

On execution of the Definitive Agreement and TSX Approval |

$100,000 |

3,100,000 |

|

|

On or before 6 months after Definitive Agreement and TSX Approval |

$100,000 |

3,100,000 |

Unity will retain a 3% NSR. The Royalty will be governed by a separate royalty agreement. The royalty agreement will include right of first offer to acquire 66.67% of the Royalty (equal to a 2% net smelter return royalty) for a cash payment of $1,500,000.

The terms of the first LOI to acquire the GRUBE Project:

|

Date |

Cash Payment |

Share Issuance |

|

On execution of the Definitive Agreement and TSX Approval |

$25,000 |

1,100,000 |

Unity will retain a 3% NSR. The Royalty will be governed by a separate royalty agreement. The royalty agreement will include right of first offer to acquire 66.67% of the Royalty (equal to a 2% net smelter return royalty) for a cash payment of $1,500,000.

Any transaction with Unity is subject to the signing of a definitive agreement and any required regulatory and third-party approvals.

Readers are cautioned that the completion of any transaction is subject to a number of conditions, including, but not limited to, negotiation of a definitive agreement in respect of such a transaction, the availability of financing on terms acceptable to the Company, and the receipt of any required regulatory and shareholder approvals. A transaction cannot be completed until these conditions are satisfied, and there can be no assurance that such a transaction, will be completed at all.

National Instrument 43-101 disclosure

Nicholas Rodway, P.Geo, is a shareholder of the company and qualified person as defined by National Instrument 43-101. Mr. Rodway supervised the preparation of the technical information in this news release.

References:

All MODS data referenced above can be sourced at the following Newfoundland and Labrador web link: https://gis.geosurv.gov.nl.ca/

Goldeneye is pleased to announce that it intends to complete a non-brokered private placement of up to 10,000,000 units of the Company at a price of $0.08 per Common Share for aggregate proceeds of up to $800,000 (the “Private Placement”) Each unit will consist of one common share and one half common share purchase warrant. Each warrant will entitle the holder to purchase one additional common share, up to a total of 5 million warrant shares, at a warrant exercise price of $0.15 cents exercisable for a period of 24 months from the date of closing.

The Company will not proceed with the financing announced on April 19, 2021, consisting of up to 30 million units of the company at a price of five cents per common share for aggregate proceeds of up to $1.5-million.

In connection with the Private Placement, the Company may pay finders’ fees in cash or securities or a combination of both, as permitted by the policies of the TSX Venture Exchange (the “Exchange”).

Closing of the Private Placement is subject to a number of conditions, including receipt of all necessary corporate and regulatory approvals, including the Exchange. All securities issued in connection with the Private Placement will be subject to a statutory hold period in accordance with applicable securities legislation. The Company intends to use the net proceeds of the Private Placement to fund exploration, for current liabilities and for general working capital purposes.

About Goldeneye Resources Corp.

Goldeneye is a mineral exploration company engaged in exploration of precious metal and base metal project in North America.

On behalf of the Board of Directors

Goldeneye Resources Corp.

“Jack Bal”)

Jack Bal, Chief Executive Officer

FOR MORE INFORMATION, PLEASE CONTACT:

Jack Bal

Telephone: 604.306.5285

Forward-Looking Information

This news release contains certain forward-looking statements within the meaning of Canadian securities laws, including statements regarding the Private Placement and Share Consolidation of Goldeneye Resources Corp. (“Goldeneye”); the availability of capital and finance for Goldeneye to execute its strategy going forward. Forward-looking statements are based on estimates and assumptions made by Goldeneye in light of its experience and perception of current and expected future developments, as well as other factors that Goldeneye believes are appropriate in the circumstances. Many factors could cause Goldeneye’s results, performance or achievements to differ materially from those expressed or implied by the forward looking statements, including: discrepancies between actual and estimated results from exploration and development and operating risks, dependence on early exploration stage concessions; uninsurable risks; competition; regulatory restrictions, including environmental regulatory restrictions and liability; currency fluctuations; defective title to mineral claims or property and dependence on key employees. Forward-looking statements are based on the expectations and opinions of the Company’s management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, undue reliance should not be placed on forward-looking statements. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS NEWS RELEASE REPRESENTS THE EXPECTATIONS OF THE COMPANY AS OF THE DATE OF THIS NEWS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD-LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE THE COMPANY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE SECURITIES LEGISLATION